Lululemon Athletica Inc (LULU) Reports Robust Fiscal 2023 Earnings With Significant Revenue and ...

Fourth Quarter Revenue: Increased by 16% to $3.2 billion.

Full Year Revenue: Grew by 19% to $9.6 billion.

Diluted EPS: $5.29 for Q4 and $12.20 for the full year, with adjusted EPS of $12.77.

Gross Margin: Expanded by 430 basis points to 59.4% in Q4.

Operating Margin: Increased to 28.5% from 11.3% in Q4 of the previous year.

Store Count: 25 net new company-operated stores opened in Q4, totaling 711 stores.

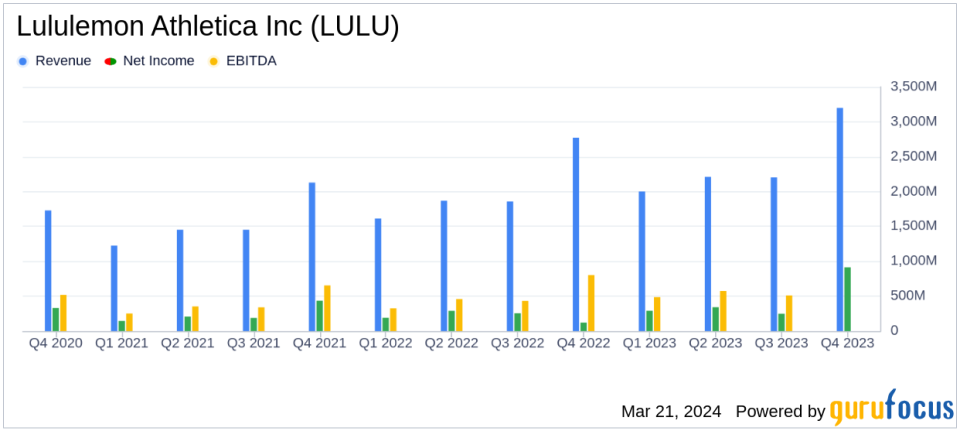

Lululemon Athletica Inc (NASDAQ:LULU) released its 8-K filing on March 21, 2024, unveiling a strong finish to its fiscal year 2023. The company, known for its high-quality athletic apparel, footwear, and accessories, has continued to outperform in the retail-cyclical sector, with a notable 16% increase in fourth-quarter revenue, reaching $3.2 billion, and a 19% full-year revenue surge to $9.6 billion.

Lululemon's growth is underpinned by its successful Power of Three 2 strategy, which has driven momentum across various channels, geographies, and merchandise categories. The company's CEO, Calvin McDonald, attributes this success to the collective efforts of Lululemon's global teams and their focus on innovative new products and brand activations.

Financial Performance and Strategic Growth

The fourth quarter saw a significant increase in net revenue, with Americas net revenue up by 9% and International net revenue soaring by 54%, or 56% on a constant dollar basis. Comparable sales rose by 12%, with a 7% increase in the Americas and a remarkable 43% (or 44% on a constant dollar basis) internationally. This performance highlights Lululemon's strong brand appeal and successful international expansion efforts.

Gross profit for the quarter increased by 25% to $1.9 billion, with a gross margin increase of 430 basis points to 59.4%. The adjusted gross margin also saw a 200 basis point increase to the same figure. Income from operations grew by an impressive 191% to $913.9 million, with operating margin expanding significantly to 28.5% from 11.3% in the previous year's fourth quarter. Adjusted income from operations increased by 16%, and the adjusted operating margin saw a 20 basis point increase to 28.5%.

The effective income tax rate for the fourth quarter was 28.1%, compared to 62.3% for the same period in the previous year. Diluted earnings per share (EPS) were reported at $5.29, a substantial increase from $0.94 in the fourth quarter of 2022. Adjusted diluted EPS was $4.40 for the fourth quarter of 2022.

Balance Sheet and Future Outlook

Lululemon ended the fiscal year with $2.2 billion in cash and cash equivalents, a significant increase from $1.2 billion at the end of 2022. Inventories decreased by 9% to $1.3 billion, reflecting efficient inventory management. The company also continued to invest in its growth, opening 56 net new company-operated stores throughout the year.

For the first quarter of 2024, Lululemon anticipates net revenue to be in the range of $2.175 billion to $2.200 billion, with diluted EPS expected to be between $2.35 and $2.40. For the full year 2024, net revenue is projected to be between $10.700 billion and $10.800 billion, representing a growth of 11% to 12%, with diluted EPS forecasted to be in the range of $14.00 to $14.20.

Chief Financial Officer Meghan Frank emphasized the resilience of Lululemon's omni operating model and its differentiated position in the marketplace. The company remains focused on driving business forward while maintaining agility and discipline.

Investor and Analyst Perspectives

Analysts view Lululemon's performance as a testament to its robust business model and ability to innovate and expand in a competitive market. The company's strategic focus on product innovation, guest experience, and market expansion, as outlined in its Power of Three 2 growth plan, is expected to continue driving its success.

Investors are encouraged by Lululemon's strong financial health, as evidenced by its solid balance sheet and cash flow statements. The company's commitment to shareholder value is also reflected in its share repurchase program, with 1.5 million shares repurchased for a cost of $554.6 million in 2023.

As Lululemon continues to execute its growth strategy, including plans to double men's, double e-commerce, and quadruple international net revenue by 2026, the company is well-positioned to maintain its trajectory of growth and profitability in the dynamic retail environment.

For more detailed financial information and to listen to the earnings call, interested parties can visit Lululemon's investor relations website.

Explore the complete 8-K earnings release (here) from Lululemon Athletica Inc for further details.

This article first appeared on GuruFocus.