A Look Back at Traditional Fast Food Stocks' Q3 Earnings: Wendy's (NASDAQ:WEN) Vs The Rest Of The Pack

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to other peers in the same sector. Today we are looking at Wendy's (NASDAQ:WEN), and the best and worst performers in the traditional fast food group.

Traditional fast-food restaurants are renowned for their speed and convenience, boasting menus filled with familiar and budget-friendly items. Their reputations for on-the-go consumption make them favored destinations for individuals and families needing a quick meal. This class of restaurants, however, is fighting the perception that their meals are unhealthy and made with inferior ingredients, a battle that's especially relevant today given the consumers increasing focus on health and wellness.

The 15 traditional fast food stocks we track reported a decent Q3; on average, revenues missed analyst consensus estimates by 0.6% Inflation (despite slowing) has investors prioritizing near-term cash flows, but traditional fast food stocks held their ground better than others, with the share prices up 8.1% on average since the previous earnings results.

Wendy's (NASDAQ:WEN)

Founded by Dave Thomas in 1969, Wendy’s (NASDAQ:WEN) is a renowned fast-food chain known for its fresh, never-frozen beef burgers, flavorful menu options, and commitment to quality.

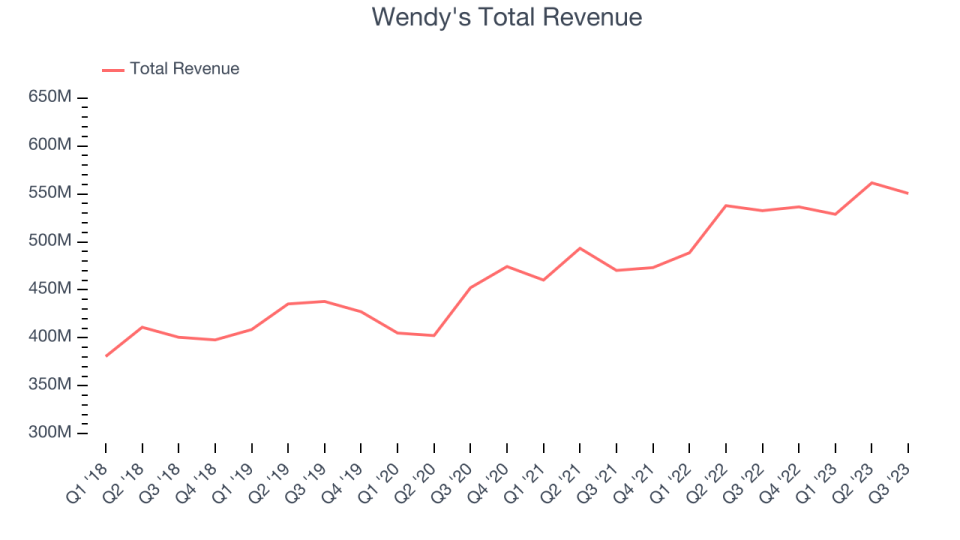

Wendy's reported revenues of $550.6 million, up 3.4% year on year, falling short of analyst expectations by 0.8%. It was a strong quarter for the company, with a decent beat of analysts' earnings estimates.

"We continued to make meaningful progress across our strategic growth pillars during the third quarter," President and Chief Executive Officer Todd Penegor said.

The stock is down 0.1% since the results and currently trades at $18.97.

Is now the time to buy Wendy's? Access our full analysis of the earnings results here, it's free.

Best Q3: Arcos Dorados (NYSE:ARCO)

Translating to “Golden Arches” in Spanish, Arcos Dorados (NYSE:ARCO) is the master franchisee of the McDonald's brand in Latin America and the Caribbean, responsible for its operations and growth in over 20 countries.

Arcos Dorados reported revenues of $1.13 billion, up 22.1% year on year, outperforming analyst expectations by 3.4%. It was a stunning quarter for the company, with an impressive beat of analysts' revenue and earnings estimates.

Arcos Dorados scored the biggest analyst estimates beat among its peers. The stock is up 15.4% since the results and currently trades at $12.16.

Is now the time to buy Arcos Dorados? Access our full analysis of the earnings results here, it's free.

Weakest Q3: Krispy Kreme (NASDAQ:DNUT)

Famous for its Original Glazed doughnuts and parent company of Insomnia Cookies, Krispy Kreme (NASDAQ:DNUT) is one of the most beloved and well-known fast-food chains in the world.

Krispy Kreme reported revenues of $407.4 million, up 7.9% year on year, falling short of analyst expectations by 1.6%. It was a weak quarter for the company, with a miss of analysts' revenue, gross margin, adjusted EBITDA, and EPS estimates. These misses were driven by underperformance in its U.S. division, which accounted for 63.9% of sales this quarter. On top of that, its revenue guidance for the full year was underwhelming.

Krispy Kreme had the weakest full-year guidance update in the group. The stock is up 1.6% since the results and currently trades at $13.66.

Read our full analysis of Krispy Kreme's results here.

Dutch Bros (NYSE:BROS)

Started in 1992 by two brothers as a single pushcart, Dutch Bros (NYSE:BROS) is a dynamic coffee chain that’s captured the hearts of coffee enthusiasts across the United States.

Dutch Bros reported revenues of $264.5 million, up 33.2% year on year, surpassing analyst expectations by 2.4%. It was a very strong quarter for the company, with an impressive beat of analysts' earnings and revenue estimates.

Dutch Bros scored the fastest revenue growth and highest full-year guidance raise among its peers. The stock is up 3.5% since the results and currently trades at $27.51.

Read our full, actionable report on Dutch Bros here, it's free.

Papa John's (NASDAQ:PZZA)

Founded by the eclectic John “Papa John” Schnatter, Papa John’s (NASDAQ:PZZA) is a globally recognized pizza delivery and carryout chain known for “better ingredients” and “better pizza”.

Papa John's reported revenues of $522.8 million, up 2.4% year on year, falling short of analyst expectations by 1.4%. It was a mixed quarter for the company, with an impressive beat of analysts' gross margin estimates but a miss of analysts' revenue estimates.

The stock is up 15.4% since the results and currently trades at $75.3.

Read our full, actionable report on Papa John's here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned