A Look Back at Household Products Stocks' Q4 Earnings: WD-40 (NASDAQ:WDFC) Vs The Rest Of The Pack

As the craze of earnings season draws to a close, here's a look back at some of the most exciting (and some less so) results from Q4. Today we are looking at the household products stocks, starting with WD-40 (NASDAQ:WDFC).

Household products companies engage in the manufacturing, distribution, and sale of goods that maintain and enhance the home environment. This includes cleaning supplies, home improvement tools, kitchenware, small appliances, and home decor items. Companies within this sector must focus on product quality, innovation, and cost efficiency to remain competitive. Household products stocks are generally stable investments, as many of the industry's products are essential for a comfortable and functional living space. Recently, there's been a growing emphasis on eco-friendly and sustainable offerings, reflecting the evolving consumer preferences for environmentally conscious options.

The 10 household products stocks we track reported a decent Q4; on average, revenues beat analyst consensus estimates by 1.9% Valuation multiples for growth stocks have reverted to their historical means after reaching highs in early 2021, but household products stocks held their ground better than others, with the share prices up 5.9% on average since the previous earnings results.

WD-40 (NASDAQ:WDFC)

Short for “Water Displacement perfected on the 40th try”, WD-40 (NASDAQGS:WDFC) is a renowned American consumer goods company known for its iconic and versatile spray, WD-40 Multi-Use Product.

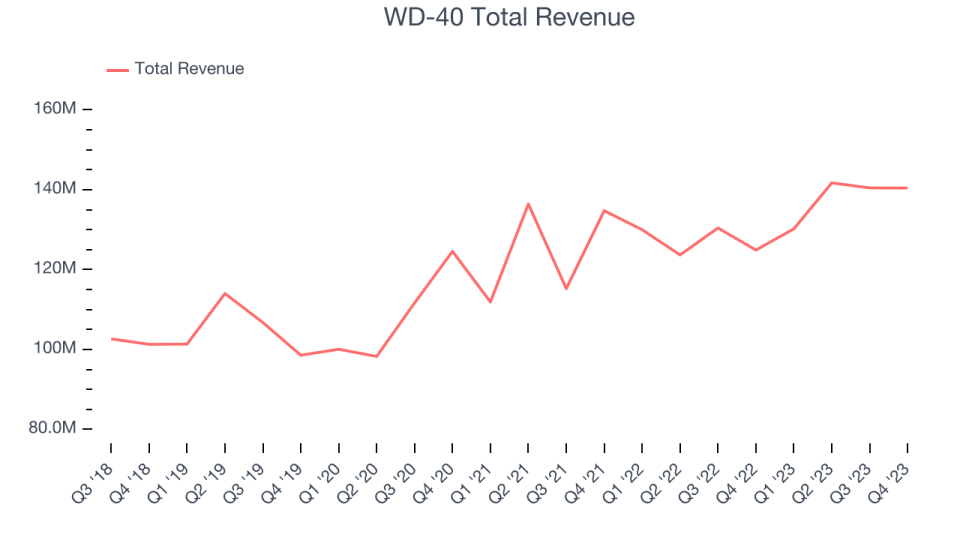

WD-40 reported revenues of $140.4 million, up 12.4% year on year, topping analyst expectations by 4.5%. It was an impressive quarter for the company, with a solid beat of analysts' revenue estimates.

“We have started fiscal year 2024 firing on all cylinders, with significant volume-related sales growth across all three trade blocs,” said Steve Brass, WD-40 Company’s president and chief executive officer.

WD-40 achieved the fastest revenue growth of the whole group. The stock is up 12.6% since the results and currently trades at $266.45.

Is now the time to buy WD-40? Access our full analysis of the earnings results here, it's free.

Best Q4: Clorox (NYSE:CLX)

Founded in 1913 with bleach as the sole product offering, Clorox (NYSE:CLX) today is a consumer products giant whose product portfolio spans everything from bleach to skincare to salad dressing to kitty litter.

