Go Long Micron Technology, Inc. (MU) Stock at This Pivotal Level

Technology has been exciting to watch. We see new trends that are making our lives more convenient, which are spurring interest in tech stocks like never before. The companies that do wind up crossing this tectonic shift in tech in one piece should have prosperous years ahead.

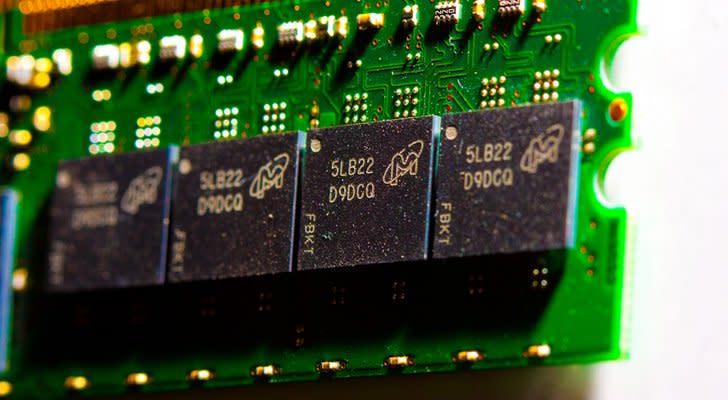

Source: Mike Deal via Flickr

Tech giants like Micron Technology, Inc. (NASDAQ:MU) and Advanced Micro Devices, Inc. (NASDAQ:AMD) are examples of who will provide the brains that power the world. Today, I want to bet long MU stock to create income out of thin air for the next 30 days.

Fundamentally, Micron stock is not expensive but feels like it’s bloated just by the shear stock price appreciation in the past 12 months. Wall Street had this one wrong. Otherwise, it wouldn’t have rallied almost 100% in 12 months.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

So traders are righting a wrong. It sounds like an easy bullish bet, but it isn’t. Momentum stocks like MU end up crippling a lot of investors. As they rally they seem like they are perpetually due for a pullback, which keeps buyers out. Conversely, when they fall they do it so fast that they become machetes, again staving off potential buyers for fear of losing fingers.

Technically, MU stock had a small scare back on Aug. 11. It then seemed like it was losing an ascending trend line, which could have invited more sellers. But luckily it bounced off $27 per share and has since rallied 12%. So did I miss my opportunity to still go long it? No.

Today I will not buy the shares and hope it continues its rally. Instead, I will use options where I can set a bullish trade and still leave room for error. The idea is to sell downside risk against support levels that are likely to hold through 2017.

Although it has traded violently in the past 12 months, I can sell puts against short-term support levels.

MU Stock Trade

The Trade: Sell the MU stock 29 Sept $27 put naked for 45 cents per contract. Here I have an 80% theoretical chance that price will stay above my strike so I can book maximum gains. Otherwise, I own the shares and could suffer losses below $26.55.

To mitigate the risk that comes with selling naked puts I can use spreads instead.

The Milder Bet: Sell the MU stock 29 Sept $27/$26 where I have about the same odds of winning, but with much smaller money at risk. Yet if successful, the spread delivers 15% in yield.

In either of these trades, MU stock can fall 10% and I can still win. Furthermore, I chose $27 as the level where to place my risk because it was where Micron stock last found support.

I chose the Sept 29 contract so not to hold the trade open through earnings. The short-term reaction to earnings is usually binary. I want to avoid the often arbitrary and potentially damaging trader knee-jerk reaction to a headline.

Investing in stocks is risky, so I never bet more than I can afford to lose.

Learn how to generate income from options here. Nicolas Chahine is the managing director of SellSpreads.com. As of this writing, he did not hold a position in any of the aforementioned securities. You can follow him on Twitter at @racernic and stocktwits at @racernic.

More From InvestorPlace

The post Go Long Micron Technology, Inc. (MU) Stock at This Pivotal Level appeared first on InvestorPlace.