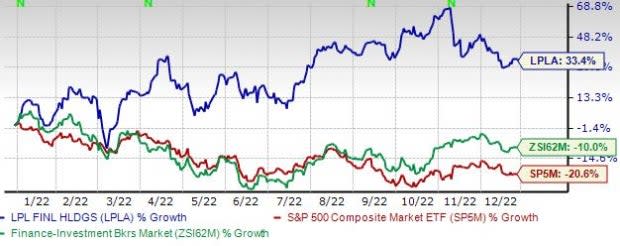

LPL Financial (LPLA) Up 33.4% YTD: Rally to Continue in 2023?

Shares of LPL Financial Holdings Inc. LPLA have gained 33.4% year to date. This is in contrast to the industry’s decline of 10% and the S&P 500’s decline of 20.6% in the same period.

The company’s performance was impressive last year as well. Despite the near-zero interest rate environment and the continued uncertainty related to the coronavirus pandemic, LPLA’s shares gained 53.6% in 2021, outperforming the industry’s rally of 34.3%.

LPLA’s solid performance is being driven by solid advisor productivity, along with the company’s recruiting and inorganic growth efforts.

Year-to-Date Price Performance

Image Source: Zacks Investment Research

Analysts are optimistic regarding this Zacks Rank #2 (Buy) company’s earnings growth prospects. Over the past two months, the Zacks Consensus Estimate for LPLA’s 2022 earnings has been revised 4.2% upward, while that for 2023 has been upped 6.4%.

Let’s take a look at the key factors that are likely to keep aiding LPL Financial’s steady price appreciation.

Revenue Growth Initiatives: LPL Financial has been making efforts to increase its client base. The company’s advisory revenues (constituting 47.4% of total revenues in the first nine months of 2022) have been increasing over the past several years. Advisory revenues witnessed a six-year (2016-2021) compound annual growth rate of 22.3%, with the uptrend continuing in the first nine months of 2022.

Given the company’s recruiting efforts and solid advisor productivity, advisory revenues are expected to keep improving in the quarters ahead. The acquisition of Allen & Company and the launch of a no-transaction-fee exchange-traded fund network will likely continue to boost the value of LPL Financial’s advisory platform.

In 2022, LPLA is expected to witness top-line growth of 11.7%, while in 2023, its top line is projected to grow 14.8%.

Inorganic Expansion Efforts: LPL Financial has accomplished several strategic deals over the past few years. In July 2022, it entered an agreement to acquire the private client group business of Boenning & Scattergood. In 2021, it acquired Waddell & Reed's wealth management business for $300 million, while in 2020, the company acquired Blaze Portfolio, the assets of E.K. Riley Investments, LLC and Lucia Securities. These, along with the past inorganic expansion efforts, will continue to support growth and help LPL Financial diversify revenues.

Earnings Strength: LPLA has witnessed earnings growth of 17.53% in the past three to five years. The uptrend is expected to continue in the near term. The company’s earnings are projected to surge 61.3% in 2022 and 72.8% in 2023. Further, its long-term (three-five years) projected earnings growth rate of 52.6% promises rewards for investors.

Solid Balance Sheet & Capital Position: As of Sep 30, 2022, LPL Financial had net long-term and other borrowings worth $2.72 billion, and cash and cash equivalents of $1.22 billion. The company has a revolving credit facility, which will not mature anytime soon. Also, its investment-grade ratings of Baa3 and stable outlook from Moody’s Investors Service as well as ratings of BB+ and outlook of positive from Standard & Poor render the company favorable access to the credit markets.

Thus, despite a high debt burden, the company is expected to continue meeting debt obligations in the near term, even if the economic situation worsens.

Given a solid capital position, the company is expected to continue to be able to sustain efficient capital deployments in the future. LPLA pays a cash dividend of 25 cents per share on a quarterly basis.

Also, it has a share buyback program in place, which had been paused in response to the concerns surrounding the coronavirus outbreak. However, the company resumed repurchases in the third quarter of 2021 and targets buybacks of $40 million per quarter. As of Sep 30, 2022, LPL Financial had $84.8 million worth of shares left to be repurchased. In October 2022, the company announced an increase in its share repurchase authorization, with $2 billion available for repurchase beginning in 2023.

Other Stocks Worth A Look

A couple of other top-ranked stocks from the same industry are Interactive Brokers Group, Inc. IBKR and BGC Partners, Inc. BGCP. At present, both IBKR and BGCP carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Interactive Brokers’ 2022 earnings has moved marginally upward over the past 30 days. In the past three months, IBKR’s shares have gained 13.5%.

The Zacks Consensus Estimate for BGC Partners’ 2022 earnings has remained unchanged over the past month. BGCP’s shares have rallied 16.7% in the past three months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

BGC Partners, Inc. (BGCP) : Free Stock Analysis Report

LPL Financial Holdings Inc. (LPLA) : Free Stock Analysis Report