A Look Back at Automotive and Marine Retail Stocks' Q3 Earnings: MarineMax (NYSE:HZO) Vs The Rest Of The Pack

As the craze of earnings season draws to a close, here's a look back at some of the most exciting (and some less so) results from Q3. Today we are looking at the automotive and marine retail stocks, starting with MarineMax (NYSE:HZO).

At their essence, cars and boats get you from point A to point B, but the former is usually a necessity in everyday life while the latter is a luxury or leisure product. The retailers that sell these vehicles therefore cater to different needs and populations. There are also retailers that may not sell cars and boats themselves but the parts and accessories needed to keep these complex machines in tip top shape.

The 11 automotive and marine retail stocks we track reported a mixed Q3; on average, revenues beat analyst consensus estimates by 1.5% Stocks have been under pressure as inflation (despite slowing) makes their long-dated profits less valuable, but automotive and marine retail stocks held their ground better than others, with the share prices up 8.9% on average since the previous earnings results.

MarineMax (NYSE:HZO)

Appropriately headquartered in Clearwater, Florida, MarineMax (NYSE:HZO) sells boats, yachts, and other marine products.

MarineMax reported revenues of $594.6 million, up 10.8% year on year, topping analyst expectations by 11.8%. It was a decent quarter for the company, with an impressive beat of analysts' revenue estimates.

“Our strong close to fiscal year 2023 stands as a testament to the exceptional performance of our team,” stated MarineMax Chief Executive Officer and President Brett McGill.

MarineMax achieved the biggest analyst estimates beat of the whole group. The stock is up 24.6% since the results and currently trades at $35.76.

Is now the time to buy MarineMax? Access our full analysis of the earnings results here, it's free.

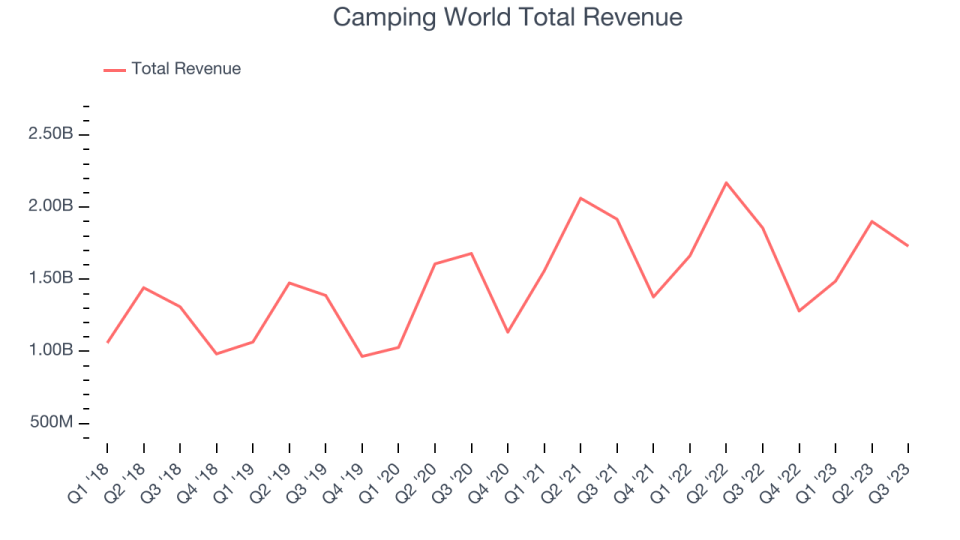

Best Q3: Camping World (NYSE:CWH)

Founded in 1966 as a single recreational vehicle (RV) dealership, Camping World (NYSE:CWH) still sells RVs along with boats and general merchandise for outdoor activities.

Camping World reported revenues of $1.73 billion, down 6.8% year on year, outperforming analyst expectations by 1.7%. It was a stunning quarter for the company, with a solid beat of analysts' earnings estimates and an impressive beat of analysts' gross margin estimates.

The stock is up 47.3% since the results and currently trades at $25.46.

Is now the time to buy Camping World? Access our full analysis of the earnings results here, it's free.

Weakest Q3: Advance Auto Parts (NYSE:AAP)

Founded in Virginia in 1932, Advance Auto Parts (NYSE:AAP) is an auto parts and accessories retailer that sells everything from carburetors to motor oil to car floor mats.

Advance Auto Parts reported revenues of $2.72 billion, up 2.9% year on year, exceeding analyst expectations by 1.6%. It was a weak quarter for the company, with underwhelming earnings guidance for the full year. In addition, gross margin declined meaningfully year on year (partly due to a one-time inventory charge) and EPS missed.

Advance Auto Parts had the weakest full-year guidance update in the group. The stock is up 4.8% since the results and currently trades at $61.25.

Read our full analysis of Advance Auto Parts's results here.

America's Car-Mart (NASDAQ:CRMT)

With a strong presence in the Southern and Central US, America’s Car-Mart (NASDAQ:CRMT) sells used cars to budget-conscious consumers.

America's Car-Mart reported revenues of $361.6 million, up 3.1% year on year, falling short of analyst expectations by 3.8%. It was a weak quarter for the company, with a miss of analysts' revenue estimates. Most worrying was a huge step-up in provision for credit losses, which impacted margins and EPS.

America's Car-Mart had the weakest performance against analyst estimates among its peers. The stock is down 21.9% since the results and currently trades at $63.09.

Read our full, actionable report on America's Car-Mart here, it's free.

Monro (NASDAQ:MNRO)

Started as a single location in Rochester, New York, Monro (NASDAQ:MNRO) provides common auto services such as brake repairs, tire replacements, and oil changes.

Monro reported revenues of $322.1 million, down 2.3% year on year, falling short of analyst expectations by 2.8%. It was a slower quarter for the company, with a miss of analysts' revenue estimates.

The stock is up 14.2% since the results and currently trades at $28.21.

Read our full, actionable report on Monro here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned