Logitech (LOGI) Acquires Console & Software Maker Loupedeck

Logitech LOGI recently revealed that it has acquired Finland’s Loupedeck, a custom consoles and software designer that makes creative process faster and more intuitive for streamers, creators and gamers.

This will enhance Logitech’s ability to provide customizable and contextual control experiences for the company’s full portfolio of devices, including Logitech Software Roadmap solution. Jointly, the companies will provide a seamless experience for creators from onboarding to everyday use with presets available out of the box and tighter coupling between the Loupedeck devices and the Streamlabs popular suite of applications and services.

Loupedeck offers deep native integrations with industry-leading creative software for photo editing, retouching, video editing, color grading design and streaming. Its custom consoles combine analog control with digital precision to offer power and flexibility to all creators.

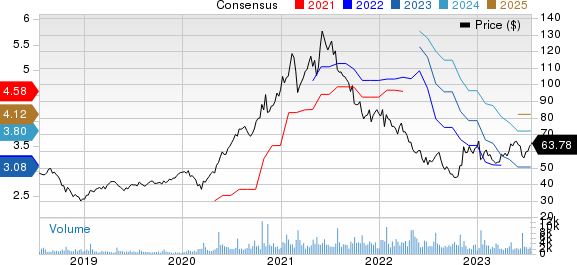

Logitech International S.A. Price and Consensus

Logitech International S.A. price-consensus-chart | Logitech International S.A. Quote

With this buyout, Logitech will leverage Loupedeck’s strong and growing developer community that will unveil advanced innovation, empowering streamers, creators and gamers. Ujesh Desai, general manager of Logitech G, stated, "This acquisition augments Logitech’s product portfolio today and accelerates our software ambitions of enabling keyboards, mice and more to become smarter and contextually aware, creating a better experience for audiences across Logitech."

Logitech has been benefiting from elevated demand for its products in the Gaming, Creativity & Productivity, and Video Collaboration units. Its continued focus on bolstering cloud-based video conferencing services is aiding it to robustly expand its client base.

In May, Logitech revealed latest additions to the premium Master Series, MX Keys S Combo, MX Keys S, and MX Anywhere 3S, designed for advanced users, such as software developers and creative professionals. Through a separate deal, the company introduced a desk booking service that delivers a better hotdesking experience for employees and greater ability to manage shared desks across multiple locations.

In May, Logitech unveiled the Logitech G PRO X 2 LIGHTSPEED Wireless Gaming Headset, designed and tested with top esports athletes. Further, it unveiled Rally Bar Huddle, a premium all-in-one appliance-based video bar for huddle and small rooms. It is the newest addition to Logitech’s family of conference cameras.

In April, LOGI entered a multi-faceted long-term partnership with the Michigan-based Pensole Lewis College of Business and Design to revolutionize the next generation of design with the help of advanced technology tools. Per the deal, Logitech will provide a bunch of technology equipment, including mouse, keyboards, headsets and streaming cameras, to the college while collaborating and co-creating spaces for students to design innovative creatives and ideas.

In March, Logitech launched Zone Learn, wired headsets designed for K-12 learners. It features comfort optimized for younger learners with smaller heads, durable architecture and replaceable ear pads and cables. These new headsets, designed with a scalable fit, were built for a deeper, more sustained focus and long-term use to keep students in their learning zones.

The growing adoption of new mobile platforms in mature and emerging markets is fueling the demand for the company’s peripherals and accessories. LOGI’s expanding partner base, which includes Google, Microsoft and Zoom Video, is a key to its top-line performance. The Zacks Consensus Estimate for LOGI’s first-quarter fiscal 2024 revenues is pegged at $905.2 million.

Zacks Rank & Stocks to Consider

Currently, Logitech carries Zacks Rank #4 (Sell). Shares of LOGI have gained 14% over the past year.

Some better-ranked stocks from the broader Computer and Technology sector are Salesforce CRM, NVIDIA Corporation NVDA and Meta Platforms META. While Salesforce and NVIDIA sport a Zacks Rank #1 (Strong Buy), Meta carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Salesforce’s second-quarter fiscal 2024 earnings has been revised northward by a penny to $1.90 per share over the past 30 days. For fiscal 2024, earnings estimates have moved up by 2 cents to $7.44 in the past 30 days.

CRM's earnings beat the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 15.5%. Shares of the company have gained 31% in the past year.

The Zacks Consensus Estimate for NVIDIA’s second-quarter fiscal 2024 earnings has been revised northward from $1.04 to $2.04 per share over the past 60 days. For fiscal 2024, earnings estimates have moved up by 2 cents to $7.66 in the past 30 days.

NVDA's earnings beat the Zacks Consensus Estimate in two of the trailing four quarters, missing twice, the average surprise being 0.26%. Shares of the company have soared 179.5% in the past year.

The Zacks Consensus Estimate for Meta Platforms' second-quarter 2023 earnings has been revised upward by a penny to $2.83 per share over the past seven days. For 2023, earnings estimates have moved north by 3 cents to $11.97 in the past seven days.

META’s earnings beat the Zacks Consensus Estimate in two of the trailing four quarters, missing twice, the average surprise being 15.5%. Shares of the company have surged 77.2% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Salesforce Inc. (CRM) : Free Stock Analysis Report

Logitech International S.A. (LOGI) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report