Low-Volatility ETFs Under the Microscope

With the SPX (S&P 500 Index) rallying above 1500 and maintaining its posture around that level, and with small cap proxy the RUT (Russell 2000 Index) also vaulting to new multi-year highs north of 900, many have questioned the ability of “Low Volatility” ETF products to continue their momentum from 2012 in terms of asset gathering, into 2013.

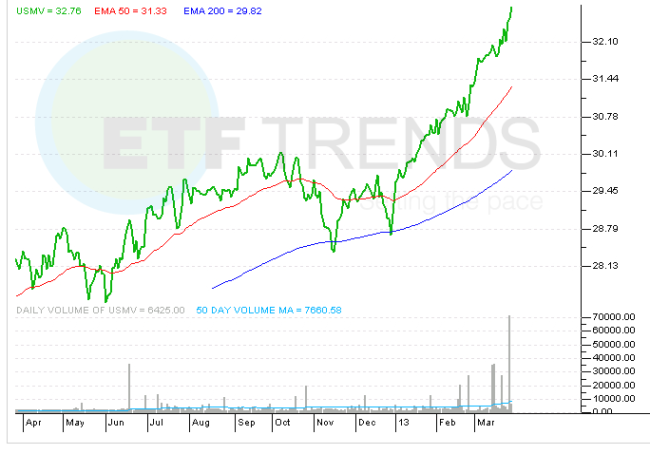

Observers will note that prominent “low vol” equity funds USMV (iShares MSCI USA Minimum Volatility Index, Expense Ratio 0.15%) and SPLV (PowerShares S&P 500 Low Volatility Portfolio, Expense Ratio 0.25%) reeled in very impressive asset flows throughout last year, and allocations are still being made to this space by the evidence of USMV attracting nearly $300 million alone in recent trading sessions via new creations.

USMV is the second largest ETF in terms of AUM in the “Low Vol” space, having now amassed approximately $1.2 billion, while SPLV has approximately $3.2 billion in current assets under management. [Low-Volatility ETFs: Small and Mid-Cap Funds on Tap]

Although the data period is relatively short (10/11-present), based on relative performance since these two products could be compared head to head (SPLV debuted 5/11 in while USMV started trading in 10/11), USMV has a noticeable edge

returns wise. Both index approaches are geared to isolate stocks from known indices, in this case provided by S&P in the case of SPLV and MSCI for USMV, that have demonstrated lower beta and volatility characteristics over time compared to the overall benchmark index. [Three Types of Low-Volatility ETFs]

Thus, as one may expect, sectors that are typically “steady eddies” such as Utilities, Consumer Staples, and Health Care for example are well represented in terms of the underlying portfolio stock weightings. [Low-Volatility ETFs for an Uncertain Market]

Currently, SPLV on its top end is tilted accordingly (30.04% Utilities, 28.31% Consumer Staples, 11.21% Health Care) while USMV demonstrates a bit more balance across the top end of the portfolio. Consumer Staples represents 17.83%, Health Care 17.17%, Industrials 11.36%, and Utilities 8.46% for those whom want to break down the individual nuances between these two products.

SPLV has a current yield of 3.01% and USMV 1.97%, so equity investors that are yield hungry as well as conscious about their overall portfolio beta/volatility exposure are also likely being drawn to these funds and this space given the atmosphere of where we have been in terms of bond yields.

iShares MSCI USA Minimum Volatility Index

For more information on Street One ETF research and ETF trade execution/liquidity services, contact Paul Weisbruch at pweisbruch@streetonefinancial.com.