A Look at GoPro's Strategic Pivot

GoPro Inc.'s (NASDAQ:GPRO) strategic shift to lower pre-pandemic pricing and the introduction of entry-level cameras has been a game-changer.

This move boosted unit sales and revenue, contributing 19% to third-quarter 2023 camera revenue, and demonstrated successful market penetration without hurting premium sales.

With $294 million in revenue for the third quarter, 78% of which came from retail channels, GoPro's market position is stronger than ever.

However, a decrease in online sales highlights an evolving consumer trend, suggesting a potential pivot in the company's future market strategy.

A Winning Strategy: Lower Prices and Expanded Retail Presence Fuel Remarkable Growth

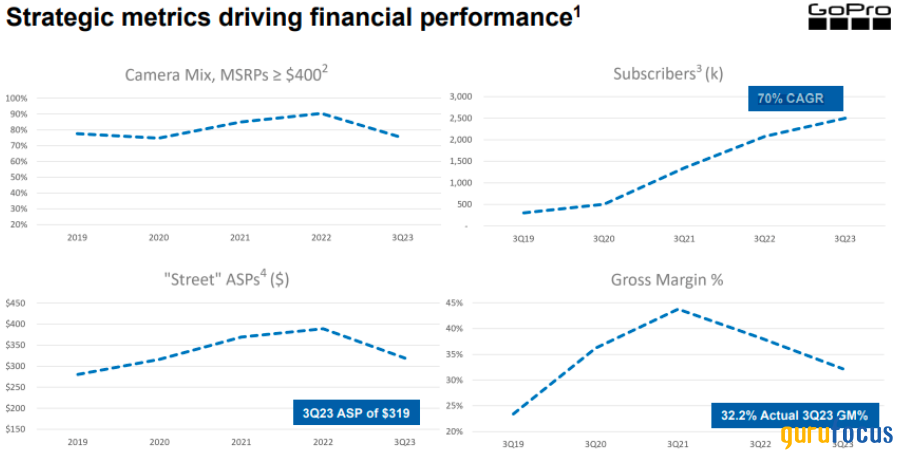

GoPro's decision to revert to lower pre-pandemic pricing and reintroduce entry-level priced cameras has been instrumental in boosting unit sales and revenue. For instance, the HERO12 Black was introduced at $399, driving revenue and receiving positive acclaim. Notably, entry-level stock-keeping units contributed 19% to camera revenue in the third quarter without significantly cannibalizing high-end SKUs. This suggests successful market penetration among new customers without compromising premium sales.

The revenue reached $294 million, with $231 million (78%) generated through retail channels. Also, the recognition from media outlets like Mashable, Slashgear, Tom's Guide and PC Magazine reflects the market's positive response to HERO12 Black's features, indicating a strengthened market position and product differentiation. It may sustain the revenue streams over the long term.

Looking at sales through GoPro.com, its direct-to-consumer channel, the proportion to total revenue stands at 22%, experiencing a decline from 2022 (38% of revenue). The decline was caused by the price dropping back to pre-Covid levels and an ending subscription originating from discounted camera offerings. The in-house sales channel is becoming ineffective in deriving sales from the target market. Thus, GoPro's increasing reliance on e-commerce platforms and distributors may eat out its competitive edge and product positioning over the long term.

Source: Third-quarter presentation

GoPro's strategy to expand its global retail presence has yielded substantial revenue growth. Retail channel revenue grew 12% year-over-year to $231 million, representing a significant portion (78%) of total revenue for the quarter. The company exceeded its target by adding 2,500 new retail doors, showcasing a proactive approach to expanding its market reach.

Management said it plans to increase the retail presence to approximately 25,000 by 2024 by adding 3,000 additional retail doors, projecting a 30% increase from the initiation of the growth strategy in May 2023. The growth indicates the effectiveness of the company's market penetration strategy in targeting a broader customer base and computing increased market share. GoPro's focus on retail expansion highlights the vitality of physical storefronts in its revenue-generating strategy.

Further, the company experienced a notable 31% sequential increase and a 16% year-over-year increase in total camera unit sales. Specifically, total camera units sold into retail grew by 35% and retail sell-through (the rate at which retailers sell inventory) grew by 29% year over year. These figures indicate increasing demand for GoPro products and highlight the effectiveness of the company's focus on retail channel expansion. Also, the dominance in retail channels highlights its ability to leverage external channels to drive sales and brand visibility.

As of the third quarter, sell-through growth witnessed an 8% year-over-year increase, reaching approximately 750,000 units. All major geographies experienced positive sell-through growth. For instance, Europe grew by 16% due to expanding door count and appropriate pricing strategies.

In contrast, in the Americas, it increased by 6% in September, showcasing resilience amidst a decline in the U.S. consumer electronics market. The Asia-Pacific region saw a 4% year-over-year improvement, reflecting steady growth.

