Lowe's (NYSE:LOW) Q4 Earnings Results: Revenue In Line With Expectations

Home improvement retailer Lowe’s (NYSE:LOW) reported results in line with analysts' expectations in Q4 FY2023, with revenue down 17.1% year on year to $18.6 billion. The company's full-year revenue guidance of $84.5 billion at the midpoint came in 1.3% below analysts' estimates. It made a GAAP profit of $1.77 per share, down from its profit of $2.28 per share in the same quarter last year.

Is now the time to buy Lowe's? Find out by accessing our full research report, it's free.

Lowe's (LOW) Q4 FY2023 Highlights:

Revenue: $18.6 billion vs analyst estimates of $18.47 billion (small beat)

EPS: $1.77 vs analyst estimates of $1.67 (6.2% beat)

Management's revenue guidance for the upcoming financial year 2024 is $84.5 billion at the midpoint, missing analyst estimates by 1.3% and implying 2.2% decline (vs -11.2% in FY2023)

Free Cash Flow of $427 million is up from -$288 million in the same quarter last year

Gross Margin (GAAP): 32.4%, in line with the same quarter last year

Same-Store Sales were down 6.2% year on year

Store Locations: 1,746 at quarter end, increasing by 8 over the last 12 months

Market Capitalization: $133 billion

"This quarter we delivered strong operating profit and improved customer satisfaction, despite the continued pullback in DIY spending," commented Marvin R. Ellison, Lowe's chairman, president and CEO.

Founded in North Carolina as Lowe's North Wilkesboro Hardware, the company is a home improvement retailer that sells everything from paint to tools to building materials.

Home Improvement Retailer

Home improvement retailers serve the maintenance and repair needs of do-it-yourself homeowners as well as professional contractors. Home is where the heart is, so any homeowner will want to keep that home in good shape by maintaining the yard, fixing leaks, or improving lighting fixtures, for example. Home improvement stores win with depth and breadth of product, in-store consultations for customers who need help, and services that cater to professionals. It is hard for non-focused retailers and e-commerce competitors to match these. However, the research, convenience, and prices of online platforms means they can’t be fully written off, either.

Sales Growth

Lowe's is a behemoth in the consumer retail sector and benefits from economies of scale, an important advantage giving the business an edge in distribution and more negotiating power with suppliers.

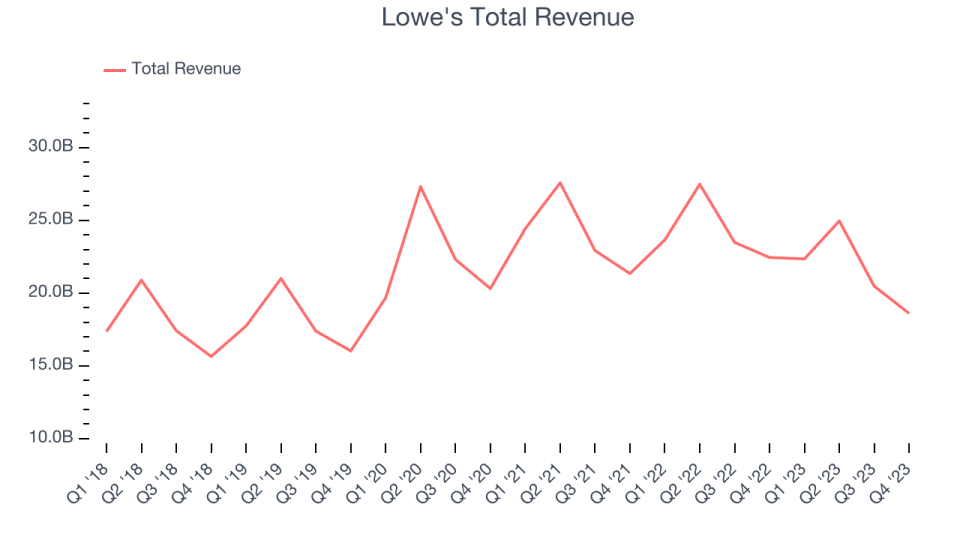

As you can see below, the company's annualized revenue growth rate of 4.6% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was weak as its store count dropped.

This quarter, Lowe's reported a rather uninspiring 17.1% year-on-year revenue decline to $18.6 billion in revenue, in line with Wall Street's estimates. Looking ahead, Wall Street expects revenue to decline 1.1% over the next 12 months.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Same-Store Sales

Same-store sales growth is an important metric that tracks demand for a retailer's established brick-and-mortar stores and e-commerce platform.

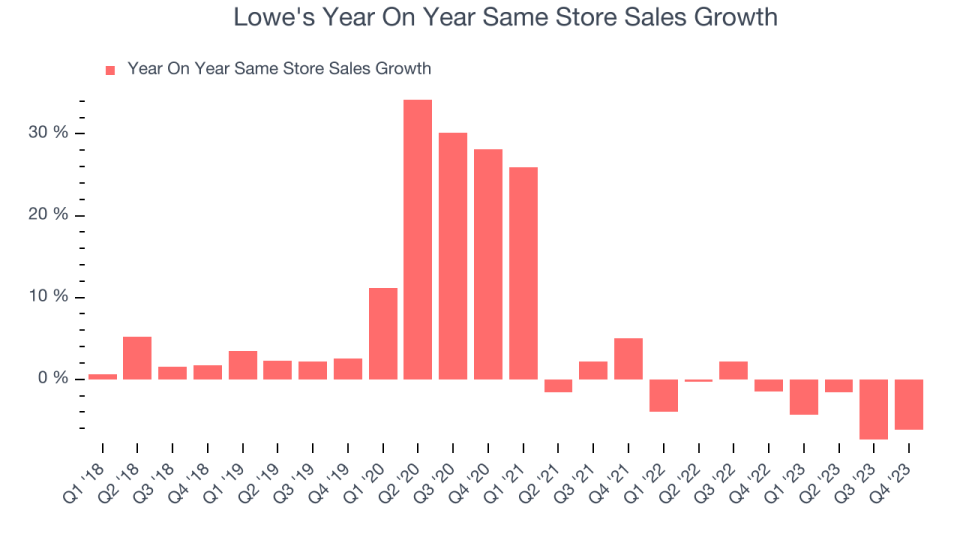

Lowe's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 2.9% year on year. The company has been reducing its store count as fewer locations sometimes lead to higher same-store sales, but that hasn't been the case here.

In the latest quarter, Lowe's same-store sales fell 6.2% year on year. This decrease was a further deceleration from the 1.5% year-on-year decline it posted 12 months ago. We hope the business can get back on track.

Key Takeaways from Lowe's Q4 Results

It was good to see Lowe's beat analysts' EPS expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street's estimates. On the other hand, its full-year forecast missed analysts' expectations and same store sales declined. Overall, this was a mediocre quarter for Lowe's. The stock is up 2% in the pre-market and currently trades at $236 per share.

So should you invest in Lowe's right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.