Low interest rates widen the gap between Main Street and Wall Street

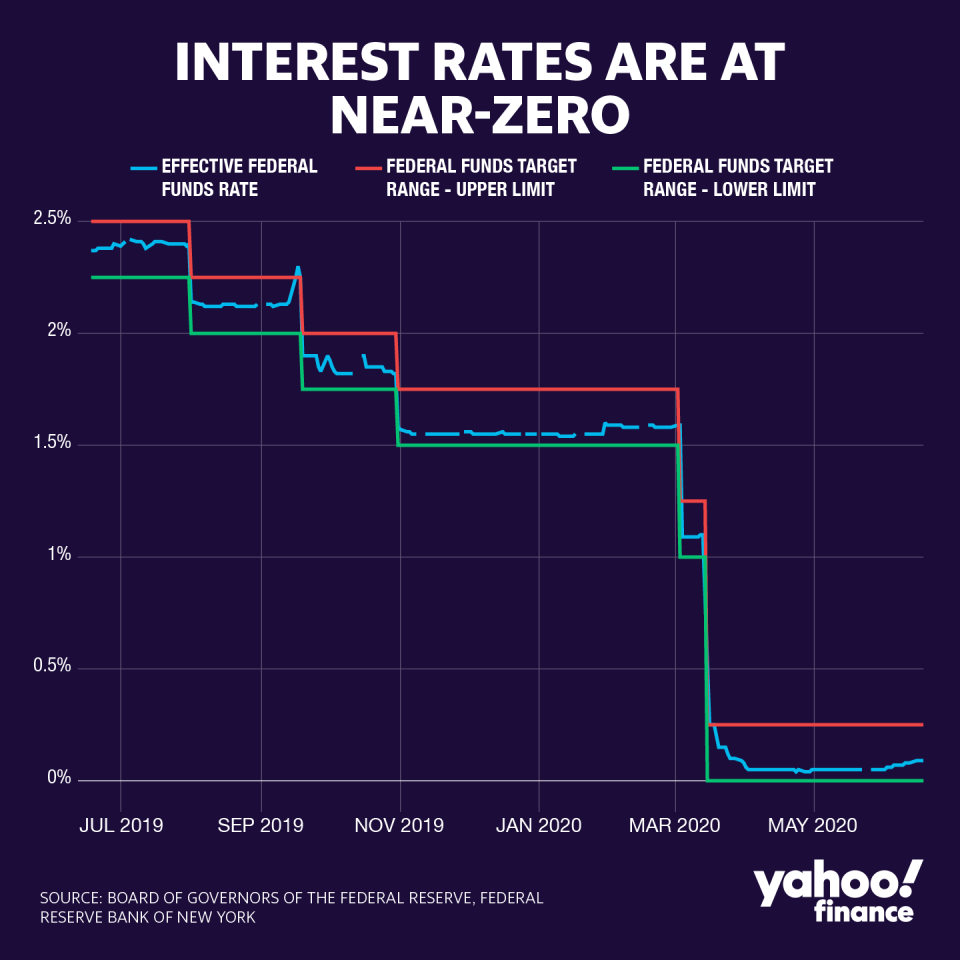

Is there no end to the absurdity of our debt culture? For most of the past 12 years, we have lived in an era of zero interest rate policy, or “ZIRP.” Designed to stimulate more economic activity by making it cheap to borrow, ZIRP has instead inflated the value of financial assets, encouraged unprecedented levels of public and private sector borrowing, and made the rich even richer - all while delivering tepid growth and stagnant wages in the “real economy.”

Now President Trump and others are escalating calls for the Fed to utilize negative rates, or “NIRP,” as a way to double down on this spent policy and actually pay borrowers to borrow and penalize savers when they save. But NIRP has been tried in Japan and Europe, and it has been unsuccessful in stimulating their economies, as growth in both regions has lagged even our modest economic gains. Thankfully, the Fed so far has resisted going this route.

