A Look Back at General Merchandise Retail Stocks' Q3 Earnings: Big Lots (NYSE:BIG) Vs The Rest Of The Pack

Let's dig into the relative performance of Big Lots (NYSE:BIG) and its peers as we unravel the now-completed Q3 general merchandise retail earnings season.

General merchandise retailers–also called broadline retailers–know you’re busy and don’t want to drive around wasting time and gas, so they offer a one-stop shop. Convenience is the name of the game, so these stores may sell clothing in one section, toys in another, and home decor in a third. This concept has evolved over time from department stores to more niche concepts targeting bargain hunters or young adults, and e-commerce has forced these retailers to be extra sharp in their value propositions to consumers, whether that’s unique product or competitive prices.

The 7 general merchandise retail stocks we track reported a very strong Q3; on average, revenues beat analyst consensus estimates by 0.9% while next quarter's revenue guidance was in line with consensus. Stocks have been under pressure as inflation (despite slowing) makes their long-dated profits less valuable, but general merchandise retail stocks held their ground better than others, with the share prices up 22.3% on average since the previous earnings results.

Big Lots (NYSE:BIG)

Priding itself on carrying brand-name items, Big Lots (NYSE:BIG) is a discount retailer that acquires excess and overstocked inventory then sells at meaningful discounts to prices of traditional retailers

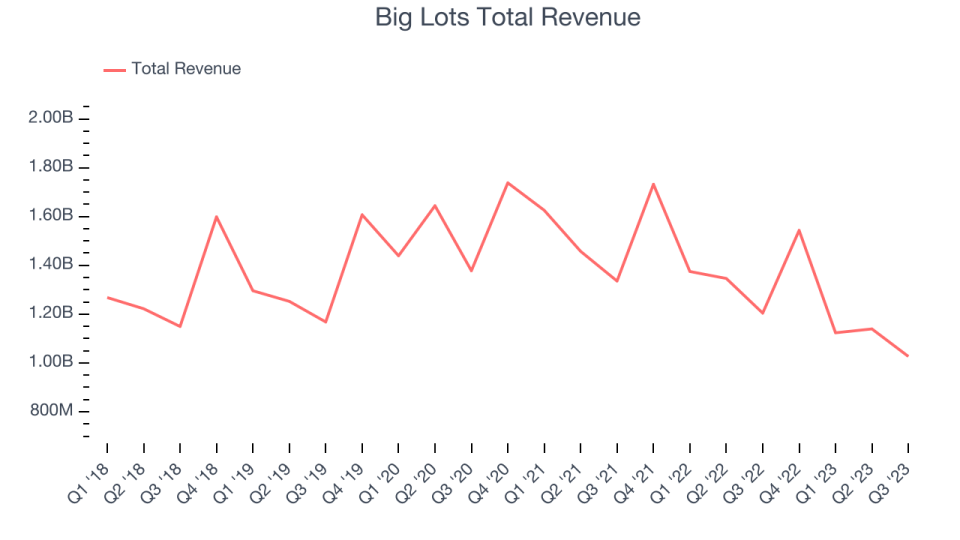

Big Lots reported revenues of $1.03 billion, down 14.7% year on year, falling short of analyst expectations by 0.4%. It was a strong quarter for the company, with an impressive beat of analysts' earnings estimates.

Commenting on today's results announcement, Bruce Thorn, President and CEO of Big Lots stated, "Although the environment remains challenging, we continued to make significant progress in turning around our business. Our key strategic actions are building momentum and we continue to play offense with our efforts to deliver incredible bargains and communicate unmistakable value. As a result, we are now on track to deliver an adjusted Q4 operating result ahead of last year, which would mark the first quarter of year-over-year improvement in nearly three years, and we expect quarterly year-over-year improvements to continue through 2024."

Big Lots delivered the slowest revenue growth of the whole group. The stock is up 44.8% since the results and currently trades at $6.95.

Is now the time to buy Big Lots? Access our full analysis of the earnings results here, it's free.

Best Q3: Macy's (NYSE:M)

With a storied history that began with its 1858 founding, Macy’s (NYSE:M) is a department store chain that sells clothing, cosmetics, accessories, and home goods.

Macy's reported revenues of $5.04 billion, down 7.3% year on year, outperforming analyst expectations by 4.4%. It was an exceptional quarter for the company, with a solid beat of analysts' earnings estimates and an impressive beat of analysts' revenue estimates.

Macy's delivered the biggest analyst estimates beat but had the weakest full-year guidance update among its peers. The stock is up 51% since the results and currently trades at $19.05.

Is now the time to buy Macy's? Access our full analysis of the earnings results here, it's free.

Weakest Q3: Five Below (NASDAQ:FIVE)

Often facilitating a treasure hunt shopping experience, Five Below (NASDAQ:FIVE) is an American discount retailer that sells a variety of products from mobile phone cases to candy to sports equipment for largely $5 or less.

Five Below reported revenues of $736.4 million, up 14.2% year on year, exceeding analyst expectations by 1.1%. It was a mixed quarter for the company, with a decent beat of analysts' earnings estimates but a miss of analysts' gross margin estimates.

The stock is up 1.9% since the results and currently trades at $191.69.

Read our full analysis of Five Below's results here.

Dillard's (NYSE:DDS)

With stores located largely in the Southern and Western US, Dillard’s (NYSE:DDS) is a department store chain that sells clothing, cosmetics, accessories, and home goods.

Dillard's reported revenues of $1.50 billion, down 4.4% year on year, falling short of analyst expectations by 1%. It was a very strong quarter for the company, with an impressive beat of analysts' earnings estimates.

The stock is up 28.2% since the results and currently trades at $395.64.

Read our full, actionable report on Dillard's here, it's free.

Kohl's (NYSE:KSS)

Founded as a corner grocery store in Milwaukee, Wisconsin, Kohl’s (NYSE:KSS) is a department store chain that sells clothing, cosmetics, electronics, and home goods.

Kohl's reported revenues of $4.05 billion, down 5.2% year on year, surpassing analyst expectations by 2.7%. It was an exceptional quarter for the company, with an impressive beat of analysts' earnings estimates.

The stock is up 11.9% since the results and currently trades at $27.83.

Read our full, actionable report on Kohl's here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned