LPL Financial's (LPLA) Q4 Earnings Beat on Higher Revenues

LPL Financial’s LPLA fourth-quarter 2023 adjusted earnings of $3.51 per share handily surpassed the Zacks Consensus Estimate of $3.33. The bottom line reflects a decline of 17% year over year.

Results benefited from robust improvement in revenues, partly offset by an increase in expenses. LPLA recorded growth in brokerage and advisory assets, which acted as a tailwind.

After considering certain non-recurring items, net income was $217.6 million or $2.85 per share compared with $319.1 million or $3.95 per share in the prior-year quarter. Our estimate for net income was $231.3 million.

For 2023, net income was $1.07 billion or $13.69 per share compared with $845.7 million or $10.40 per share in 2022. Our estimate for net income was $1.08 billion.

Revenues Improve, Expenses Rise

Total quarterly net revenues of $2.64 billion grew 13% year over year. The top line beat the Zacks Consensus Estimate of 2.54 billion.

Full-year net revenues were $10.05 billion, up 17% year over year. The top line surpassed the Zacks Consensus Estimate of $9.86 billion.

Total quarterly expenses jumped 23% year over year to $2.35 billion. The rise was due to an increase in all cost components except communications and data processing costs. Our estimate for total expenses was $2.22 billion.

As of Dec 31, 2023, LPL Financial’s total brokerage and advisory assets were $1,354.1 billion, up 22% year over year. Our estimate was $1,240.9 billion.

In the reported quarter, total net new assets were $24.7 billion, up from $21.3 billion in the prior-year quarter. Our estimate for the metric was $32.4 billion. Total client cash balances declined 24% year over year to $48.5 billion.

Balance Sheet Position Solid

As of Dec 31, 2023, total assets were $10.39 billion, up 9% on a sequential basis. As of the same date, cash and cash equivalents totaled $465.7 million, down from $799.2 million in the prior-quarter end.

Total stockholders’ equity was $2.08 billion as of Dec 31, 2023, down 1% sequentially.

Share Repurchase Update

In the reported quarter, the company repurchased shares worth $225 million.

Our View

LPL Financial’s recruiting efforts and solid advisor productivity will likely continue aiding advisory revenues. Strategic buyouts will keep supporting financials. However, mounting expenses and a tough operating backdrop remain major near-term concerns for the company.

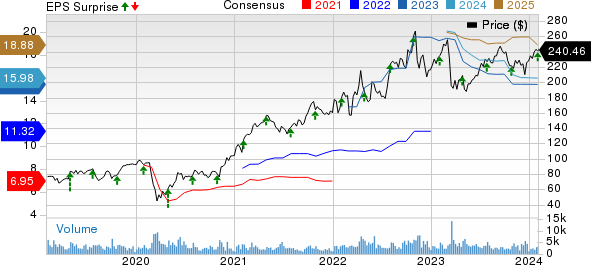

LPL Financial Holdings Inc. Price, Consensus and EPS Surprise

LPL Financial Holdings Inc. price-consensus-eps-surprise-chart | LPL Financial Holdings Inc. Quote

Currently, LPL Financial carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Brokerage Firms

Charles Schwab’s SCHW fourth-quarter 2023 adjusted earnings of 68 cents per share beat the Zacks Consensus Estimate of 65 cents. The bottom line, however, declined 36% from the prior-year quarter.

SCHW’s results benefited from the solid performance of the asset management business. The absence of fee waivers and solid brokerage account numbers acted as tailwinds in the quarter. However, lower revenues due to higher funding costs and lower volatility posed a major headwind for SCHW.

Interactive Brokers Group’s IBKR fourth-quarter 2023 adjusted earnings per share of $1.52 missed the Zacks Consensus Estimate of $1.54. However, the bottom line reflected a rise of 16.9% year over year.

IBKR’s results were primarily hurt by an increase in expenses. However, higher revenues supported results to an extent. Also, the company recorded an increase in customer accounts during the quarter, which, along with a rise in daily average revenue trades, was a tailwind.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Charles Schwab Corporation (SCHW) : Free Stock Analysis Report

Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

LPL Financial Holdings Inc. (LPLA) : Free Stock Analysis Report