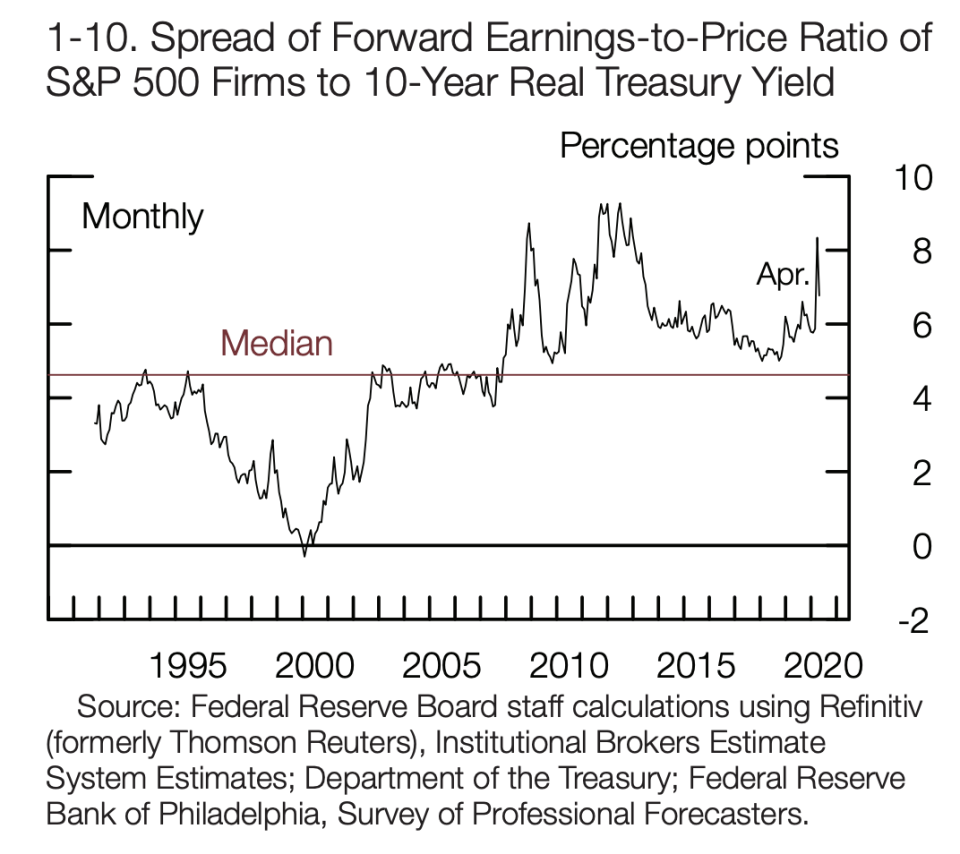

When central banks lower rates on safe assets like government securities, they make riskier assets like stocks more attractive in comparison. Stocks are generally valued based on their expected future returns relevant to risk-free assets. So when rates on Treasuries go down, stock values go up.

No real underlying value has been created. It’s just math. Stock prices further benefit from increased demand, as investors leave low-yielding bonds for higher return equities. The ability of corporations to issue cheap debt to finance dividend increases and stock buybacks also contributes to elevated stock prices. Low interest rates have been key to the stock market’s meteoric rise over the past decade. The Fed’s stepped-up actions to implement ZIRP through expanded lending, and bond purchases help explain why stocks have rebounded so quickly during the pandemic.

Corporations win with low rates

Because the overwhelming majority of stocks are owned by the wealthiest Americans, this boost in stock prices and other risk assets primarily inures to their benefit. But wealthy investors want to invest their money, not spend it. So their gains do not translate into increased consumption, which would support real economic growth. Proponents of low to negative rates argue that there is still a “Main Street” benefit in the form of lower borrowing costs. True, ZIRP has helped higher income households with good credit histories borrow cheaply. But low and middle income families with less stellar credit records too often pay higher, “risk-based” rates.

