Will Lower Cash Collection Hurt PRA Group's (PRAA) Q2 Earnings?

PRA Group, Inc. PRAA is set to report its second-quarter 2023 results on Aug 7, after the closing bell.

What Do the Estimates Say?

The Zacks Consensus Estimate for second-quarter loss per share of 16 cents suggests a 117.6% drop from the prior-year earnings of 91 cents. The consensus mark remained stable over the past week. The consensus estimate for second-quarter revenues of $204.2 million indicates a 20.9% decrease from the year-ago reported figure.

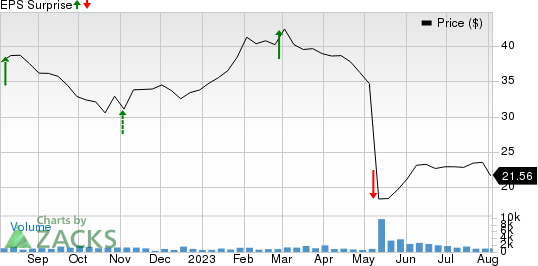

PRA Group beat the consensus estimate for earnings in three of the prior four quarters and missed once, with the average surprise being negative 68.2%. This is depicted in the graph below:

PRA Group, Inc. Price and EPS Surprise

PRA Group, Inc. price-eps-surprise | PRA Group, Inc. Quote

Before we get into what to expect in the to-be-reported quarter in detail, let’s see how the company performed in the last quarter.

Q1 Earnings Rewind

In the last reported quarter, the global financial and business services company’s adjusted loss per share of $1.50 missed the Zacks Consensus Estimate of earnings of 45 cents. The quarterly results were hurt by an elevated expense level, weaker portfolio income and softer-than-expected U.S. tax season. Nevertheless, the upside was partly offset by a favorable supply environment that led to strong portfolio acquisition volumes.

Now, let’s see how things have shaped up before the second-quarter earnings announcement.

Q2 Factors to Note

Our model predicts lower cash collection from all regions in the quarter under review due to a reduced portfolio purchase level. Our estimate for total cash collection in the quarter indicates a more than 16% decline year over year.

The majority of the cash collection decline is expected from Americas and Australia Core, and Americas Insolvency. Our estimate suggests a nearly 15% decline in revenue generation from U.K. operations, while the same from the United States indicates a more than 31% fall.

We expect portfolio income to drop 12.5% in the quarter under discussion. Our model suggests a 12.6% year-over-year increase in legal collection costs in the second quarter, along with higher net interest expenses.

The above-mentioned factors are likely to have led to a year-over-year decline in results, making an earnings beat uncertain. However, lower total costs are expected to have provided some respite.

We expect total operating expenses in the second quarter to have declined 4.6% from a year ago. Reduced rent and occupancy, communication and agency fees costs are likely to have contributed to the year-over-year decrease.

Also, higher other revenues and lower compensation and employee services expenses are likely to have partially offset the negatives in the second quarter.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for PRA Group this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. That is not the case here, as you will see below.

Earnings ESP: The company has an Earnings ESP of -93.75%. This is because the Most Accurate Estimate currently stands at a loss of 31 cents per share, wider than the Zacks Consensus Estimate of 16 cents.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: PRA Group currently carries a Zacks Rank #2.

Stocks to Consider

While an earnings beat looks uncertain for PRA Group, here are some companies from the broader Finance space that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this time around:

Forge Global Holdings, Inc. FRGE has an Earnings ESP of +11.11% and is a Zacks #3 Ranked player.

The Zacks Consensus Estimate for Forge Global’s earnings per share for the to-be-reported quarter suggests an improvement of 64.5% from the year-ago period. The estimate remained stable over the past week. The consensus mark for FRGE’s revenues is pegged at $16.4 million.

American Equity Investment Life Holding Company AEL has an Earnings ESP of +0.77% and is a Zacks #2 Ranked player. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for American Equity Investment’s bottom line for the to-be-reported quarter is pegged at $1.65 per share, which indicates a 68.4% increase from the year-ago period. The consensus estimate for AEL’s revenues is pegged at $555 million.

Postal Realty Trust, Inc. PSTL has an Earnings ESP of +3.09% and is a Zacks #3 Ranked player.

The Zacks Consensus Estimate for Postal Realty’s bottom line for the to-be-reported quarter is pegged at 24 cents per share, which remained stable over the past week. The consensus mark for PSTL’s revenues is pegged at $15.3 million, signaling 20.4% year-over-year growth.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PRA Group, Inc. (PRAA) : Free Stock Analysis Report

American Equity Investment Life Holding Company (AEL) : Free Stock Analysis Report

Postal Realty Trust, Inc. (PSTL) : Free Stock Analysis Report

Forge Global Holdings, Inc. (FRGE) : Free Stock Analysis Report