Lowe's (LOW) Digital and Pro Businesses Exhibit Strength

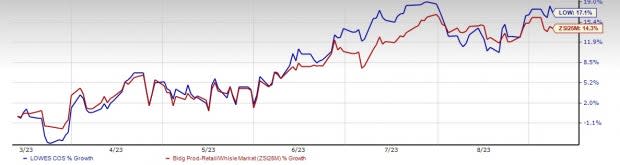

Lowe's Companies, Inc. LOW remains well-positioned to capitalize on the demand for the home improvement market, backed by investments in technology, merchandise category and strength in the Pro business. A robust digital base has been aiding the company’s performance for a while. LOW’s Total Home strategy, which includes complete solutions for various home improvement needs, also bodes well. Buoyed by such strengths, this renowned home-improvement retailer has gained 17.1% in the past six months compared with the industry’s 14.1% growth.

Let’s Delve Deep

Management continues investing in omni-channel capabilities to drive growth, including expanding online assortment, boosting user experience and improving fulfillment. It has been expanding Lowes.com's assortment to meet customers' design and lifestyle. Management has also been enhancing the pick up in store experience to streamline processes and advance technology. The company has launched a same-day delivery option on lowes.com and its mobile app, powered by OneRail. This will allow the company to tap into their network to directly deliver to Pro job sites and consumers in a few hours.

Lowe’s has been making efforts to roll out a market delivery model for huge products, with 13 geographic regions presently supporting over 1200 stores, and is on track to conclude the initial rollout by the year-end. It also remains committed to improving productivity via its perpetual productivity improvement initiatives or PPI. Within the company’s supply chain, it is boosting greater throughput with new mobile applications, automation, and robotics to enhance productivity, maximize speed, and minimize damages. Management also introduced a digital Will This Fit capability, which aids customers in determining whether a refrigerator will fit into their space with a refined search experience and better recommendations, filters, and featured categories.

Image Source: Zacks Investment Research

During the second quarter of fiscal 2023, Lowe’s online comp sales rose 6.9%, and nearly half of such orders were picked up in a store. The company is focused on enhancing its workforce-management tools to align staffing levels with customer demand efficiently. Lowe's One Roof Media Network has also been performing well. This is boosting traffic on lowes.com and generating higher results. It has also expanded its merchandising and services team.

Pro customers have been a significant driver in Lowe's business growth. Moreover, in a bid to continue augmenting sales from pro customers, the company has been augmenting pro-focused brands. Earlier, Lowe’s had refurbished its pro-service business website, LowesForPros.com, to give special attention to the needs of its Pro-customers. Moreover, prudent partnerships are helping the company provide pro customers with a broad range of assortments that suit their home improvement and maintenance needs. Continued focus on the Pro category is a significant component of the Total Home strategy.

In the reported quarter, the company generated positive comps despite lumber deflation. It has also launched its newest online tool, which is purchase authorization to save Pros time. Management looks to advance online business tools for Pros, allowing them to generate quotes and track orders owing to the MVP Pro rewards program. Management is quite focused on enhancing the Pro offering across the company’s stores and online with improved service levels, deeper inventory quantities, intuitive store layout and more Pro national brands. The Pro segment is expected to continue its momentum with improved in-stock inventory levels, enhanced service offerings and a Pro loyalty program.

Wrapping up, Lowe’s is well-poised for growth, considering the above-discussed tailwinds. The Zacks Consensus Estimate for Lowe’s fiscal 2024 sales and earnings per share (EPS) is currently pegged at $89.42 billion and $14.59, respectively. These estimates suggest growth of 1.8% and 8.5%, respectively, from the year-ago fiscal quarter’s corresponding figures, raising analysts’ optimism about the stock. A long-term expected earnings growth rate of 11.4% coupled with a VGM Score of B, further speaks volumes for this current Zacks Rank #3 (Hold) company.

Eye These Solid Picks

We have highlighted three better-ranked stocks, namely Abercrombie & Fitch ANF, American Eagle Outfitters AEO and Boot Barn BOOT.

Abercrombie & Fitch, a leading casual apparel retailer, currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Abercrombie & Fitch’s current financial-year sales and earnings per share (EPS) suggests growth of 0.5% and 526.3%, respectively, from the year-ago reported figures. ANF delivered an earnings surprise of 107.7% in the last reported quarter.

American Eagle Outfitters, a retailer of casual apparel, accessories and footwear, currently sports a Zacks Rank of 1. AEO delivered an earnings surprise of 82.6% in the last reported quarter.

The Zacks Consensus Estimate for American Eagle Outfitters’ current financial-year sales and EPS suggests growth of 3.3% and 24.2%, respectively, from the year-ago reported figures.

Boot Barn, a fashion retailer of apparel and accessories, currently carries a Zacks Rank #2 (Buy). The company has a trailing four-quarter earnings surprise of 8.7%, on average.

The Zacks Consensus Estimate for Boot Barn’s current financial-year sales and EPS suggests growth of 8.2% and 9.1%, respectively, from the year-ago reported figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

Lowe's Companies, Inc. (LOW) : Free Stock Analysis Report

Boot Barn Holdings, Inc. (BOOT) : Free Stock Analysis Report