Louisiana-Pacific (LPX) Q2 Earnings & Sales Miss, Stock Down

Louisiana-Pacific Corporation LPX, or LP, reported unimpressive results for second-quarter 2023. Earnings and net sales missed the Zacks Consensus Estimate and declined year over year.

LPX’s shares plunged 6.91% in the pre-market trading session on Aug 2 after the tepid quarterly results and lackluster guidance for the third quarter and full-year 2023.

That said, LP's strategy positions it well for long-term growth as the housing outlook continues to improve.

Detailed Discussion

Louisiana-Pacific reported adjusted earnings of 55 cents per share, lagging the Zacks Consensus Estimate of 64 cents by 14.1%. The bottom line declined immensely from the year-ago quarter’s reported figure of $4.19 per share.

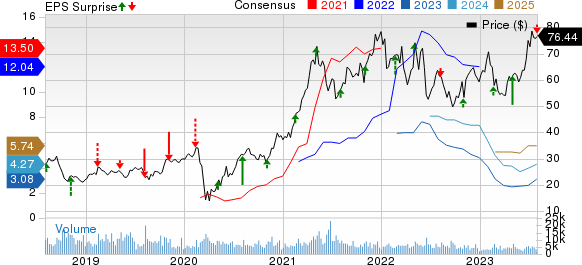

Louisiana-Pacific Corporation Price, Consensus and EPS Surprise

Louisiana-Pacific Corporation price-consensus-eps-surprise-chart | Louisiana-Pacific Corporation Quote

Net sales of $611 million also missed the consensus estimate of $668 million by 8.6% and declined 46% from the prior year’s $1,130 million, due to tepidness across the segments.

Single-family housing starts fell to 261 from the 303 units reported in the year-ago period. Multi-family starts were down to 138 units from 147 units reported a year ago.

Adjusted EBITDA of $93 million was down from the prior-year quarter’s level of $491 million.

Segmental Analysis

Siding: The segment’s sales of $320 million were down 10% from the prior-year period, with a decline of 11% in Siding Solutions’ (formerly known as SmartSide) revenues to $318 million. A 6% rise in the average net selling price (ASP) was offset by a 16% decrease in volume from prior-year levels. The average net selling price benefited from list price increases. Volume reduced on challenging new and existing home selling markets and elevated levels of channel inventory compared with the prior periods.

Adjusted EBITDA came in at $59 million, a 24% decline from $78 million reported a year ago. Reduced net sales, raw material inflation and discretionary investments in capacity and sales & marketing impacted adjusted EBITDA.

OSB: Sales in the segment decreased 66% year over year to $229 million, owing to lower OSB prices, a decrease in sales volume from production curtailments and a decline related to production volume from the conversion of its Sagola, MI, mill to siding production.

The company’s adjusted EBITDA fell 91% year over year to $37 million due to lower prices and sales volumes, partially offset by lower mill-related costs.

South America: Sales of $53 million declined 25% due to lower OSB volumes and ASP. Adjusted EBITDA fell 52% from the year-ago quarter to $13 million due to lower revenues and higher raw material costs.

Financials

As of Jun 30, 2023, Louisiana-Pacific had cash and cash equivalents of $71 million compared with $369 million at 2022-end. Long-term debt was $377 million compared with the 2022-end level of $346 million.

For the second quarter, net cash provided by operations was $88 million, down from $483 million reported in the respective year-ago period. At June-end, $200 million remained of the total authorization.

Guidance

For 2023, the company expects Siding Solutions’ revenues to decline by 10% from the year-ago period.

For third-quarter, OSB revenues are expected to be sequentially higher by at least 50% (based on Random Lengths’ report published on Jul 28, 2023). It anticipates a consolidated adjusted EBITDA of $160-$180 million.

For the year, the company anticipates capital expenditures to range between $290 million and $310 million. The capital expenditure for mill conversions is likely to be $120-$130 million, $120-$125 million for sustaining maintenance and $50-$55 million for other strategic growth projects.

Zacks Rank & Recent Construction Releases

Louisiana-Pacific currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Weyerhaeuser Company WY reported mixed second-quarter 2023 results, wherein its earnings handily beat the Zacks Consensus Estimate, but net sales missed the same marginally. On a year-over-year basis, the top and bottom lines declined.

Meanwhile, in July, Weyerhaeuser made a significant acquisition, purchasing 22,000 acres of timberlands in Mississippi for around $60 million. These timberlands are known for their high productivity and have been strategically chosen due to their proximity to Weyerhaeuser's current operations. The acquisition is expected to bring about immediate synergies and create additional opportunities for real estate and natural climate solutions.

Masco Corporation MAS reported strong earnings for second-quarter 2023. The bottom line surpassed the Zacks Consensus Estimate and increased from the prior year. Strong pricing actions and operational efficiency helped it deliver solid results.

Masco’s quarterly net sales topped the consensus mark but declined on a year-over-year basis. The benefits received from pricing actions were more than offset by lower volumes.

Otis Worldwide Corporation’s OTIS second-quarter 2023 earnings and sales surpassed the Zacks Consensus Estimate. Its quarterly results reflected 11 consecutive quarters of organic sales growth and solid operating margin expansion, contributing to mid-single digit adjusted earnings per share growth.

The company remains focused on strong portfolio growth and generating a solid New Equipment backlog. It also intends to expand operating margins, return cash to shareholders through a capital-allocation strategy and pursue additional progress toward ESG goals.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Weyerhaeuser Company (WY) : Free Stock Analysis Report

Masco Corporation (MAS) : Free Stock Analysis Report

Louisiana-Pacific Corporation (LPX) : Free Stock Analysis Report

Otis Worldwide Corporation (OTIS) : Free Stock Analysis Report