A Look Back at Semiconductors Stocks' Q2 Earnings: Seagate Technology (NASDAQ:STX) Vs The Rest Of The Pack

As Q2 earnings season comes to a close, it’s time to take stock of this quarter's best and worst performers amongst the semiconductors stocks, including Seagate Technology (NASDAQ:STX) and its peers.

The semiconductor industry is driven by cyclical demand for advanced electronic products like smartphones, PCs, servers and data storage. While analog chips serve as the building blocks of most electronic goods and equipment, processors (CPUs) and graphics chips serve as their brains. The growth of data and technologies like artificial intelligence, 5G, Internet of Things and smart cars are creating a next wave of secular growth for the industry.

The 41 semiconductors stocks we track reported a mixed Q2; on average, revenues beat analyst consensus estimates by 1.71%, while on average next quarter revenue guidance was 1.72% under consensus. Increasing interest rates hurt growth companies as investors search for near-term cash flows and while some of the semiconductors stocks have fared somewhat better than others, they have not been spared, with share prices declining 9.08% since the previous earnings results, on average.

Seagate Technology (NASDAQ:STX)

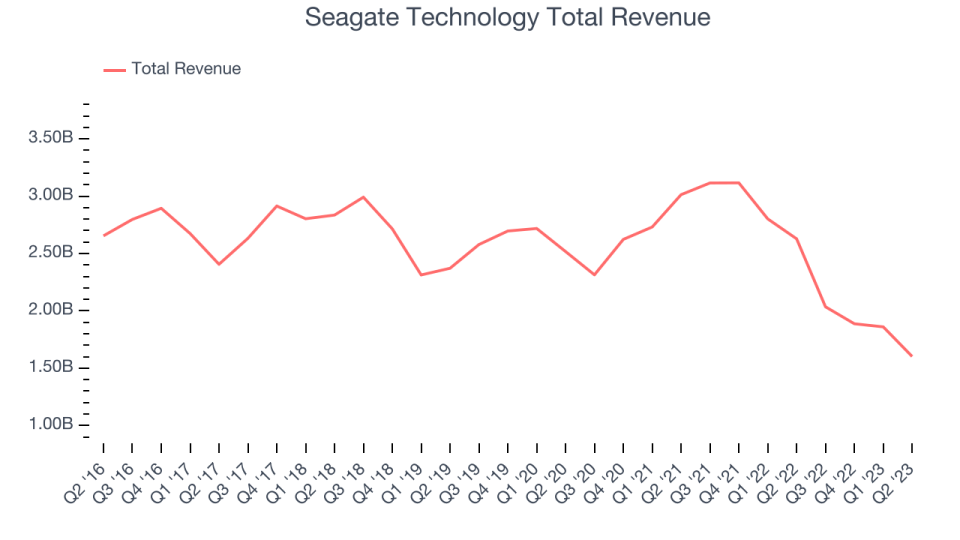

The developer of the original 5.25inch hard disk drive, Seagate (NASDAQ:STX) is a leading producer of data storage solutions, including hard drives and Solid State Drives (SSDs) used in PCs and data centers.

Seagate Technology reported revenues of $1.6 billion, down 39% year on year, missing analyst expectations by 5.01%. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and a miss of analysts' revenue estimates.

The stock is up 15.4% since the results and currently trades at $66.88.

Read our full report on Seagate Technology here, it's free.

Best Q2: Nvidia (NASDAQ:NVDA)

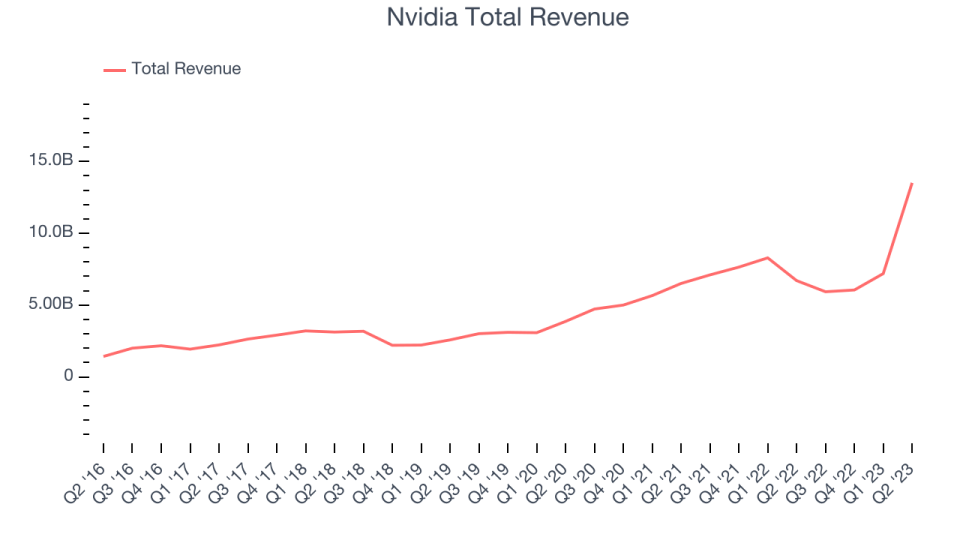

Founded in 1993 by Jensen Huang and two former Sun Microsystems engineers, Nvidia (NASDAQ:NVDA) is a leading fabless designer of chips used in gaming, PCs, data centers, automotive, and a variety of end markets.

Nvidia reported revenues of $13.5 billion, up 101% year on year, beating analyst expectations by 21.9%. It was an incredible quarter for the company, with beats across nearly every key metric. Nvidia's revenue guidance for the next quarter also blew past analysts' expectations.

Nvidia scored the strongest analyst estimates beat and fastest revenue growth among its peers. The stock is down 3.49% since the results and currently trades at $454.77.

Is now the time to buy Nvidia? Access our full analysis of the earnings results here, it's free.

Weakest Q2: IPG Photonics (NASDAQ:IPGP)

Both a designer and manufacturer of most of its products, IPG Photonics (NASDAQ:IPGP) is a provider of high-performance fiber lasers that are used for cutting, welding and processing raw materials.

IPG Photonics reported revenues of $340 million, down 9.83% year on year, missing analyst expectations by 1.79%. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and a miss of analysts' revenue estimates.

The stock is down 27.3% since the results and currently trades at $95.53.

Read our full analysis of IPG Photonics's results here.

Nova (NASDAQ:NVMI)

Headquartered in Israel, Nova (NASDAQ: NVMI) is a provider of quality control systems used in semiconductor manufacturing.

Nova reported revenues of $122.7 million, down 13.4% year on year, in line with analyst expectations. It was a weak quarter for the company, with an increase in its inventory levels and a decline in its operating margin.

The stock is down 11.7% since the results and currently trades at $107.28.

Read our full, actionable report on Nova here, it's free.

Skyworks Solutions (NASDAQ:SWKS)

Result of a merger of Alpha Industries and the wireless communications division of Conexant, Skyworks Solutions (NASDAQ: SWKS) is a designer and manufacturer of chips used in smartphones, autos, and industrial applications to amplify, filter, and process wireless signals.

Skyworks Solutions reported revenues of $1.07 billion, down 13.1% year on year, missing analyst expectations by 0.19%. It was a weaker quarter for the company, with a decline in key profitability metrics, including gross and operating margin.

The stock is down 13.8% since the results and currently trades at $94.95.

Read our full, actionable report on Skyworks Solutions here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned