We Take A Look At Why Shoe Zone plc's (LON:SHOE) CEO Compensation Is Well Earned

Key Insights

Shoe Zone to hold its Annual General Meeting on 12th of March

Salary of UK£359.3k is part of CEO Anthony Edward Smith's total remuneration

Total compensation is similar to the industry average

Shoe Zone's total shareholder return over the past three years was 345% while its EPS grew by 87% over the past three years

The performance at Shoe Zone plc (LON:SHOE) has been quite strong recently and CEO Anthony Edward Smith has played a role in it. The pleasing results would be something shareholders would keep in mind at the upcoming AGM on 12th of March. The focus will probably be on the future company strategy as shareholders cast their votes on resolutions such as executive remuneration and other matters. Here is our take on why we think CEO compensation is not extravagant.

View our latest analysis for Shoe Zone

How Does Total Compensation For Anthony Edward Smith Compare With Other Companies In The Industry?

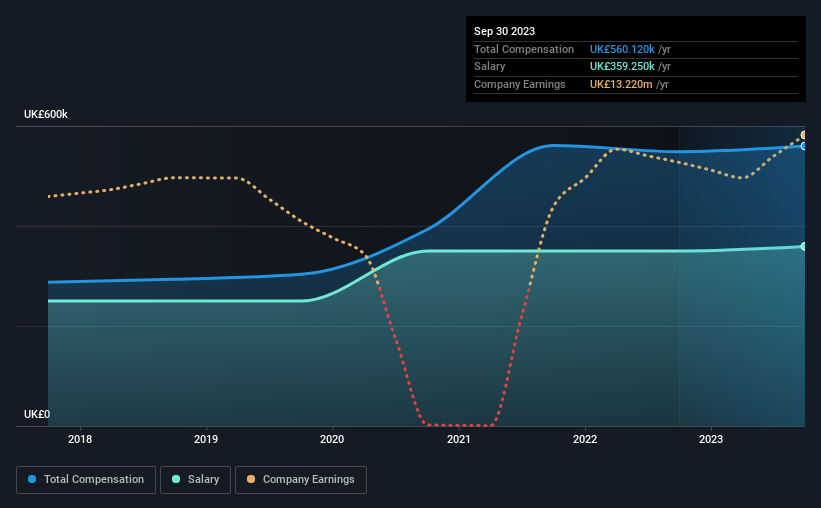

Our data indicates that Shoe Zone plc has a market capitalization of UK£120m, and total annual CEO compensation was reported as UK£560k for the year to September 2023. This means that the compensation hasn't changed much from last year. We note that the salary portion, which stands at UK£359.3k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the British Specialty Retail industry with market capitalizations ranging between UK£79m and UK£315m had a median total CEO compensation of UK£665k. This suggests that Shoe Zone remunerates its CEO largely in line with the industry average. What's more, Anthony Edward Smith holds UK£39m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

Component | 2023 | 2022 | Proportion (2023) |

Salary | UK£359k | UK£350k | 64% |

Other | UK£201k | UK£199k | 36% |

Total Compensation | UK£560k | UK£549k | 100% |

Talking in terms of the industry, salary represented approximately 49% of total compensation out of all the companies we analyzed, while other remuneration made up 51% of the pie. Shoe Zone pays out 64% of remuneration in the form of a salary, significantly higher than the industry average. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Shoe Zone plc's Growth

Over the past three years, Shoe Zone plc has seen its earnings per share (EPS) grow by 87% per year. In the last year, its revenue is up 6.1%.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's nice to see revenue heading northwards, as this is consistent with healthy business conditions. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Shoe Zone plc Been A Good Investment?

Boasting a total shareholder return of 345% over three years, Shoe Zone plc has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

The company's solid performance might have made most shareholders happy, possibly making CEO remuneration the least of the matters to be discussed in the AGM. In fact, strategic decisions that could impact the future of the business might be a far more interesting topic for investors as it would help them set their longer-term expectations.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. In our study, we found 2 warning signs for Shoe Zone you should be aware of, and 1 of them is a bit concerning.

Important note: Shoe Zone is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.