Lockheed (LMT) Secures Contract to Aid F-35 Jet Program

Lockheed Martin Corp.’s LMT Aeronautics business segment recently clinched a modification contract involving its F-35 fighter jet program. The award has been offered by the Naval Air Systems Command, Patuxent River, MD.

Details of the Deal

Valued at $21.9 million, the contract is projected to be completed by April 2025. Per the terms of the deal, Lockheed will provide maintenance and sustainment operations of the Australia, Canada and the U.K. Reprogramming Laboratory facilities and systems for the F-35 A/B aircraft program.

Work related to this deal will be executed in Eglin Air Force Base, FL.

Significance of F-35 Jets

Lockheed’s F-35 is the most lethal fighter jet in the world. It has the ability to securely connect high-tech platforms to share information across every domain, air, land, sea, space and cyber. Such remarkable features of this fighter jet must have been ushering in solid contract wins for LMT, like the latest one.

Consequently, the F-35 program remains a major revenue contributor for the United States’ largest defense contractor. Evidently, the F-35 program generated approximately 26% of LMT’s total consolidated net sales in the fourth quarter of 2023.

Looking ahead, LMT expects to deliver 147-153 jets in 2024, and 156 jets in 2025 and beyond. This, along with the latest contract win, surely reflects the solid demand that the F-35 program enjoys in the combat jet market. Successful delivery of F-35 jets in due time, along with the recent agreement, should significantly bolster the company’s revenues in the coming quarters.

Growth Prospects

Amid the geopolitical tensions prevalent across the globe, nations are rapidly augmenting defense purchases to strengthen their warfare capabilities. This has led to an increased demand for fighter jets, which form an integral part of a country’s defense products. Per a report by the Mordor Intelligence firm, the global military aviation market is estimated to witness a CAGR of 5.23% during 2024-2030.

Such projections indicate immense growth opportunities for prominent combat jet manufacturers like Lockheed. Its Aeronautics segment is engaged in the research, design, development, manufacture, integration, sustainment, support and upgrade of advanced military aircraft, including combat and air mobility aircraft, unmanned air vehicles and related technologies. The company’s fighter jet portfolio includes C-130 Super Hercules, F-16 Fighting Falcon jet and F-16 Fighting Falcon, in addition to F-35 jets.

Peer Opportunities

A few other defense players that are likely to gain from the expanding military aviation market are Airbus SE EADSY, Textron TXT and Northrop Grumman NOC.

Airbus’ military aircraft consists of A400M, C295 tactical transporter, the new-generation A330 Multi Role Tanker Transport and Eurofighter, the most advanced swing-role fighter ever conceived. During 2023, 61% of the Defence and Space segment’s revenues came from military air systems.

EADSY boasts a long-term (three-to-five years) earnings growth rate of 12.4%. The Zacks Consensus Estimate for Airbus’ 2024 sales indicates an improvement of 9.5% from the top line reported in 2023.

Textron’s military aircraft includes Beechcraft T-6 training aircraft and Beechcraft AT-6 light-attack aircraft. The company also manufactures Beechcraft Model 18 light bomber, T-44 and T-34 training aircraft and T-1A jet trainer.

TXT boasts a long-term earnings growth rate of 10.1%. The Zacks Consensus Estimate for Textron’s 2024 sales indicates an improvement of 7% from the top line reported in 2023.

Northrop Grumman has been a pioneer in the development of manned aircraft. From fighter jets and stealth bombers to surveillance and electronic warfare, it has been providing manned solutions to customers worldwide. The company has built some of the world’s most advanced aircraft, ranging from the innovative B-2 Spirit stealth bomber to the game-changing E-2D Advanced Hawkeye.

NOC boasts a long-term earnings growth rate of 10.1%. The Zacks Consensus Estimate for Northrop Grumman’s 2024 sales indicates an improvement of 4.6% from the top line reported in 2023.

Price Performance

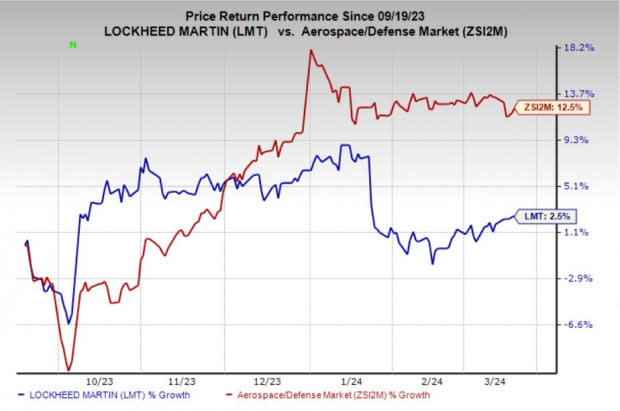

In the past six months, shares of LMT have risen 2.5% compared with the industry’s 12.5% growth.

Image Source: Zacks Investment Research

Zacks Rank

Lockheed currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Northrop Grumman Corporation (NOC) : Free Stock Analysis Report

Textron Inc. (TXT) : Free Stock Analysis Report

Airbus Group (EADSY) : Free Stock Analysis Report