Lorber David A Boosts Stake in PhenixFIN Corp

On August 16, 2023, Lorber David A (Trades, Portfolio), a renowned investment firm, made a significant addition to its portfolio by boosting its holding in PhenixFIN Corp (NASDAQ:PFX). This article provides an in-depth analysis of this transaction, the profiles of Lorber David A (Trades, Portfolio) and PhenixFIN Corp, and the potential implications for investors.

Details of the Transaction

The transaction took place on August 16, 2023, with Lorber David A (Trades, Portfolio) purchasing 5,177 shares of PhenixFIN Corp at a price of $37.14 per share, bringing the holding to 187,099 shares . Despite the significant number of shares acquired, the transaction had no impact on Lorber David A (Trades, Portfolio)'s portfolio due to its size. The firm now holds 8.95% of PhenixFIN Corp's total shares.

Profile of Lorber David A (Trades, Portfolio)

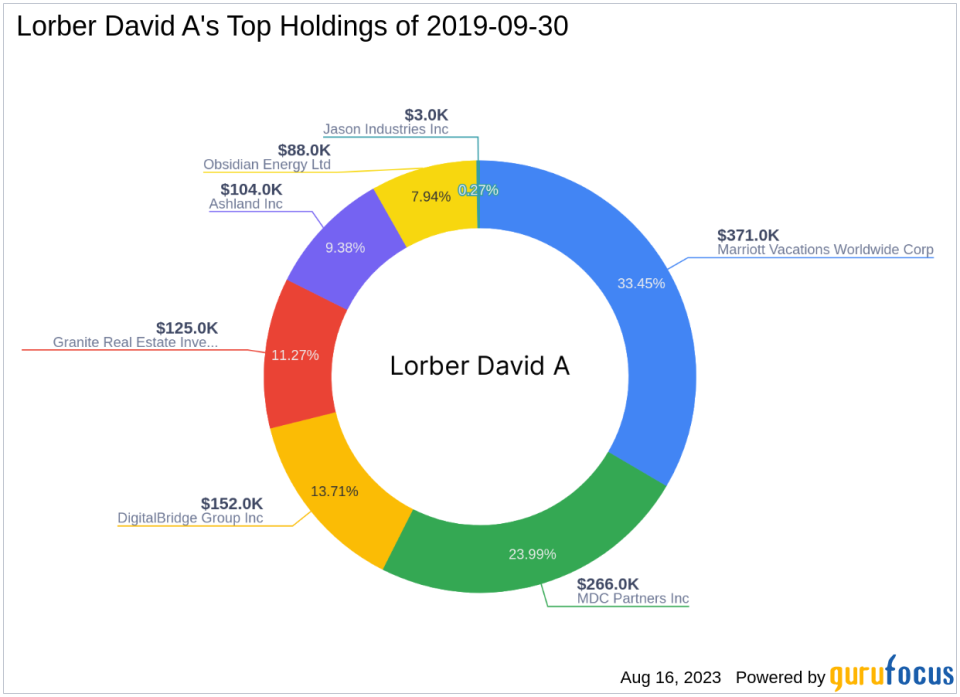

Lorber David A (Trades, Portfolio) is an investment firm based in Greenwich, CT. The firm's portfolio consists of seven stocks, with a total equity of $1 million. Its top holdings include MDC Partners Inc (MDCA), Ashland Inc (NYSE:ASH), DigitalBridge Group Inc (NYSE:DBRG), Granite Real Estate Investment Trust (NYSE:GRP.U), and Marriott Vacations Worldwide Corp (NYSE:VAC). The firm primarily focuses on the Consumer Cyclical and Real Estate sectors.

Overview of PhenixFIN Corp

PhenixFIN Corp, formerly known as Medley Capital Corp, is a non-diversified closed-end management investment company based in the United States. The company's primary objective is to generate current income and capital appreciation by lending directly to privately held middle market companies. PhenixFIN Corp's portfolio consists of securities across all sectors, and it mainly invests in senior secured first lien term loans, senior secured second lien term loans, unitranche, senior secured first lien notes, subordinated notes, and warrants and minority equity securities. The company's market capitalization stands at $77.215 million, and its current stock price is $36.97.

Analysis of PhenixFIN Corp's Financials

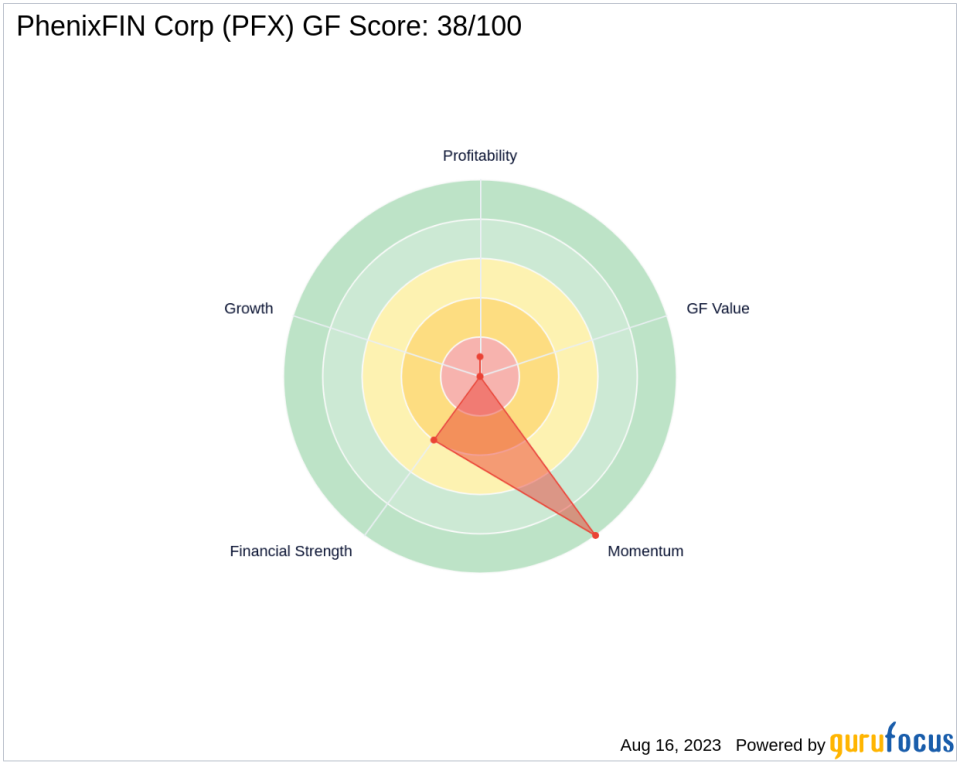

PhenixFIN Corp's PE Percentage is 5.05, indicating that the company is profitable. However, due to insufficient data, the company's GF Valuation cannot be evaluated. The company's GF Score is 38/100, its Financial Strength is ranked 4/10, its Profitability Rank is 1/10, although its Growth Rank cannot be computed due to lack of growth data. The company's Piotroski F-Score is 2 yet its Altman Z score is not available.

PhenixFIN Corp's Performance in the Asset Management Industry

PhenixFIN Corp's Cash to Debt ratio is 0.14, ranking it 1216th in the Asset Management industry. The company's ROE is -2.50, and its ROA is -1.50, ranking it 897th and 884th in the industry, respectively. The company's Gross Margin Growth and Operating Margin Growth cannot be computed due to lack of data.

PhenixFIN Corp's Stock Momentum

The company's RSI 5 Day is 74.26, its RSI 9 Day is 66.31, and its RSI 14 Day is 61.28. The company's Momentum Index 6 - 1 Month is 1.66, and its Momentum Index 12 - 1 Month is 2.08. The company's RSI 14 Day Rank is 1584, and its Momentum Index 6 - 1 Month Rank is 531.

Conclusion

In conclusion, Lorber David A (Trades, Portfolio)'s acquisition of 5,177 shares in PhenixFIN Corp is a significant transaction that could have implications for both the firm and the company. Despite the size of the transaction, it had no impact on Lorber David A (Trades, Portfolio)'s portfolio due to its size. PhenixFIN Corp's financials and performance in the Asset Management industry provide valuable insights into the company's current state and future prospects. Investors should monitor the situation closely for potential opportunities.

This article first appeared on GuruFocus.