Louisiana-Pacific Corp (LPX) Reports Mixed Results for Q4 and Full Year 2023

Q4 Net Income: Increased to $59 million, with diluted EPS at $0.81, up from a loss in the prior year.

Full Year Net Income: Decreased to $178 million, with diluted EPS at $2.46, reflecting a significant drop from the previous year.

Consolidated Net Sales: Decreased by 7% in Q4 and 33% for the full year, with notable declines in Siding and OSB segments.

Adjusted EBITDA: Improved in Q4 to $129 million, but fell to $478 million for the full year.

Liquidity: Ended the year with approximately $770 million in total liquidity.

Capital Allocation: Invested $300 million in capital expenditures and $80 million for facility assets in 2023.

Dividends and Share Repurchases: Paid $69 million in cash dividends and declared a quarterly dividend of $0.26 per share.

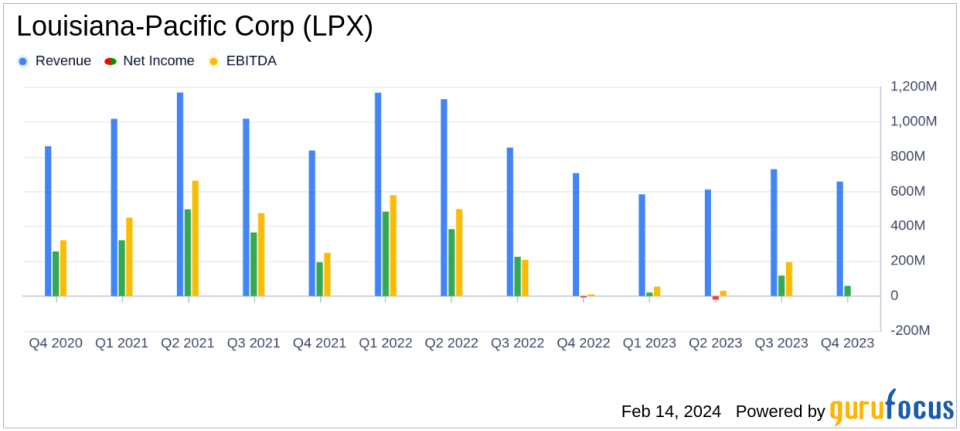

On February 14, 2024, Louisiana-Pacific Corp (NYSE:LPX) released its 8-K filing, detailing its financial results for the fourth quarter and full year ended December 31, 2023. The company, a leading producer of oriented strand board (OSB) and engineered wood siding, faced a challenging year with significant declines in net sales and net income for the full year, despite a rise in net income for the fourth quarter.

Financial Performance Overview

For the fourth quarter, Louisiana-Pacific Corp reported a 7% decrease in consolidated net sales to $658 million, with Siding net sales down by 14% to $332 million due to lower volumes, partially offset by higher prices. OSB net sales, however, saw a 6% increase to $272 million. The company's net income for the quarter was $59 million, a significant increase from the prior year, and net income per diluted share was $0.81, up $0.92 per share.

For the full year, the company's net sales decreased by 33% to $2.6 billion, with a notable 50% decrease in OSB net sales to $1.0 billion. Net income for the year was $178 million, a decrease of $905 million from the previous year, and net income per diluted share was $2.46, down $11.41 per share. Adjusted EBITDA for the full year was $478 million, a decrease of $911 million.

Operational Highlights and Challenges

LPX's Siding segment experienced a decrease in net sales and adjusted EBITDA for both the quarter and full year, primarily due to lower volumes. The OSB segment, while seeing an increase in net sales for the quarter, faced a significant decrease for the full year, largely due to lower prices and volumes. The company's LPSA segment also reported lower net sales and adjusted EBITDA for the full year.

Despite these challenges, LPX remains optimistic about its future, with CEO Brad Southern highlighting increased operational efficiency and an improving outlook for single-family housing. The company's recent investments in mill and prefinishing capacity are expected to position it well for expansion and share gains in Siding and Structural Solutions.

Capital Allocation and Liquidity

LPX's capital allocation for 2023 included $300 million in capital expenditures and $80 million for facility assets in Wawa, Ontario, Canada. The company also paid $69 million in cash dividends and declared a quarterly cash dividend of $0.26 per share. As of December 31, 2023, LPX had $222 million in cash and cash equivalents and borrowing availability under its revolving credit facility of $550 million, resulting in total liquidity of approximately $770 million.

Outlook for 2024

The company provided financial guidance for the first quarter and full year of 2024, projecting Siding net sales year-over-year growth of 3% to 5% for Q1 and 8% to 10% for the full year. Adjusted EBITDA is expected to be between $130 million to $145 million for Q1 and $495 million to $525 million for the full year. Capital expenditures are anticipated to be between $200 million to $220 million.

LPX's performance in 2023 reflects the volatility of the construction industry and the impact of broader economic factors. While the company has faced significant headwinds, its strategic investments and focus on operational efficiency may provide a foundation for recovery as market conditions evolve.

For a detailed analysis of Louisiana-Pacific Corp's financial results and further insights into the company's performance and strategy, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Louisiana-Pacific Corp for further details.

This article first appeared on GuruFocus.