LPL Financial (LPLA) Launches New Advisor Affiliation Model

LPL Financial LPLA introduces a new affiliation model for advisors focused on serving high-net-worth clients called LPL Private Wealth Management. Owing to the model, advisors will enjoy the benefits of industry-leading payouts, client ownership and business autonomy while gaining access to enhanced service, expanded capabilities and an exclusive high-net-worth advisor community.

Gary Carrai, the executive vice president of the advisor business lines, stated, “Private Wealth represents the best of both worlds — exclusive access to specialized teams and resources vital to supporting the needs of high-net-worth investors while enjoying all the benefits of independence, all while earning up to 50% higher payouts than the average wire. Private Wealth allows advisors the same full support of working in a wirehouse, without the common downsides of grid changes, growth targets, household minimums and proprietary products.”

Anna Howard, the senior vice president of LPL Private Wealth, said, “The Private Wealth offering was designed for high-net-worth-focused advisors to easily access resources and serve their clients’ sophisticated and complex needs.”

Howard added, “Private Wealth provides advisors with a tremendous opportunity to own their business and effectively serve their client’s needs at a large organization that provides safety and stability while also creating a boutique and personalized experience. With higher payouts, cutting-edge technology and specialized resources, Private Wealth represents a unique and attractive offering in the industry.”

A few months ago, during its financial event — Focus 2023 — held in San Diego, CA, LPLA unveiled a new addition to its Model Wealth Portfolios (MWP) unified managed account program.

The innovation came in the form of direct indexing, a strategy that promises to revolutionize investment trading strategies by enhancing tax efficiency and tailoring outcomes for clients. The dual benefit holds immense promise for advisors and investors.

LPL Financial has always been striving to offer the best investment solutions. The launch of a no-transaction-fee exchange-traded fund network will continue to boost the value of the company’s advisory platform. LPLA’s advisory revenues have been increasing in the past several years. Advisory revenues witnessed a five-year (2017-2022) compound annual growth rate of 22.4%.

Over the years, LPLA has been diversifying its business through opportunistic acquisitions. In August, it signed a relationship agreement with Prudential Financial to accelerate growth. In July, it entered an agreement to acquire the wealth management business of Crown Capital. In February, it acquired FRGIS and the Private Client Group business of Boenning & Scattergood. In 2021, it took over Waddell & Reed's wealth management business, while in 2020, LPLA acquired Blaze Portfolio, the assets of E.K. Riley Investments, LLC and Lucia Securities.

These, along with the past inorganic expansion efforts, continue to help LPL Financial in diversifying revenues and supporting growth.

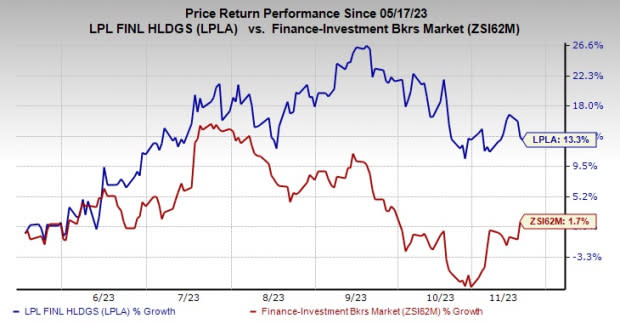

In the past six months, shares of LPL Financial have rallied 13.3% compared with the industry’s growth of 1.7%.

Image Source: Zacks Investment Research

Currently, LPLA carries a Zacks Rank #5 (Strong Sell).

A couple of better-ranked stocks from the finance space are Community Trust Bancorp, Inc. CTBI and Interactive Brokers Group, Inc. IBKR.

Community Trust currently sports a Zacks Rank #1 (Strong Buy). The company’s earnings estimates for 2023 have been revised 5% upward over the past 60 days. In the past six months, CTBI shares have gained 15.7%. You can see the complete list of today's Zacks #1 Rank stocks here.

Earnings estimates for Interactive Brokers have been revised 2.1% upward for 2023 in the past 60 days. Shares of IBKR have increased 7.6% in the past six months. The company currently carries a Zacks Rank #2 (Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

Community Trust Bancorp, Inc. (CTBI) : Free Stock Analysis Report

LPL Financial Holdings Inc. (LPLA) : Free Stock Analysis Report