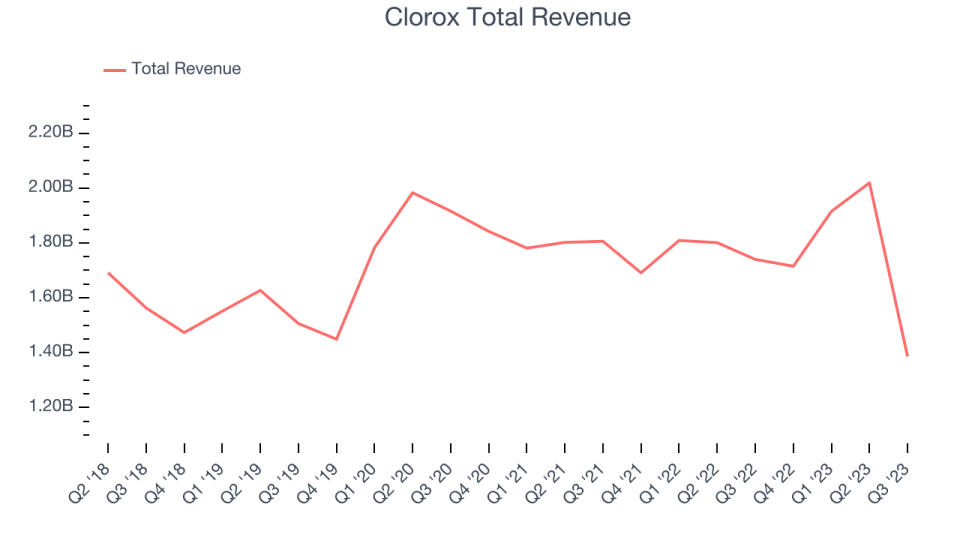

Clorox reported revenues of $1.39 billion, down 20.3% year on year, outperforming analyst expectations by 5.8%. It was an exceptional quarter for the company, with an impressive beat of analysts' earnings estimates.

Clorox pulled off the biggest analyst estimates beat but had the slowest revenue growth among its peers. The stock is up 24.2% since the results and currently trades at $143.35.

Is now the time to buy Clorox? Access our full analysis of the earnings results here, it's free.

Weakest Q4: Central Garden & Pet (NASDAQ:CENT)

Enhancing the lives of both pets and homeowners, Central Garden & Pet (NASDAQGS:CENT) is a leading producer and distributor of essential products for pet care, lawn and garden maintenance, and pest control.

Central Garden & Pet reported revenues of $750.1 million, up 6% year on year, exceeding analyst expectations by 2.1%. It was a weak quarter for the company, with underwhelming earnings guidance for the full year.

The stock is up 7.6% since the results and currently trades at $47.18.

Read our full analysis of Central Garden & Pet's results here.

Procter & Gamble (NYSE:PG)

Founded by candle maker William Procter and soap maker James Gamble, Proctor & Gamble (NYSE:PG) is a consumer products behemoth whose product portfolio spans everything from facial tissues to laundry detergent to feminine care to men’s grooming.

Procter & Gamble reported revenues of $21.87 billion, up 6.1% year on year, surpassing analyst expectations by 1.4%. It was a decent quarter for the company, with a beat of analysts' revenue expectations.

The stock is up 1.4% since the results and currently trades at $148.34.

Read our full, actionable report on Procter & Gamble here, it's free.

Church & Dwight (NYSE:CHD)

Best known for its Arm & Hammer baking soda, Church & Dwight (NYSE:CHD) is a household and personal care products company with a vast portfolio that spans laundry detergent to toothbrushes to hair removal creams.

Church & Dwight reported revenues of $1.46 billion, up 10.5% year on year, surpassing analyst expectations by 1.5%. It was a mixed quarter for the company, with a decent beat of analysts' revenue estimates. On the other hand, its earnings forecast for next quarter missed analysts' expectations and its EPS missed Wall Street's estimates.

The stock is up 5.5% since the results and currently trades at $96.93.

Read our full, actionable report on Church & Dwight here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned