Look Down the Cap Spectrum for Opportunities in Industrials Sector

This article was originally published on ETFTrends.com.

Investors looking for lucrative opportunities in the industrials sector may want to look down the cap spectrum.

The Invesco S&P SmallCap Industrials ETF (PSCI) has seen a notable spike in interest as small-cap industrial stocks have outperformed in recent weeks and have a constructive outlook. PSCI is based on the S&P SmallCap 600 Capped Industrials Index. The index imposes capped weights on the index constituents included in the S&P SmallCap 600.

See more: “High Beta ETF ‘SPHB’ Lifted by Heavy Tech Sector Tilt”

Launched in 2010, PSCI has hauled in considerable flows in the past week. The fund has grown by 45%, reaching $118 million in assets under management.

“While large-cap industrial companies have more exposure to global economies, small-cap stocks found inside PSCI are more domestically focused,” Todd Rosenbluth, head of research at VettaFi, said. “As advisors look to the second half of 2023 and see the opportunity for U.S. economic growth, they will want to turn to up-and-coming companies.”

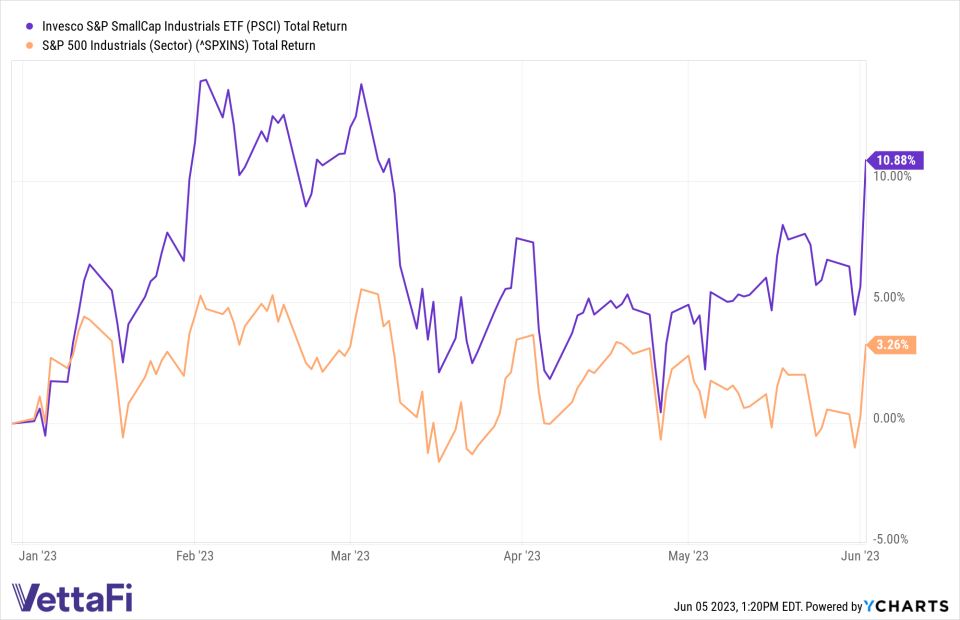

Small-Caps Outperform in the Industrials Sector

PSCI is up 10.9% while the S&P 500 Industrials index is up 3.3% year-to-date through June 2. In the past month, PSCI has rallied 8.5%, while the large-cap index has climbed 3.0%.

See more: “7 Fixed Income ETFs to Consider in the Current Environment”

PSCI offers significantly different exposure than the large-cap S&P 500 Industrials index. PSCI’s underlying index has a median total market cap around $1.5 million. Conversely, the S&P 500 Industrials index’s median total market cap is over $31 million.

The top 10 constituents in the S&P 500 Industrials comprise roughly 39% of the index by weight. The index includes 76 names. Meanwhile, the top 10 constituents in PSCI’s underlying index comprise 25% of the index by weight. PSCI’s underlying index includes 76 companies.

For more news, information, and analysis, visit the Innovative ETFs Channel.

POPULAR ARTICLES AND RESOURCES FROM ETFTRENDS.COM