A Look Back at Sales Software Stocks' Q2 Earnings: Freshworks (NASDAQ:FRSH) Vs The Rest Of The Pack

The end of an earnings season can be a great time to assess how companies are handling the current business environment and discover new stocks. Let’s take a look at how Freshworks (NASDAQ:FRSH) and the rest of the sales software stocks fared in Q2.

Companies need to be able to interact with and sell to their customers as efficiently as possible. This reality coupled with the ongoing migration of enterprises to the cloud drives demand for cloud-based customer relationship management (CRM) software that integrates data analytics with sales and marketing functions.

The 4 sales software stocks we track reported a mixed Q2; on average, revenues beat analyst consensus estimates by 1.83%, while next quarter's revenue guidance was 0.71% below consensus. Technology stocks have been hit hard by fears of higher interest rates as investors search for near-term cash flows and sales software stocks have not been spared, with share prices down 12.4% on average, since the previous earnings results.

Freshworks (NASDAQ:FRSH)

Founded in Chennai, India in 2010 with the idea of creating a “fresh” helpdesk product, Freshworks (NASDAQ: FRSH) offers a broad range of software targeted at small and medium-sized businesses.

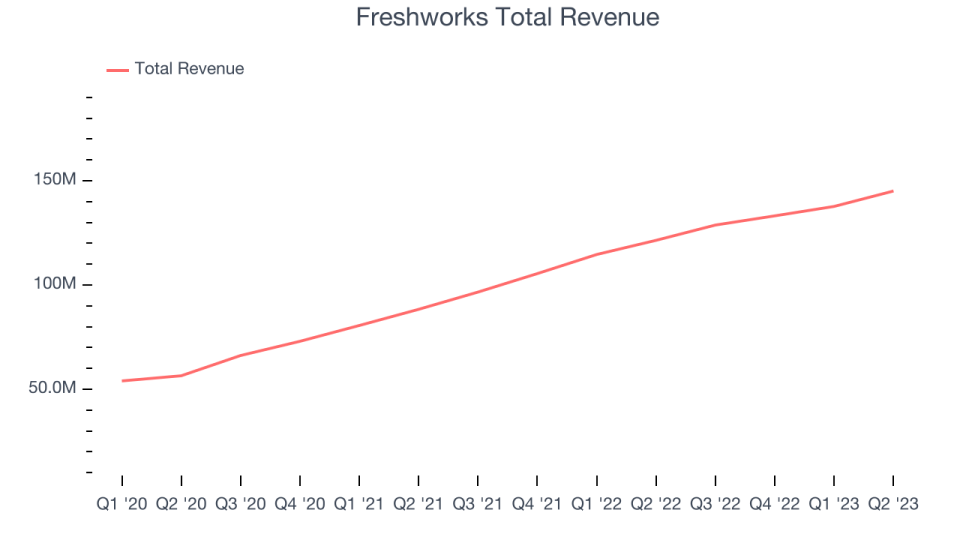

Freshworks reported revenues of $145.1 million, up 19.5% year on year, topping analyst expectations by 2.57%. It was a mixed quarter for the company, with a decent beat of analysts' revenue estimates.

“Freshworks is building on the foundations we set at the start of the year to deliver faster product innovation, and improve our efficiency,” said Girish Mathrubootham, CEO and Founder of Freshworks.

The stock is up 2.91% since the results and currently trades at $18.75.

Is now the time to buy Freshworks? Access our full analysis of the earnings results here, it's free.

Best Q2: HubSpot (NYSE:HUBS)

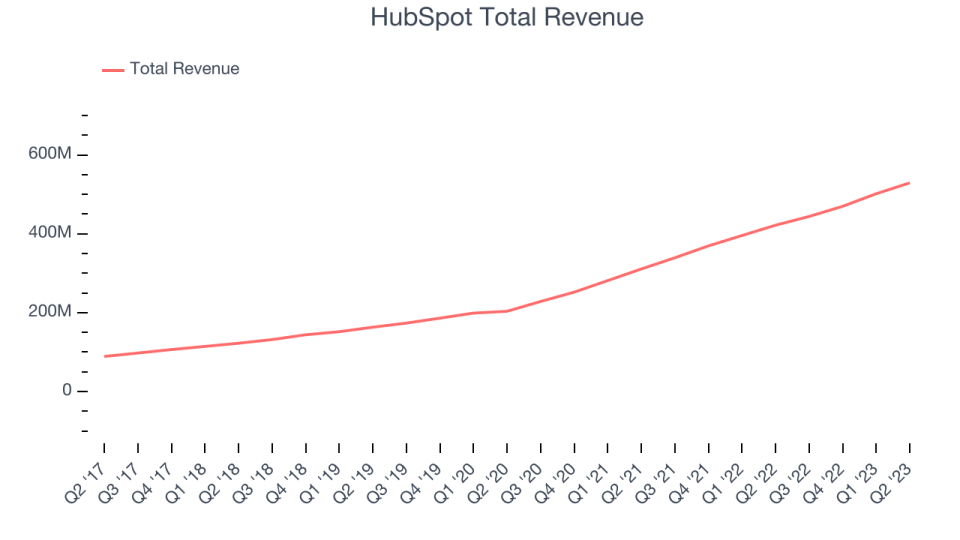

Started in 2006 by two MIT grad students, HubSpot (NYSE:HUBS) is a software-as-a-service platform that helps small and medium-sized businesses sell, market themselves, and get found on the internet.

HubSpot reported revenues of $529.1 million, up 25.5% year on year, outperforming analyst expectations by 4.68%. It was a decent quarter for the company, with a decent beat of analysts' revenue estimates but decelerating customer growth.

HubSpot scored the strongest analyst estimates beat, fastest revenue growth, and highest full year guidance raise among its peers. The company added 7,626 customers to a total of 184,924. The stock is down 15.3% since the results and currently trades at $469.16.

Is now the time to buy HubSpot? Access our full analysis of the earnings results here, it's free.

Weakest Q2: ZoomInfo (NASDAQ:ZI)

Founded in 2007 as DiscoveryOrg and renamed after a merger in 2019, ZoomInfo (NASDAQ:ZI) is a software-as-a-service product that provides sales departments with access to a database of prospective clients.

ZoomInfo reported revenues of $308.6 million, up 15.5% year on year, falling short of analyst expectations by 0.8%. It was a weak quarter for the company, with full-year revenue guidance missing analysts' expectations and underwhelming revenue guidance for the next quarter.

ZoomInfo had the weakest performance against analyst estimates and weakest full year guidance update in the group. The company lost 12 enterprise customers paying more than $100,000 annually and ended up with a total of 1,893. The stock is down 33% since the results and currently trades at $17.15.

Read our full analysis of ZoomInfo's results here.

Salesforce (NYSE:CRM)

Launched in 1999 from a rented one-bedroom apartment in San Francisco by Marc Benioff and his three co-founders, Salesforce (NYSE:CRM) is a software-as-a-service platform that helps companies access, manage, and share sales information.

Salesforce reported revenues of $8.6 billion, up 11.4% year on year, in line with analyst expectations. It was a mixed quarter for the company, with an improvement in its gross margin.

Salesforce had the slowest revenue growth among its peers. The stock is down 3.28% since the results and currently trades at $208.21.

Read our full, actionable report on Salesforce here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned