Can Lower Transactions Affect Western Union's (WU) Q3 Earnings?

The Western Union Company WU is set to report its third-quarter 2023 results on Oct 25, after the closing bell. This time around, the company’s overall earnings performance is likely to have received a boost from lower cost of service, only to be undone by reduced transactions in Europe.

What Do the Estimates Say?

The Zacks Consensus Estimate for third-quarter earnings per share of 38 cents suggests a 9.5% decrease from the prior-year figure of 42 cents. The consensus mark remained stable over the past week. The consensus estimate for third-quarter revenues of nearly $1 billion indicates a 5.2% decrease from the year-ago reported figure.

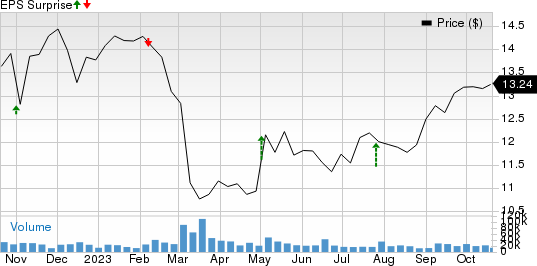

Western Union beat the consensus estimate for earnings in two of the trailing four quarters, met once and missed on the other occasion, with the average surprise being 14.7%. This is depicted in the graph below:

The Western Union Company Price and EPS Surprise

The Western Union Company price-eps-surprise | The Western Union Company Quote

Before we get into what to expect for the to-be-reported quarter in detail, it’s worth taking a look at WU’s previous-quarter performance first.

Q2 Earnings Rewind

The leading global money transfer company reported adjusted earnings of 51 cents per share for the previous quarter, beating the Zacks Consensus Estimate by 34.2%. The quarterly results were supported by growth in business originating from Iraq, Argentinian inflation and better-than-expected C2C transactions. Evolve 2025’s momentum and strength in the Middle East business further benefited the results, partially offset by higher expenses.

Now, let’s see how things have shaped up before the third-quarter earnings announcement.

Q3 Factors to Note

Lower transactions in multiple regions are expected to have affected WU’s C2C Segment in the third quarter. Reduced transactions in North America and Europe and the Commonwealth of Independent States regions are expected to have affected the metric, partially offset by strength in the Middle East, Africa and South Asia operations.

The Zacks Consensus Estimate and our model indicate C2C transactions to decline 3% year over year to 64.9 million in the third quarter. This is likely to have affected the company’s revenues and profits. The consensus mark for the unit’s revenues implies a 2.1% decrease from the year-ago period’s $982.4 million, whereas our estimate suggests a 2.9% fall.

Furthermore, both the consensus estimate and our model for the C2C business’ operating income indicate a 9.6% decrease from the year-ago period’s $193.7 million.

The above-mentioned factors are likely to have positioned the company for a year-over-year decline and made an earnings beat uncertain. However, the Other segment, which includes Western Union’s bill payments businesses, as well as retail money order services, is expected to have provided some breathing room for the company in the quarter under review.

Our estimate for revenues from the Other segment signals almost 5% year-over-year growth. Both the consensus estimate and our model indicate a 54.7% increase in operating income from the segment from the year-ago period’s $21.6 million.

Also, our estimate for total operating expense implies a 4.5% decline from a year ago due to lower cost of service, which will provide an impetus to the margins.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for Western Union this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. That is not the case here, as you will see below.

Earnings ESP: The company has an Earnings ESP of 0.00%. This is because the Most Accurate Estimate currently stands at 38 cents per share, in line with the Zacks Consensus Estimate.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Western Union currently carries a Zacks Rank #3.

Stocks to Consider

While an earnings beat looks uncertain for Western Union, here are some companies from the broader Business Services space that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this time around:

FirstCash Holdings, Inc. FCFS has an Earnings ESP of +5.71% and is a Zacks #2 Ranked player. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for FirstCash’s bottom line for the to-be-reported quarter is pegged at $1.40 per share, indicating 7.7% year-over-year growth. The estimate increased by a penny over the past week. Furthermore, the consensus mark for FCFS’ revenues is pegged at $767 million, suggesting 14.1% growth from a year ago.

PagSeguro Digital Ltd. PAGS has an Earnings ESP of +1.96% and a Zacks Rank of 3.

The Zacks Consensus Estimate for PagSeguro’s bottom line for the to-be-reported quarter is pegged at 26 cents per share, which suggests an 8.3% year-over-year jump. The estimate remained stable over the past week. PAGS beat earnings estimates in all the past four quarters, with an average of 9.3%.

Shift4 Payments, Inc. FOUR has an Earnings ESP of +9.38% and a Zacks Rank of 3.

The Zacks Consensus Estimate for Shift4 Payments’ bottom line for the to-be-reported quarter is pegged at 70 cents per share, indicating 59.1% year-over-year growth. FOUR beat earnings estimates in all the past four quarters, with an average surprise of 21.9%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Western Union Company (WU) : Free Stock Analysis Report

FirstCash Holdings, Inc. (FCFS) : Free Stock Analysis Report

PagSeguro Digital Ltd. (PAGS) : Free Stock Analysis Report

Shift4 Payments, Inc. (FOUR) : Free Stock Analysis Report