Louisiana-Pacific (LPX) to Expand Siding Capacity With Wawa OSB

Louisiana-Pacific Corporation LPX, commonly known as LP Building Solutions or LP, inked a deal with Forex Inc. to acquire the assets of the latter’s subsidiary — Wawa OSB Inc.

The transaction includes a manufacturing facility in Wawa, Ontario, that will be converted into an LP SmartSide Trim & Siding mill. With the addition of approximately 400 million square feet of capacity, LP's total siding capacity will increase to 2.7 billion square feet annually. Post-conversion, the mill will become LP's largest single-line siding mill.

The deal is expected to be completed in early May 2023, subject to court approval and customary closing conditions. Meanwhile, LP is evaluating project schedules to determine when construction at the facility will begin.

Executive vice president and general manager of Siding, Jason Ringblom, said, "LP SmartSide Trim & Siding has experienced tremendous growth over the past few years, becoming one of the fastest-growing siding brands in the United States. In response to customer demand, we continue to expand our capacity across North America to position SmartSide for long-term growth.”

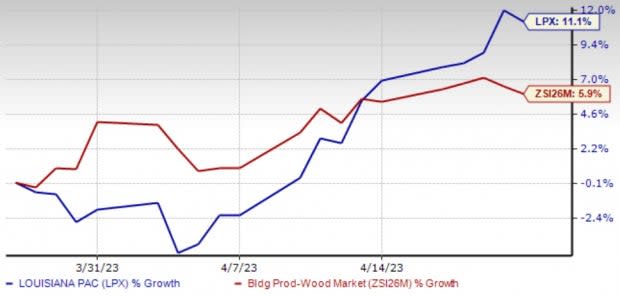

Price Performance

Shares of the company have gained 11.1% in the past month compared with the Zacks Building Products – Wood industry’s 5.9% growth. The trend is likely to continue, given its focus on the Siding business, cost-containment efforts and enhancing shareholders’ value.

Image Source: Zacks Investment Research

LP has been increasing the penetration of Siding products in repair/remodeling and rolling out SmartSide products. It exited the fiber product line to focus on higher-margin SmartSide strand products. The company also launched ExpertFinish within the Prefinish product line.

LP is gradually transforming from a commodity producer into a more stable, cash-generative business by increasing revenues and the EBITDA mix. LP continues focusing on three areas — increasing the efficiency of mills by improving productivity, run time and quality through overall equipment effectiveness or OEE initiatives; applying best practices to its supply chain; and optimizing infrastructure costs.

In a bid to reduce costs, LP lowered the cost structure of its facilities through Lean Six Sigma efforts, the sale or shutdown of underperforming mills and manufacturing facilities, as well as investments in technology. Louisiana-Pacific resorts to a strategy of curtailing production at selected facilities to meet customer demand and optimize its portfolio as well as margins.

Zacks Rank & Stocks to Consider

LPX currently carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some better-ranked stocks in the Zacks Construction sector are:

Altair Engineering Inc. ALTR currently sports a Zacks Rank #1. ALTR delivered a trailing four-quarter earnings surprise of 135.8%, on average.

The Zacks Consensus Estimate for ALTR’s 2023 sales and EPS indicates growth of 7.8% and 11.2%, respectively, from the previous year’s reported levels.

CRH plc CRH currently flaunts a Zacks Rank #1. The company's long-term earnings growth rate is anticipated to be 10.2%.

The Zacks Consensus Estimate for CRH’s 2023 sales and EPS indicates growth of 6% and 13.2%, respectively, from the previous year’s reported levels.

Quanta Services, Inc. PWR currently sports a Zacks Rank #1. PWR has a trailing four-quarter earnings surprise of 4.7%, on average.

The Zacks Consensus Estimate for PWR’s 2023 sales and EPS indicates growth of 8.8% and 10.3%, respectively, from the previous year’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Quanta Services, Inc. (PWR) : Free Stock Analysis Report

Altair Engineering Inc. (ALTR) : Free Stock Analysis Report

Louisiana-Pacific Corporation (LPX) : Free Stock Analysis Report

CRH PLC (CRH) : Free Stock Analysis Report