A Look Back at Leisure Facilities Stocks' Q4 Earnings: Live Nation (NYSE:LYV) Vs The Rest Of The Pack

As leisure facilities stocks’ Q4 earnings season wraps, let's dig into this quarter's best and worst performers, including Live Nation (NYSE:LYV) and its peers.

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

The 10 leisure facilities stocks we track reported a weaker Q4; on average, revenues beat analyst consensus estimates by 3.4% while next quarter's revenue guidance was 21.6% below consensus. Valuation multiples for growth stocks have reverted to their historical means after reaching highs in early 2021, but leisure facilities stocks held their ground better than others, with the share prices up 11.1% on average since the previous earnings results.

Live Nation (NYSE:LYV)

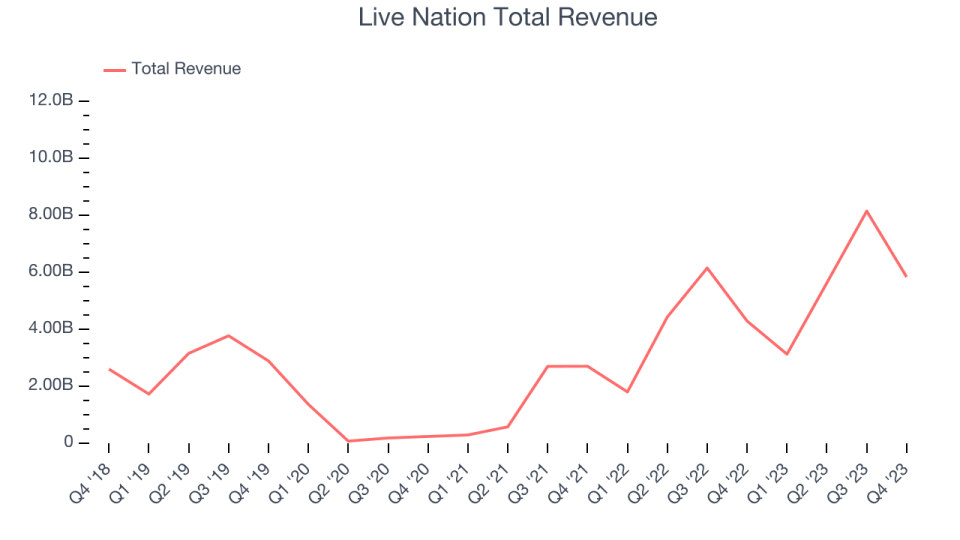

Owner of Ticketmaster and operator of music festival EDC, Live Nation (NYSE:LYV) is a company specializing in live event promotion, venue management, and ticketing services for concerts and shows.

Live Nation reported revenues of $5.84 billion, up 36.1% year on year, topping analyst expectations by 22.1%. It was a decent quarter for the company, with an impressive beat of analysts' revenue estimates but a miss of analysts' earnings estimates.

"The live music industry reached new heights in 2023, and demand for live music continues to build. Our digital world empowers artists to develop global followings, while inspiring fans to crave in-person experiences more than ever. At the same time, the industry is delivering a wider variety of concerts which draws in new audiences, and developing more venues to support a larger show pipeline. Against this backdrop, we expect all our businesses to continue growing and adding value to artists and fans as we deliver double-digit operating income and AOI growth again this year, with our profitability compounding by double-digits over the next several years."

Live Nation pulled off the biggest analyst estimates beat and fastest revenue growth of the whole group. The stock is up 14.5% since the results and currently trades at $107.1.

Is now the time to buy Live Nation? Access our full analysis of the earnings results here, it's free.

