A Look At Five Star Senior Living's (NASDAQ:FVE) Share Price Returns

Five Star Senior Living Inc. (NASDAQ:FVE) shareholders will doubtless be very grateful to see the share price up 51% in the last quarter. But spare a thought for the long term holders, who have held the stock as it bled value over the last five years. Five years have seen the share price descend precipitously, down a full 76%. It's true that the recent bounce could signal the company is turning over a new leaf, but we are not so sure. The real question is whether the business can leave its past behind and improve itself over the years ahead.

Check out our latest analysis for Five Star Senior Living

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During five years of share price growth, Five Star Senior Living moved from a loss to profitability. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics might give us a better handle on how its value is changing over time.

It could be that the revenue decline of 6.8% per year is viewed as evidence that Five Star Senior Living is shrinking. That could explain the weak share price.

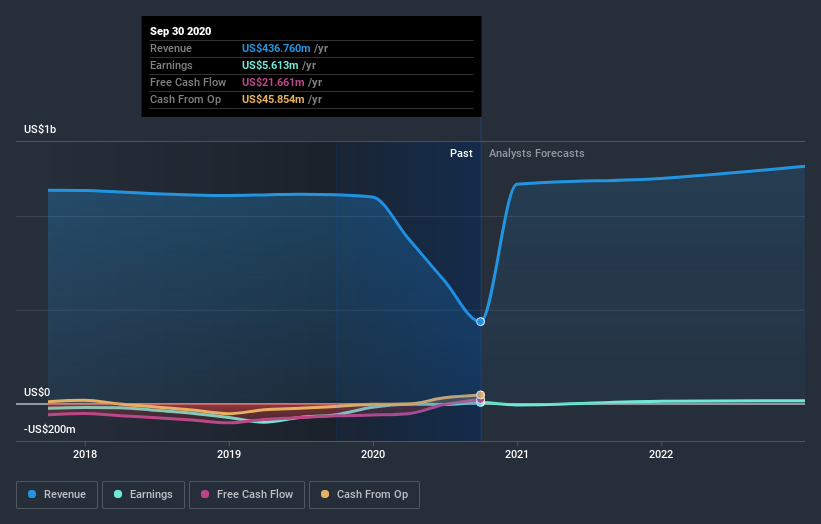

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We know that Five Star Senior Living has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for Five Star Senior Living in this interactive graph of future profit estimates.

A Different Perspective

We're pleased to report that Five Star Senior Living shareholders have received a total shareholder return of 67% over one year. That certainly beats the loss of about 12% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Five Star Senior Living (of which 1 shouldn't be ignored!) you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.