The Lovesac Company (LOVE) Posts Encouraging Q2 Preliminary Results

The Lovesac Company LOVE rose 1.83% in the after-hours trading session on Aug 31 after it announced some preliminary unaudited and unreviewed financial results for the second quarter of fiscal 2024 (ended Jul 30, 2023). Impressively, it exceeded the previously provided guidance range for net sales and earnings.

A Look at Preliminary Results

Second-quarter fiscal 2024 net sales of approximately $154 million is up from $149-$151 million expected earlier. In the previous year, net sales were $148.5 million.

Gross margin is likely to increase by 59% versus 54.5% reported in the year-ago period. The company is likely to generate a net loss of $0.5-$1.5 million in the fiscal second quarter, down from $2-$2.5 million predicted earlier. In second-quarter fiscal 2023, LOVE generated a net income of $7.1 million.

The company has determined the need to restate its fiscal 2023 and first-quarter fiscal 2024 results due to errors in accounting for a last-mile journal entry and the methodology used to calculate the accrual of its last-mile freight expenses. It currently expects a delay in completing its customary quarterly review and reporting process and the filing of its Form 10-Q for the second quarter of fiscal 2024.

Share Price Performance

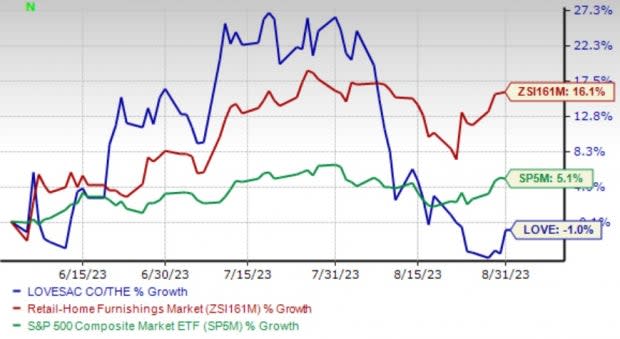

Shares of LOVE have declined 1% in the past three months. In the said period, the industry and S&P 500 composite increased by 16.1% and 5.1%, respectively.

Image Source: Zacks Investment Research

The Lovesac Company’s expected earnings growth rate for the current year is 6.2% on 9.2% higher net sales. The Zacks Consensus Estimate for current-year earnings has remained stable over the past 60 days.

Zacks Rank

LOVE currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Releases

Williams-Sonoma Inc. WSM reported mixed results in second-quarter fiscal 2023 (ended Jul 30, 2023). Its earnings beat the Zacks Consensus Estimate, but revenues missed the same. The metrics declined year over year. The downside was primarily due to the increasing promotional environment and softening industry metrics.

WSM anticipates fiscal 2023 net revenues to decline between 5% and 10%. The company now expects its operating margin to be 15-16% versus earlier expectations of 14-15%.

Builders FirstSource BLDR reported second-quarter 2023 results wherein earnings and net sales surpassed the Zacks Consensus Estimate. The company has exceeded expectations, thanks to a more stable housing environment, a strong value-added product portfolio and the positive impact of operational initiatives implemented in recent years.

However, on a year-over-year basis, the results were hampered by declining single-family starts and commodity deflation.

Darden Restaurants, Inc. DRI reported fourth-quarter fiscal 2023 results, with earnings and revenues beating the Zacks Consensus Estimate. The metrics increased on a year-over-year basis.

For fiscal 2023, DRI expects sales to be approximately $11.5-$11.6 billion. Same-restaurant sales in fiscal 2024 are anticipated in the range of 2.5-3.5%. EPS from continuing operations is anticipated in the band of $8.55-$8.85. Its mid-point of $8.7 is lower than the Zacks Consensus Estimate of $8.73.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Darden Restaurants, Inc. (DRI) : Free Stock Analysis Report

Builders FirstSource, Inc. (BLDR) : Free Stock Analysis Report

Williams-Sonoma, Inc. (WSM) : Free Stock Analysis Report

The Lovesac Company (LOVE) : Free Stock Analysis Report