Will Low C2C Transactions Hurt Western Union (WU) Q2 Earnings?

The Western Union Company WU is scheduled to release second-quarter 2023 results on Jul 26, after the closing bell. The focal point of the leading global money transfer company’s earnings release will be its Consumer-to-Consumer (C2C) operations. Lower year-over-year transactions during the quarter under discussion are likely to impact results.

Click here to find out how the company’s overall second-quarter performance is expected to have been.

C2C Business

The Consumer-to-Consumer operating segment offers money transfer services between two consumers, primarily through an interconnected global network. This segment includes money transfer transactions that can be initiated through websites and mobile devices. A substantial majority of the transfer in this segment is cross-border. It also provides intra-country transfer services for some nations.

C2C's Q1 Performance

In the last reported quarter, the company’s C2C segment reported revenues of $938.3 million, which tumbled 6% year over year on a reported basis (5% on a constant-currency basis). Branded Digital revenues, which represented 22% of C2C’s revenues, decreased 7% on a reported basis (6% on a constant-currency basis). Operating income plunged 14% to $177.8 million, while the margin of 18.9% fell from 20.7% a year ago.

Affected by the suspension of operations in Russia and Belarus, its transactions within the segment fell 6% year over year. Lower transactions across the Europe and the Commonwealth of Independent States, North America and Asia Pacific region were partially offset by solid performance in the Latin American and Caribbean regions and the Middle East, Africa and South Asia.

Forecast for Q2 Performance

Reduced transactions across the Europe and the Commonwealth of Independent States, as well as in North America, are likely to have affected transaction volumes in the second quarter. Transactions figure in the segment is expected to have declined almost 7% in the quarter under review to 63.5 million.

Nevertheless, its Branded Digital go-to-market strategy is likely to have garnered improved transaction volumes in the to-be-reported quarter. Yet, promotional pricing in Branded Digital strategy is likely to affect revenues. It is also likely to include a negative impact from foreign exchange translations.

Our estimate for second-quarter C2C segment’s revenues is pegged at over $950 million, indicating 7.4% year-over-year decline. Also, our model suggests that revenue per transaction is likely to decline in the quarter under discussion, affecting the overall top line.

The negatives are likely to have been partially offset by improved volumes in Latin America, Middle East and South Asia. We also expect Cross-border Principal to have improved in the second quarter due to monetary policy changes in Iraq.

Higher information technology related investments and lower revenues are likely to have affected operating income from the C2C segment. Our estimate for C2C operating income is pegged at $158.4 million, indicating a significant decline from $225.6 million a year ago. However, lower agent commissions and other expenses are expected to have provided some support.

Overall Projections for Q2

The Zacks Consensus Estimate for total revenues is pegged at $1.1 billion, suggesting an 8.1% year-over-year decline. The consensus estimate for adjusted earnings per share stands at 38 cents, which suggests a 25.5% decrease from the year-ago tally of 51 cents.

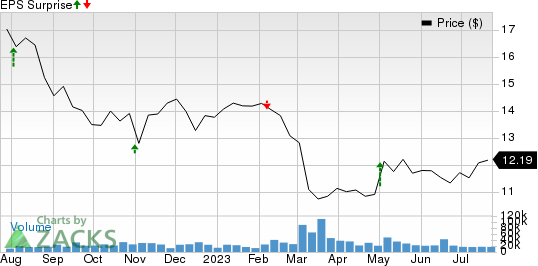

Western Union beat estimates in two of the trailing four quarters, met once and missed on the other occasion, delivering an average surprise of 12.2%.

The Western Union Company Price and EPS Surprise

The Western Union Company price-eps-surprise | The Western Union Company Quote

Our proven model does not conclusively predict an earnings beat for Western Union this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat, which is not the case here.

Western Union has an Earnings ESP of 0.00% and currently carries a Zacks Rank #3.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Stocks to Consider

While an earnings beat looks uncertain for WU, here are some stocks from the broader Business Services space that you may want to consider as our model shows that these have the right combination of elements to beat on earnings this time around.

Flywire Corporation FLYW has an Earnings ESP of +6.67% and is a Zacks #2 Ranked player. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Flywire’s bottom line for the to-be-reported quarter indicates a 31.8% improvement from the year-ago period. The estimate remained stable over the past week. Furthermore, the consensus mark for FLYW’s revenues is pegged at $74.3 million, suggesting 44.2% year-over-year growth.

S&P Global Inc. SPGI has an Earnings ESP of +1.89% and a Zacks Rank of 2.

The Zacks Consensus Estimate for S&P Global’s bottom line for the to-be-reported quarter is pegged at $3.12 per share, indicating 11% year-over-year growth. SPGI beat estimates in three of the past four quarters and missed once, with an average surprise of 3.1%.

Booz Allen Hamilton Holding Corporation BAH has an Earnings ESP of +3.20% and a Zacks Rank of 2.

The Zacks Consensus Estimate for Booz Allen’s bottom line for the to-be-reported quarter is pegged at $1.25 per share, which suggests a 10.6% year-over-year jump. BAH beat estimates in all the past four quarters, the average being 10.2%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Western Union Company (WU) : Free Stock Analysis Report

Booz Allen Hamilton Holding Corporation (BAH) : Free Stock Analysis Report

S&P Global Inc. (SPGI) : Free Stock Analysis Report

Flywire Corporation (FLYW) : Free Stock Analysis Report