Lululemon Is Fairly Valued After Double-Digit Drop

Shares of Lululemon Athletica Inc. (NASDAQ:LULU) experienced a nearly 16% drop in a single day after the company released full-year guidance that fell below analysts' expectations on March 21.

However, looking over a broader timeline, the retailer has been a great compounder. Its shareholders have enjoyed a nearly 167% return in the past five years, with a compounded annual return of 22.10%. My analysis shows that after the recent drop, Lululemon is fairly valued.

Growing revenue and profitability with high return on invested capital

The designer and retailer of athletic apparel operates in more than 25 countries in four regional markets: the Americas, China, Asia Pacific and Europe and the Middle East. It sells its products through 711 company-operated stores and its e-commerce platform.

In the fourth quarter of 2023, Lululemon experienced significant growth. Its revenue jumped by 16% to $3.20 billion, driven by a 9% increase in Americas revenue and a substantial 54% surge in international revenue. The company's comparable store sales, which measures organic growth from stores that have been open for at least one year, escalated by 12%. Moreover, the operating income experienced a dramatic increase of 191%, reaching $913.90 million. This resulted in significant expansion in the operating margin, from 11.30% in the prior-year quarter to 28.50%.

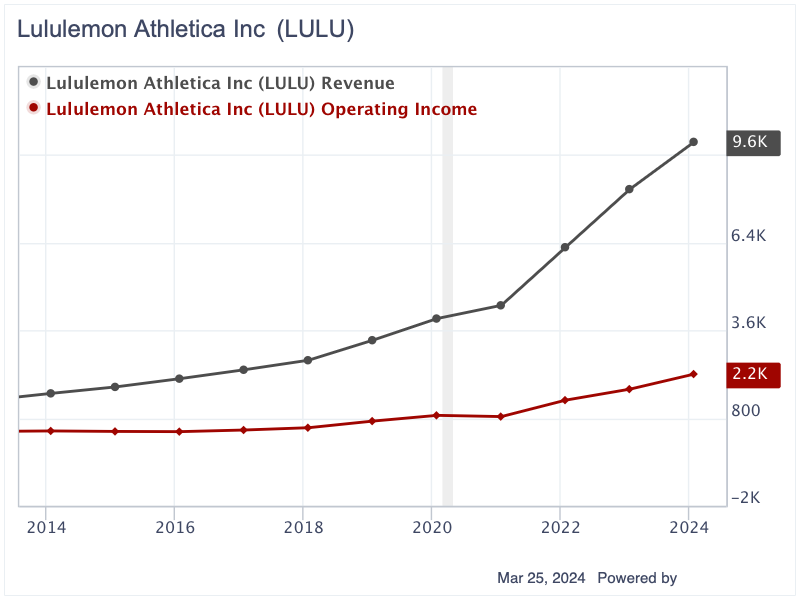

For full-year 2023, Lululemon also achieved exceptional double-digit growth. Total sales rose 19% to $9.60 billion, with a 13% rise in comparable sales. The operating profit gained 64% to reach $2.18 billion. The operating margin improved from 16.40% in 2022 to 22.20% in 2023. Additionally, diluted earnings per share increased 82.60% to $12.20.

Lululemon has managed to grow its revenue consistently year after year over the past decade. Its revenue has risen from $1.59 billion in 2013 to $9.60 billion in 2023. Its operating income also increased from $391.40 million to $2.20 billion over the same period.

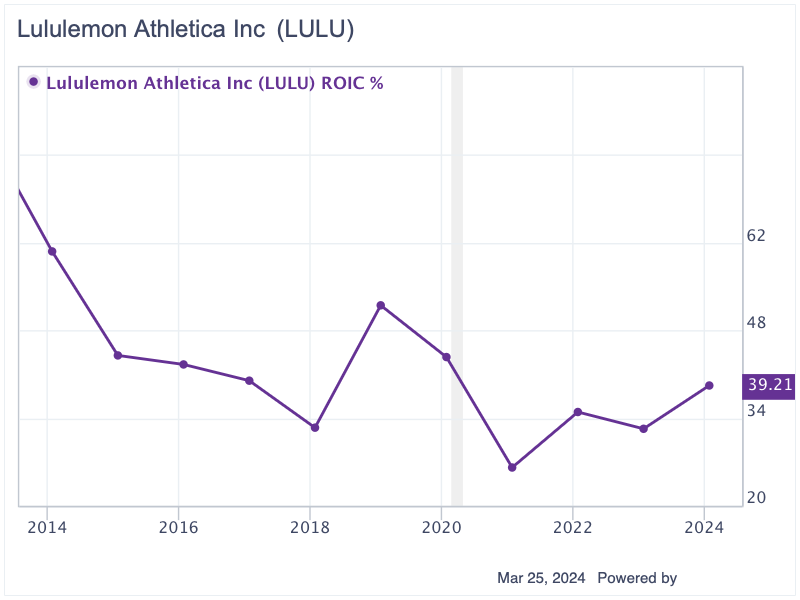

Moreover, investors should be amazed by Lululemon's ability to deliver high returns on invested capital. Since 2013, its ROIC has stayed between 26.15% and 60.61%, settling at 39.21% in 2023. This sustained high ROIC highlights the company's efficient capital management, demonstrating its success in generating significant value for shareholders.

