How Low Will Bitcoin Go?

Bitcoin continues dancing around the key $30,000 level … looking at support levels if it breaks lower … reasons for optimism despite the bearish pressure … a “Cash Calendar” event today

Let’s get the bad news out of the way first.

$30,000 is a key support level for bitcoin. But the grandaddy crypto can’t seem to hold it.

As you can see below, bitcoin has been bouncing around the $30,000 level (dotted black line) for the last eight days. As I write on Friday approaching lunch, it’s at $29,229.

InvestorPlace - Stock Market News, Stock Advice & Trading Tips

Source: StockCharts.com

The $30,000 level needs to hold and become a price floor. If not, the crypto sector is likely to see a significant leg lower.

For what’s behind this recent weakness, let’s turn to our crypto experts Luke Lango and Charlie Shrem of Crypto Investor Network, and their update this past Saturday:

Last week, we drew a pretty little chart for you which illustrated that bitcoin had broken its January 2022 uptrend and was set for a short-term collapse to $30,000.

One week and a Terra (LUNA) flush later, bitcoin has done just that.

Following the unprecedented collapse of the $40 billion Terra project this past week, fears reverberated throughout the crypto markets, sending bitcoin – and all cryptos – significantly lower.

In the sell-off, bitcoin collapsed to and even broke below $30,000.

***The question is where does it go now?

Let’s rephrase – after all, if price surges, great. What we really want to know is: “If it keeps falling, how low could bitcoin go?”

There are a handful of support levels to watch.

First, Luke and Charlie point toward $26,500, though they don’t believe there’s tremendous strength there. So, if that breaks, they’re watching roughly $23,000.

For more on why this level could provide support, let’s turn to our newest crypto expert, Ashley Cassell.

For readers less familiar, Ashley helms The New Digital World (NDW), which is a fantastic free resource dedicated to keeping you up-to-date on the latest in the crypto, NFT, metaverse world.

Understanding the details behind sector volatility, technological breakthroughs, and the latest digital offerings can give you a key advantage over the market. Click here to sign up – again, it’s totally free.

***Returning to our discussion of bitcoin support levels, what’s the significance of $23,000?

From Ashley’s Wednesday NDW update:

…We can gauge the cost basis of all the BTC that’s currently in circulating supply. This “realized price” has “provided sound support during bear markets,” as on-chain analysts at Glassnode have found. And as of Monday, BTC investors’ realized price is far below 2021 levels – at $23,940…

Even now, bitcoin’s only about 20% from its realized price – which “has provided signals of market bottom formation when the market price trades below it,” notes Glassnode.

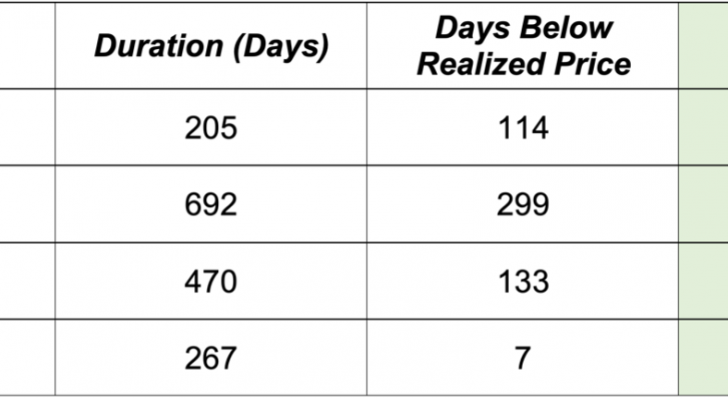

Ashley provides the chart below using data from Glassnode. It highlights the last four bitcoin bear markets.

Notice the shaded column on the right. It’s showing us the percentage of time of each bear market that is spent with prices below the “realized price.”

As you’ll see, each bear market has seen less relative time in this category.

Given bitcoin’s current proximity to its realized price (again, $23,940), combined with this trend of increasingly fewer days spent time beneath the realized price, this support level could provide a bounce.

But what if it too breaks?

For that, let’s jump back to Luke and Charlie:

Below that, we have $18K – also strong, but not super strong.

Finally, we have a very strong support level at $10K, which is where in a worst-case scenario, this current sell-off would bottom, technically speaking.

Does that mean you might want to add to your position at these prices?

Back to Luke and Charlie:

Patience is our best friend here.

Cryptos are a long-term investment. There’s no need to rush in and suffer short-term pain.

Let’s let this volatility sort itself out. Let’s let Bitcoin prove it can hold the $30,000 level. Let’s let altcoins regain their footing. Then, if the stars start to align, we can start buying this dip in a big way.

Until then, we are heavily emphasizing portfolio consolidation. This is a crypto bear market. Strong cryptos will survive bear markets. Weak cryptos will get flushed…

***Despite the broad bearish conditions of crypto today, Luke and Charlie are continuing to find pockets of strength that are worth putting on your radar

With this in mind, I want to make sure you know something that just happened this morning with Luke and Charlie’s Crypto Cash Calendar.

For newer Digest readers, here they are to explain what this Calendar is:

Crypto is the future. But that doesn’t mean all cryptocurrencies are the future.

To sift through all the blockchain noise, we’ve put together an exclusive team of crypto engineers and coders to collectively research, analyze, and understand the core technologies underlying the cryptocurrency revolution.

Informed by this research, we’re able to interpret the usefulness and potential impacts of those technologies.

Here’s how it works: Behind the scenes, our proprietary research system gathers information and indicates which altcoins and crypto events are of particular interest.

From there, we’ll share with you the most exciting and promising of those coins and events in our Crypto Cash Calendar.

This morning, Luke and Charlie announced an event that’s triggered their Crypto Cash Calendar system.

From their alert:

…In the rubble of this crash, we’ve found some very compelling long-term investment opportunities. One in particular has enormous upside potential.

There’s just one secret… one key, if you will, to surviving – and thriving – within this crypto bear market. That is, you must identify the cryptos that sport bullish indicators and anchor your portfolio around them.

Today, we’re going to highlight the crypto that we believe may be the highest-quality option out there.

If you’re interested in learning more as a subscriber, click here.

Returning to bitcoin, let’s give Luke and Charlie the final word about what to expect going forward:

Long-term, we remain exceptionally bullish. We still believe the BTC halving cycle will kickstart a bull market in early 2023 that will last into 2025. The only thing that remains unclear is what cryptos do between now and then.

Have a good evening,

Jeff Remsburg

The post How Low Will Bitcoin Go? appeared first on InvestorPlace.