Best Q4: Life Time (NYSE:LTH)

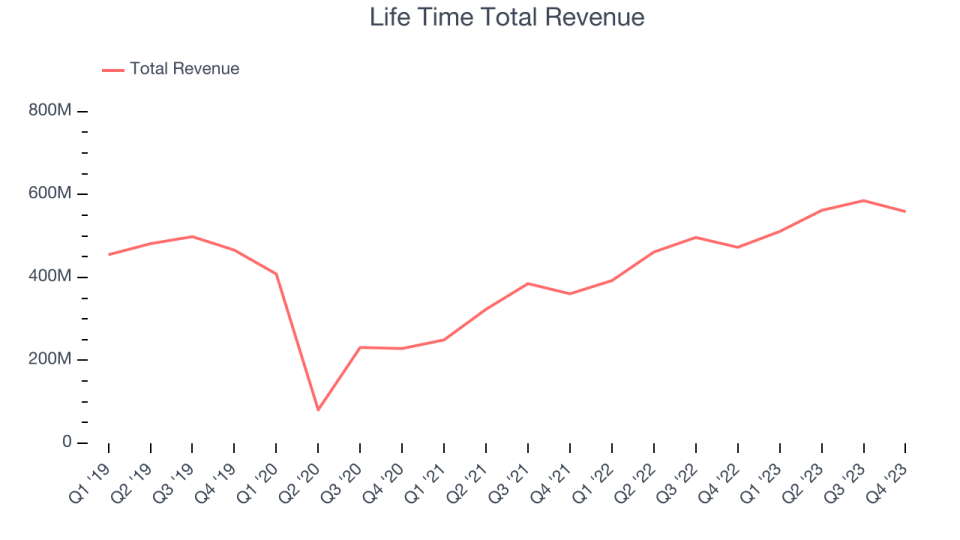

With over 150 locations and gyms that include saunas and steam rooms, Life Time (NYSE:LTH) is an upscale fitness club emphasizing holistic well-being and fitness.

Life Time reported revenues of $558.8 million, up 18.2% year on year, in line with analyst expectations. It was a strong quarter for the company, with a solid beat of analysts' earnings estimates and revenue guidance for next quarter exceeding analysts' expectations.

Life Time scored the highest full-year guidance raise among its peers. The stock is up 18.1% since the results and currently trades at $14.68.

Is now the time to buy Life Time? Access our full analysis of the earnings results here, it's free.

Slowest Q4: Six Flags (NYSE:SIX)

Sporting the fastest rollercoaster in the United States, Six Flags (NYSE:SIX) is a regional theme park operator offering thrilling rides, entertainment, and family-friendly attractions.

Six Flags reported revenues of $292.6 million, up 4.5% year on year, falling short of analyst expectations by 1.7%. It was a weak quarter for the company, with a miss of analysts' earnings estimates.

The stock is up 2.9% since the results and currently trades at $25.29.

Read our full analysis of Six Flags's results here.

European Wax Center (NASDAQ:EWCZ)

Founded by two siblings, European Wax Center (NASDAQ:EWCZ) is a beauty and waxing salon chain specializing in professional wax services and skincare products.

European Wax Center reported revenues of $56.33 million, up 5.2% year on year, surpassing analyst expectations by 4.2%. It was a decent quarter for the company, with an impressive beat of analysts' earnings estimates but full-year revenue guidance missing analysts' expectations.

European Wax Center had the weakest full-year guidance update among its peers. The stock is down 3.3% since the results and currently trades at $12.66.

Read our full, actionable report on European Wax Center here, it's free.

Vail Resorts (NYSE:MTN)

Founded by two Aspen, Colorado ski patrol guides, Vail Resorts (NYSE:MTN) is a mountain resort company offering luxury experiences in over 30 locations across the globe.

Vail Resorts reported revenues of $1.08 billion, down 2.2% year on year, falling short of analyst expectations by 6.5%. It was a weak quarter for the company, with a miss of analysts' visitors and revenue estimates.

Vail Resorts had the weakest performance against analyst estimates and slowest revenue growth among its peers. The stock is down 2.4% since the results and currently trades at $219.3.

Read our full, actionable report on Vail Resorts here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.