Lastly, in the fourth quarter, GoPro expects to hit a unit sell-through of nearly 1 milliion, representing a 33% sequential improvement, implying the company's products are positioned well with customers across various demographics and regions.

Subscription surge: 2.5 million strong and growing, powering revenue across all tiers

GoPro's subscription service remains a significant revenue driver, boasting 2.5 million subscribers and a substantial 20% year-over-year growth. The company achieved a 40% subscription attach rate, indicating a strong correlation between camera purchases and subscription sign-ups. This correlation demonstrates that many customers who buy GoPro cameras are inclined to subscribe to the additional services offered.

Notably, entry-level camera buyers exhibited a nearly 30% subscription attachment rate, showcasing the service's appeal across different price points and ranges, not just higher-end products. It also demonstrates the progress of the subscription service even among buyers of lower-priced products, demonstrating customers' willingness to opt for subscription services, irrespective of the camera price point they purchase.

Looking at the sustainability of the subscriber base, the retention rates for annual subscribers remained robust, with first-year renewals at 60% to 65% and second-year renewals at 70% to 75%. This reflects consistent subscriber satisfaction and loyalty with the subscription duration.

Lastly, consistent renewal rates suggest subscribers find value in the subscription service, leading to sustained revenue streams year over year.

Going forward, GoPro's focus on continued subscriber growth in 2024 and the introduction of a higher-tier subscription with advanced features and increased cloud storage reflect the company's commitment to leveraging subscription services for revenue generation.

Source: Third-quarter supplemental material

Balancing lower ASP with margin challenges for future growth

Street average selling price impacts revenue due to a weakness in GoPro's pricing strategy. In the third quarter, GoPro reported a street ASP of $319, down from $383 in the prior-year period. It represents a significant year-over-year decline of approximately 17%, attributed primarily to GoPro's strategic decision to stimulate sales.

At its core, the decline in ASP results from the intentional reduction in camera prices. GoPro aimed to return to pre-pandemic price points, enhancing affordability and market competitiveness. Lower pricing strategies were pivotal in driving increased unit sales and subscriber growth.

However, the decrease in ASP is accompanied by a shift in the revenue mix. In the third quarter, 75% of camera revenue came from suggested retail prices of $400 and above, as opposed to 87% in the year-ago quarter. This shift highlights the increased contribution from lower-priced products to the revenue stream.

The increase in sales of entry-level cameras, while beneficial for volume, has led to a compression in profit margins. To ensure continued success, GoPro needs to maintain and increase these sales volumes, necessitating strategic actions to improve margins in this area.

Therefore, lower-priced products tend to have lower profit margins, likely contributing to the deterioration in GoPro's gross margins. The company expects a decrease in gross margin to 32% in 2023 (from 38% in 2022) due to increased sales of lower-priced products. However, the forecasted improvement to approximately 37% in 2024 suggests a positive outlook, potentially driven by a mix of factors like cost-saving measures, product mix adjustments or economies of scale.

Source: Third-quarter presentation

Technical take: Navigating cyclical trends and aiming for a $4.25 peak by year's end

GoPro's stock price is projected to reach $4.25 by the conclusion of 2023, marked by the yellow arrow below, should its current momentum persist, potentially buoyed by the Santa Claus Rally. Despite this short-term outlook, the company's long-term fundamentals do not support an uplift in market valuation.

A primary concern lies in the lack of consistent revenue growth, with GoPro experiencing a cyclical quarterly trend over six years, barring the anomaly caused by the Covid crisis, indicated by a blue highlight. Looking ahead, there appears to be a slight improvement in revenue estimates as fourth-quarter projections remain stagnant at $326.13 million, mirroring last year's figures.

The super trend signals initiate a bullish trend following a double bottom formation near the long-term support of around $2.30. Subsequently, the purple arrow indicates the anticipated long-term entry point stands at $2.60, potentially achievable by early 2024. This level also presents an opportunity for accumulating positions to optimize the average cost of long-term holdings.

Lastly, short-term technical indicators (i.e., moving averages and oscillators) confirm a bullish trend. However, a definitive close above $4.70 is necessary to validate a mid-term bullish trend. Notably, the range between $4.25 and $4.70 holds significant resistance based on Fibonacci retracement and extension analysis.

Source: tradingview

Takeaway

GoPro's strategic shift to lower pricing and expansion into retail channels has successfully driven revenue growth, as seen with the HERO12 Black's launch at $399 and a notable 19% contribution from entry-level SKUs to Q3 2023 revenue.

However, a decline in GoPro.com sales signals a shift toward retail and e-commerce, reflecting changing consumer preferences. Retail channel growth and subscription service expansion indicate robust market penetration and customer engagement.

Despite this, a decrease in average selling price and concerns over long-term stock valuation challenge future profitability. Investors should remain alert as technical analysis suggests a short-term bullish trend, but caution on the long-term outlook.

This article first appeared on GuruFocus.