Louisiana-Pacific (LPX) Focuses on Siding Unit Amid Inflation

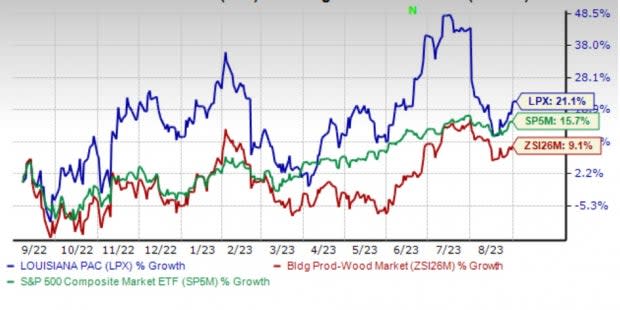

Louisiana-Pacific Corporation LPX or LP, has been banking on its efforts to increase penetration of Siding products in repair/remodel and roll out SmartSide products. In the past year, the company’s shares have gained 21.1% compared with the Zacks Building Products – Wood industry and S&P 500 index’s 9.1% and 15.7% growth, respectively.

Earnings estimates for 2023 have increased to $3.41 per share from $3.25 in the past 30 days. This can further be substantiated from its VGM Score of B. These positive trends indicate bullish analysts’ sentiments, robust fundamentals and the expectation of further outperformance in the near term.

LPX’s strategic business transformation efforts, effective cash management and inorganic moves are added positives.

However, softness in single-family residential construction, along with supply chain woes and inflationary pressure, primarily for material and labor, are concerns.

Image Source: Zacks Investment Research

Let’s discuss the factors substantiating its Zacks Rank #3 (Hold).

Major Growth Drivers

Solid Siding Business: LP has been increasing penetration of Siding products in repair/remodel and rolling out SmartSide products. Siding is less sensitive to new housing market cyclicality as more than 50% of Siding Solutions demand comes from other markets like sheds and repair and remodeling. The company believes that long-term market trends and demographics indicate continued growth in demand for sustainable engineered wood siding in these markets. The company has been witnessing higher-than-expected demand for Smooth SmartSide and ExpertFinish. It also exited the fiber product line to focus on higher-margin SmartSide strand products.

The Siding unit comprised 54.5% of sales in the first six months of 2023. In the first half of 2023, the Siding unit’s revenues grew at a compound annual rate of 14% compared with the first six months of 2019.

The ExpertFinish product witnessed 9% volume growth in the second quarter of 2023 compared with 7% in the prior year quarter, despite the current housing market softness. The company also announced the opening of a new ExpertFinish facility in Bath, NY, in the third quarter of 2023. This new facility will shed light on increased automation and improved efficiency on LP's prefinished siding production. The introduction of two new products in the second quarter of 2023, which are brushed smooth ExpertFinish lap and pebble stucco panels, to the siding product portfolio will help the company gain market share.

Strategic Initiatives: LP is gradually transforming from a commodity producer to a more stable, cash-generative business by increasing revenues and EBITDA mix. On that note, it has been increasing the efficiency of mills by improving productivity, run time and quality through overall equipment effectiveness or OEE initiatives, applying best practices to the supply chain and optimizing infrastructure costs. LP achieved a $1.2 billion growth in adjusted EBITDA from 2019 to 2022.

Louisiana-Pacific’s business banks on acquisitions, business combinations and divestures divestitures of low-profitable businesses. Recently, LP inked a deal with Forex to acquire the Wawa OSB mill. Post-completion, Wawa will become LP’s largest single-line siding mill, adding nearly 400 million square feet of capacity. This will bring the total siding capacity to about 2.7 billion square feet. LP believes this deal will generate solid returns in the future.

Impressive Shareholders’ Return: Louisiana-Pacific has been consistently enhancing shareholders’ returns through share repurchases and dividends. In the first six months of 2023, the company paid $35 million in cash dividends and repurchased common stocks for a total value of $400 million.

On Feb 17, 2023, it hiked quarterly cash dividends by 9% to 24 cents per share. The company had committed to return over time to its shareholders at least 50% of the cash flow from operations in excess of capital expenditures to sustain its core business as well as grow Siding and value-added OSB.

Hurdles to Cross

Louisiana-Pacific has been witnessing significant supply chain woes and inflationary pressure, primarily for material and labor. The second-quarter 2023 bottom line plunged by a whopping 86.9% from the year-ago quarter. The gross margin contracted to 19.5% from 45.8% reported a year ago. Adjusted EBITDA of $93 million was down 81.1% from the prior year, primarily due to increased raw material costs, along with decreased sales volume and average selling prices.

Demand for the company’s products has a strong relationship with the level of new home construction activity in North America, which historically has been characterized by significant cyclicality. The prevailing softness in the housing industry is hampering Louisiana-Pacific’s performance.

Key Picks

Some top-ranked stocks in the sector are:

Boise Cascade Company BCC sports a Zacks Rank #1 (Strong Buy). BCC has a trailing four-quarter earnings surprise of 25.5% on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for BCC’s 2023 sales and earnings per share (EPS) indicates a decline of 20.1% and 45.5%, respectively, from the year-ago period’s levels.

EMCOR Group, Inc. EME flaunts a Zacks Rank #1. It has a trailing four-quarter earnings surprise of 17.2%, on average.

The Zacks Consensus Estimate for EME’s 2023 sales and EPS suggests growth of 11.5% and 35.9%, respectively, from the year-ago period’s levels.

TopBuild Corp. BLD sports a Zacks Rank #1. It has a trailing four-quarter earnings surprise of 14.1%, on average.

The Zacks Consensus Estimate for BLD’s 2023 sales and EPS indicates gains of 3.3% and 6.1%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Louisiana-Pacific Corporation (LPX) : Free Stock Analysis Report

EMCOR Group, Inc. (EME) : Free Stock Analysis Report

Boise Cascade, L.L.C. (BCC) : Free Stock Analysis Report

TopBuild Corp. (BLD) : Free Stock Analysis Report