In any event, these families need good jobs and wages, not more debt burdens. And low rates have done precious little to support labor markets. Low rates have also hurt working families’ ability to accumulate wealth as they do not own stocks and must keep what meager savings they have in low yield bank accounts. Current and future retirees are also put at risk as insurance companies and pension plans have trouble generating sufficient returns to fund pension and annuity obligations.

There is evidence that negative rates actually cause credit to become less available as lenders are no longer able to earn a profitable rate of return on their loans. One recent study by the Bank for International Settlements found that low to negative rates favor securities trading, investment banking and other fee-based financial services, while penalizing traditional lending where profitability is driven by the “spread” between what banks must pay on their deposits and receive on their loans. Thus they favor Wall Street banks with big trading and securities operations but penalize traditional lenders like community and regional banks, who struggle to make loans with such thin interest rate margins.

This, in turn, hurts credit availability for small and mid-sized businesses which are not big enough to access the corporate debt markets and must rely on bank loans.

At the same time, low rates make it all too easy for large corporations to borrow. Over the past 12 years, our economy has become less vibrant and more concentrated as companies have found it very cheap to finance acquisitions. Healthy, innovative companies have been punished by the ability of their zombie competitors to stay afloat with cheap capital. High levels of debt in corporate America have made the economy less resilient in responding to the current pandemic— but interest rate policies have incentivized their behavior. Companies can actually lower their cost of capital by increasing their borrowing, even if their credit ratings fall to near-junk territory. Negative rates will only encourage them to go deeper into debt.

One of the great strengths of the American economic system is market allocation of capital. It is our major advantage over state run systems. But markets can not efficiently allocate capital if it is essentially free for the asking. Like a spoiled child who doesn’t have to work for his allowance, inefficient companies propped up with limitless cheap capital become sluggish and lethargic, with little need to prove their value and effectiveness to the market.

The same can be said for government. Both private and public sectors have become inefficient and bloated atop combined debt now exceeding $52 trillion. To be sure, this pandemic has created exceptional challenges which in the short term, will have to be addressed through yet more borrowing. But we would have been in much better shape going into this crisis if we had been paying down our debt over the past decade of recovery, instead of amassing more of it.

What should the Fed do?

It will be years before we can escape this trap of indebtedness through rate normalization, but we have to start trying.

If we want dynamic growth, if we want efficient government, then we have to get off the cheap debt carousel. Instead of having to fend off calls to “go negative,” the Fed, working with elected officials, should be trying to develop a new paradigm which eventually gets us back on a trajectory of real economic growth.

As I have previously argued, if we are going to use monetary policy to ease periods of economic turmoil, it would be better for the Fed to just print money and distribute it to households instead of lowering rates and encouraging everyone to lever up. During this pandemic, cash assistance in the form of Economic Impact Payment (EIP) funds and unemployment benefits has been of far greater benefit to our consumer-driven economy than booming stock prices. But the process of getting those funds to households has been bureaucratic and inefficient. New technology makes it possible for central banks to distribute digital cash to households swiftly and securely and condition its use on consumption during times like these when we need consumers to spend. Market forces would guide re-allocation of these payments into the economy, as households spent them on goods and services they found of value.

I am happy for investors that the stock market has done so well despite the pandemic. But the giant chasm between the struggling real economy and inflated stock values is something we should all care about. If we need more stimulus, instead of charging households for saving their cash, maybe we should think about just giving them more of it.

-

Sheila Bair is the former Chair of the FDIC and has held senior appointments in both Republican and Democrat Administrations. She currently serves as a board member or advisor to several companies and is a founding board member of the Volcker Alliance, a nonprofit established to rebuild trust in government.

Read more:

The mystery behind the Fed’s refusal to suspend bank dividends

Why student loan forgiveness should target graduates who need it the most

The $1.4 trillion student loan market faces a huge issue — transparency

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.