Lowe's Companies Inc (LOW) Reports Decline in Q4 Comparable Sales, Maintains Confidence in Home ...

Net Earnings: Reported at $1.0 billion for Q4 2023.

Diluted EPS: Increased to $1.77 from $1.58 in Q4 2022.

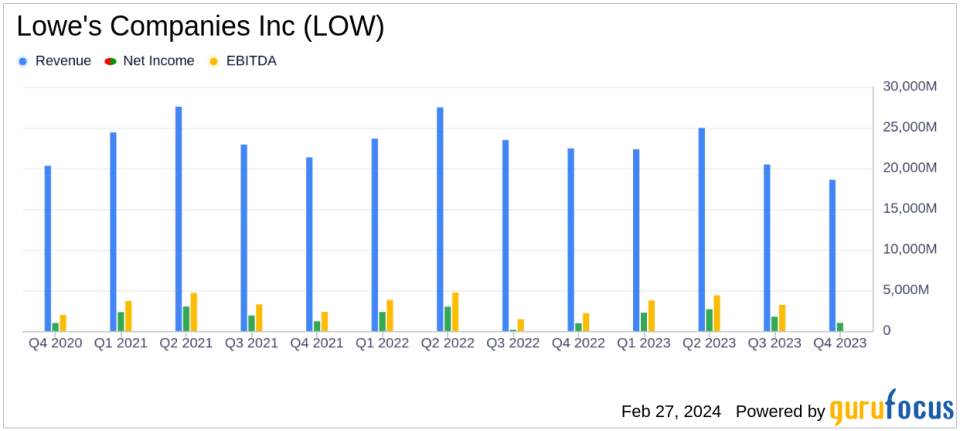

Total Sales: Decreased to $18.6 billion from $22.4 billion in the prior year quarter.

Comparable Sales: Decreased by 6.2% in Q4 2023.

Pro Customer Sales: Remained flat for the quarter.

Capital Allocation: Repurchased 1.9 million shares for $404 million; paid $633 million in dividends in Q4.

Full Year 2024 Outlook: Anticipates total sales of $84 to $85 billion and diluted EPS of approximately $12.00 to $12.30.

Lowe's Companies Inc (NYSE:LOW) released its 8-K filing on February 27, 2024, detailing its fourth quarter 2023 sales and earnings results. The home improvement giant reported net earnings of $1.0 billion and diluted earnings per share (EPS) of $1.77 for the quarter ended February 2, 2024. This marks an increase from the diluted EPS of $1.58 in the fourth quarter of 2022, which included pre-tax transaction costs associated with the sale of its Canadian retail business.

Lowe's, the second-largest home improvement retailer in the world, operates more than 1,700 stores in the United States. The company's stores offer a wide range of products and services for home decoration, maintenance, repair, and remodeling, with a focus on both retail do-it-yourself and professional business clients. Despite a challenging quarter, Lowe's remains confident in the long-term strength of the home improvement market and continues to invest in its Total Home strategy to capture market share.

However, the company faced headwinds with total sales for the quarter decreasing to $18.6 billion, down from $22.4 billion in the prior year quarter. Comparable sales for the quarter decreased by 6.2%, attributed to a slowdown in DIY demand and unfavorable January winter weather. Pro customer comparable sales were flat for the quarter. Lowe's chairman, president, and CEO, Marvin R. Ellison, commented on the results:

"This quarter we delivered strong operating profit and improved customer satisfaction, despite the continued pullback in DIY spending. We remain confident in the long-term strength of the home improvement market, and we are making the right investments in our Total Home strategy to take share. We are also pleased to award $140 million in discretionary bonuses to our frontline associates in recognition of their exceptional customer service in 2023."

The company's commitment to returning value to shareholders remained evident as it repurchased approximately 1.9 million shares for $404 million during the quarter, and paid $633 million in dividends. In total, Lowe's returned $8.9 billion to shareholders through share repurchases and dividends in fiscal 2023.

Looking ahead, Lowe's introduced its outlook for the full year 2024, which anticipates total sales of $84 to $85 billion, a comparable sales decrease of -2 to -3% compared to the prior year, and diluted earnings per share of approximately $12.00 to $12.30. The company also plans capital expenditures of approximately $2 billion.

Despite the near-term macroeconomic uncertainty, Lowe's remains focused on its strategic initiatives and capital allocation strategy to drive long-term, sustainable shareholder value. The company's performance in the fourth quarter, while facing market challenges, demonstrates its resilience and commitment to its customers and shareholders alike.

Investors interested in the detailed financial results and future projections can access the full earnings conference call and supplemental slides on Lowe's website at ir.lowes.com.

Explore the complete 8-K earnings release (here) from Lowe's Companies Inc for further details.

This article first appeared on GuruFocus.