Louisiana-Pacific (LPX) Gains 31% in 3 Months: Here's Why

Louisiana-Pacific Corporation LPX has been gaining from the efficient execution of its business and cost-control strategies, which are reflected in the declining costs and expenses of the company, along with its investment decisions. These initiatives are aiding the growth of the company’s Siding business segment, given the sequential improvements in the housing market, especially single-family housing starts.

Moreover, the housing market is currently witnessing an impressive uptrend, thanks to the recent interest rate stabilization decision by the Federal Open Market Committee (“FOMC”). Per the FOMC, the interest rate benchmark is to be maintained between 5.25% and 5.5%, with expectations of possible interest rate cuts in 2024. This macro tailwind induced a wave of relief among the housing market-related industry companies like LPX, determining prospects of growth.

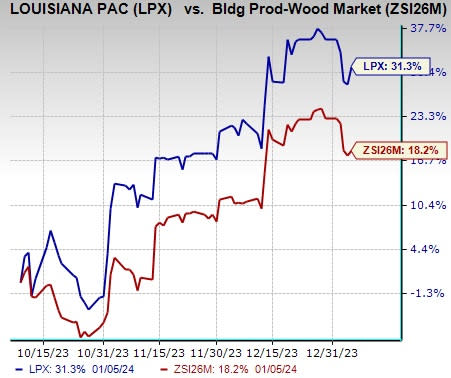

Thanks to these tailwinds, shares of this current Zacks Rank #3 (Hold) company grew 31.3% in the past three months, outperforming the Zacks Building Products - Wood industry’s 18.2% growth. Although the high-cost environment is restricting the growth prospects, increase in Siding sales volume and housing starts are offsetting the negative impacts to much extent.

Image Source: Zacks Investment Research

The company’s earnings estimates for 2024 have moved north to $3.85 per share from earnings of $3.84 per share over the past seven days. This earnings estimate showcases 28.3% year-over-year growth. LPX also delivered a trailing four-quarter earnings surprise of 98.3%, on average. The positive trend signifies bullish analysts’ sentiments, robust fundamentals and the prospects of an outperformance in the near term.

Growth Driving Factors of the Stock

Business Growth Strategies: Louisiana-Pacific intently focuses on increasing the growth scopes of its business, primarily through planned investment considerations. The investments can be for organic as well as inorganic growth plans, depending on the requirement trajectory of the company.

During third-quarter 2023 earnings call, LPX stated that its capital allocation strategy as well as the flexibility of capital deployment for investments are unchanged. The capital allocation strategy includes earning cash, investing in its growth as per the requirement and returning a significant amount of the remainder to shareholders.

The company anticipates that if the housing and repair and remodel markets are considerably flat in 2024, then its Sagola mill and Bath pre-finishing facility will provide its LP Siding business with sufficient capacity to supply enough SmartSide to meet the demand. If the demand pattern sees consistent growth, which might be the case given the surge in housing starts, LPX will convert its newly-acquired Wawa facility for its Siding business. The company’s liquidity position is sufficient to carry on its business with the sudden alterations in the market demand.

Focus on Siding Business: Louisiana-Pacific has been making efforts to increase the penetration of Siding products in repair/remodel and roll out SmartSide products. It exited the fiber product line to focus more on higher-margin SmartSide strand products, as well as, launched ExpertFinish within the Prefinish product line. For the first nine months of 2023, the Siding unit comprised 51.8% of sales, under which, the ExpertFinish product witnessed an 8% volume growth. The company remains committed to growing strand Siding revenues in 2024 and beyond by continuing to increase the investment in selling and marketing in the said business.

The Siding business is less volatile to the housing market cyclicality as more than 50% of Siding Solutions demand comes from other markets like sheds and repair and remodeling. The company believes that the long-term market trends and demographics indicate continued growth in demand for sustainable engineered wood siding in these markets.

Cost-Control Initiatives: The cost control strategies of Louisiana-Pacific are boding well, given the decline in the costs and expenses. The company is simultaneously focusing on reducing its cost structure along with improving its business trends. In a bid to reduce costs, Louisiana-Pacific lowered the cost structure of its facilities through Lean Six Sigma efforts, the sale or shutdown of underperforming mills and manufacturing facilities as well as investments in technology. It resorts to a strategy of curtailing production at selected facilities to meet customer demand and optimize portfolio as well as margins.

For the first nine months of 2023, the selling, general and administrative expenses declined 2.6% to $191 million compared with the comparable period a year ago. This was attributable to lower incentive-based compensation.

Key Picks

Here are some better-ranked stocks from the Construction sector.

M-tron Industries, Inc. MPTI presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

It has a trailing four-quarter earnings surprise of 35.6%, on average. Shares of MPTI have surged 251.1% in the past year. The Zacks Consensus Estimate for MPTI’s 2024 sales and earnings per share (EPS) indicates a rise of 12.5% and 13.4%, respectively, from the prior-year levels.

Martin Marietta Materials, Inc. MLM currently sports a Zacks Rank of 1. MLM delivered a trailing four-quarter earnings surprise of 37.3%, on average. The stock has gained 41.1% in the past year.

The Zacks Consensus Estimate for MLM’s 2024 sales and EPS indicates growth of 9.7% and 14%, respectively, from a year ago.

Taylor Morrison Home Corporation TMHC currently carries a Zacks Rank #2 (Buy). TMHC delivered a trailing four-quarter earnings surprise of 17.5%, on average. The stock has gained 57.4% in the past year.

The Zacks Consensus Estimate for TMHC’s 2024 sales indicates an improvement of 0.8% while EPS indicates a decline of 6.6%, respectively, from a year ago.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Louisiana-Pacific Corporation (LPX) : Free Stock Analysis Report

Martin Marietta Materials, Inc. (MLM) : Free Stock Analysis Report

Taylor Morrison Home Corporation (TMHC) : Free Stock Analysis Report

M-tron Industries, Inc. (MPTI) : Free Stock Analysis Report