A Look At Straight Path Communications Inc (STRP) And The Telco Sector

Straight Path Communications Inc (AMEX:STRP), a USD$2.31B mid-cap, is a telco company operating in an industry which continues to face innovations and technological developments, confronting industry incumbents with rapid changes. Telco analysts are forecasting for the entire industry, a positive double-digit growth of 14.46% in the upcoming year, and an optimistic near-term growth of 24.47% over the next couple of years. This rate is larger than the growth rate of the US stock market as a whole. Below, I will examine the sector growth prospects, and also determine whether STRP is a laggard or leader relative to its telco sector peers. View our latest analysis for Straight Path Communications

What’s the catalyst for STRP's sector growth?

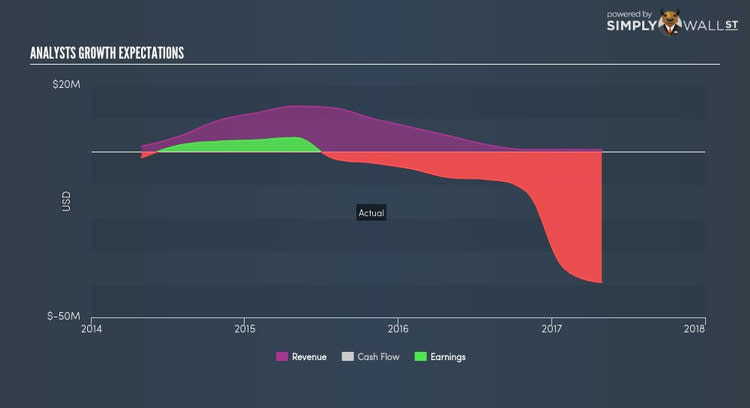

The convergence that has been talked about is now happening, but driven by disruption rather than well-considered strategies and marketing campaigns. Overall the growth in this segment of the telco industry is stagnating, and often the only way to maintain profitability is through cost-cutting. On the positive side, innovations and technological developments allow these companies to be more cost-competitive. In the past year, the industry delivered negative growth of -10.42%, underperforming the US market growth of 4.49%. STRP lags the pack with its negative growth rate of -399.11% over the past year, which indicates the company has been growing at a slower pace than its telco peers. As the company trails the rest of the industry in terms of growth, STRP may also be a cheaper stock relative to its peers.

Is STRP and the sector relatively cheap?

Telco companies are typically trading at a PE of 20x, in-line with the US stock market PE of 22x. This illustrates a fairly valued sector relative to the rest of the market, indicating low mispricing opportunities. However, the industry returned a lower 6.74% compared to the market’s 9.99%, illustrative of the recent sector upheaval. Since STRP’s earnings doesn’t seem to reflect its true value, its PE ratio isn’t very useful. A loose alternative to gauge STRP’s value is to assume the stock should be relatively in-line with its industry.

What this means for you:

Are you a shareholder? STRP has been an telco industry laggard in the past year. If your initial investment thesis is around the growth prospects of STRP, there are other telco companies that have delivered higher growth, and perhaps trading at a discount to the industry average. Consider how STRP fits into your wider portfolio and the opportunity cost of holding onto the stock.

Are you a potential investor? If STRP has been on your watchlist for a while, now may be a good time to dig deeper into the stock. Although its growth has delivered lower growth relative to its telco peers in the near term, the market may be pessimistic on the stock, leading to a potential undervaluation. Before you make a decision on the stock, I suggest you look at STRP’s future cash flows in order to assess whether the stock is trading at a reasonable price.

For a deeper dive into Straight Path Communications's stock, take a look at the company's latest free analysis report to find out more on its financial health and other fundamentals. Interested in other telco stocks instead? Use our free playform to see my list of over 300 other telco companies trading on the market.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.