Strong cash flow-generating abilities

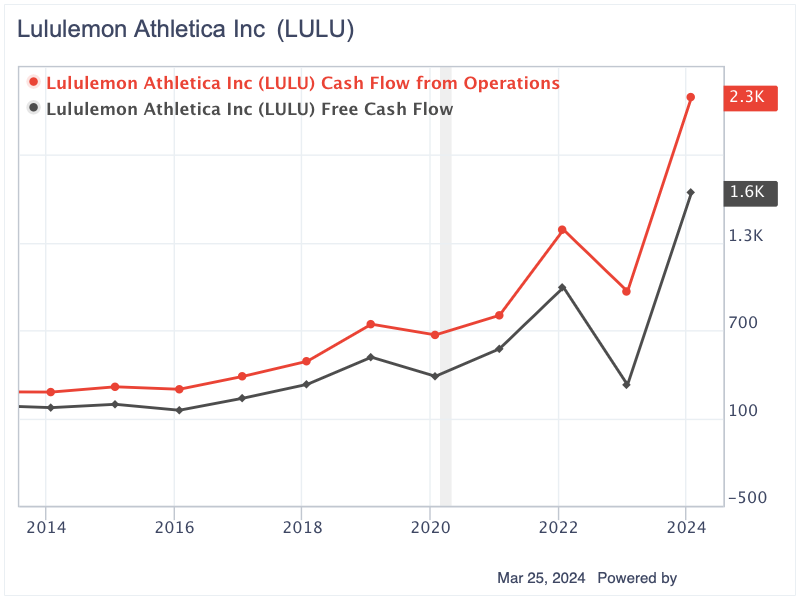

Along with rising revenue and operating income, Lululemon has also demonstrated consistent positive cash flow generation. Its operating cash flow increased from $278.30 million in 2013 to nearly $2.30 billion in 2023, while its free cash flow followed a similar trend, rising from $172 million to $1.64 billion over the same period.

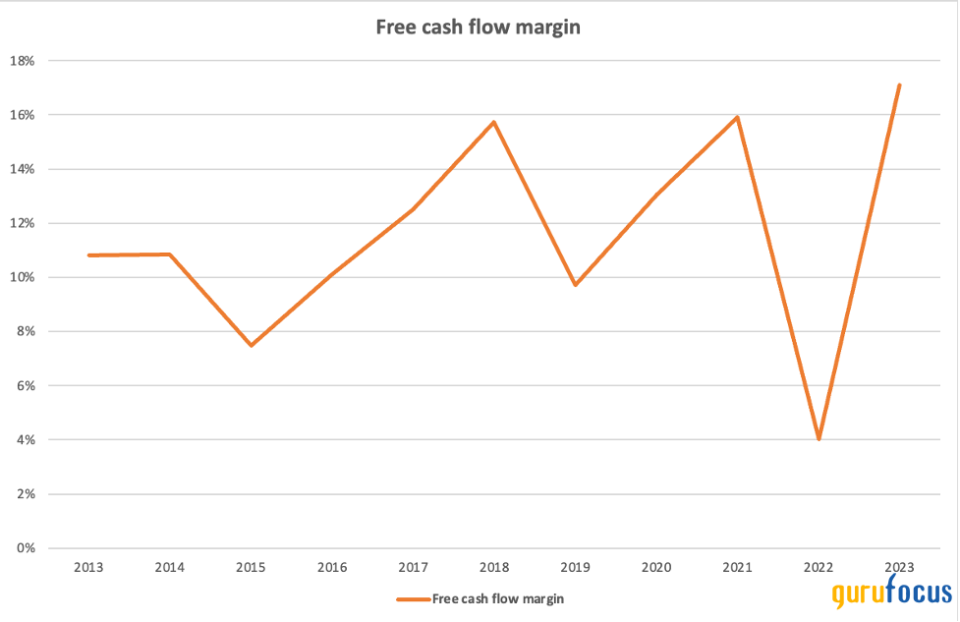

The free cash flow margin of the company, reflecting the proportion of revenue that converts to free cash flow, has fluctuated in the range of 4% and 17%. In 2023, its free cash flow margin reached the 10-year high of 17%. The average margin over the past decade has been approximately 12%.

Source: Author's chart

Solid balance sheet strength

Lululemon has solid balance sheet strength with a conservative capital structure. As of January, it recorded $4.23 billion in shareholders' equity, including more than $2.24 billion in cash and cash equivalents. The company had no interest-bearing debt. The lease liabilities came in at only $1.4 billion. Thus, it had a net cash position of more than $840 million. The debt-to-equity was only 0.33.

With the current net cash position and strong cash flow generation, the company is in a comfortable position to settle its lease obligations in the future.

Fairly valued

In 2024, Lululemon is expected to generate around $10.75 billion in revenue. If the company maintains its revenue growth at a rate of 19.70% over the next five yearssimilar to its revenue growth rate over the past decadeits revenue by 2028 is estimated to reach $22.29 billion. Assuming a consistent 12% free cash flow margin, aligning with its 10-year average, Lululemon's free cash flow is anticipated to be $2.23 billion by 2028. With a free cash flow yield of 3%, the company's enterprise value would be $73.60 billion.

Applying a discount rate of 8%, the present value of Lululemon's enterprise is calculated to be $50 billion. After adjusting for the current net cash position of $840 million, its equity value would be $50.84 billion, or $403 per share, equal to its current trading price. Thus, Lululemon is currently fairly valued.

Conclusion

Over the past decade, Lululemon Athletica has demonstrated outstanding achievements in growing revenue, enhancing profitability, generating strong cash flows, maintaining a solid balance sheet and delivering a high return on invested capital. These factors underline the company's adeptness at navigating the competitive landscape of athletic apparel while consistently creating value for its shareholders. After the recent price drop, the stock appears to be fairly valued currently.

This article first appeared on GuruFocus.