lululemon (LULU) Q4 Earnings Beat Estimates, Sales Rise Y/Y

lululemon athletica inc. LULU reported fourth-quarter fiscal 2021 results, with earnings and revenues improving year over year. The bottom line surpassed the Zacks Consensus Estimate, while the top line missed the same.

lululemon continues to benefit from various consumer trends. In this regard, the company’s athletic apparel category continues to outgrow overall apparel. The company is capitalizing on the importance of both physical retail and the convenience of online engagement. That being said, it continues to grapple with delays across the supply chain, mainly in regard to transporting its products through ocean freight. Incidentally, management is more heavily dependent on air freight. Despite the challenging macro environment, the company successfully achieved its Power of Three growth target before schedule.

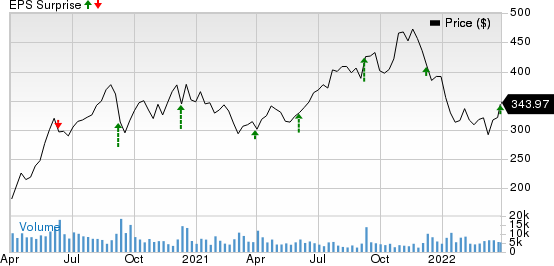

lululemon athletica inc. Price and EPS Surprise

lululemon athletica inc. price-eps-surprise | lululemon athletica inc. Quote

Q4 Numbers

lululemon’s fiscal fourth-quarter adjusted earnings of $3.37 per share beat the Zacks Consensus Estimate of $3.27 and increased 31% from $2.58 reported in the year-ago quarter. The metric improved 22% on a two-year compounded annual growth rate (CAGR) basis.

The Vancouver, Canada-based company’s quarterly revenues advanced 23% year over year to $2,129.1 million but missed the Zacks Consensus Estimate of $2,135 million. On a constant-dollar basis, revenues increased 23%. The company’s net revenues grew 21% in North America, while the same surged 35% internationally. Compared with the fourth quarter of fiscal 2019, net revenues improved 52%, reflecting a two-year CAGR of 23%.

The Zacks Rank #3 (Hold) company’s total comparable sales rose 22% year over year, with a 32% increase in stores and 16% growth from e-commerce. Comparable store sales advanced 32%.

Direct to consumer net revenues climbed 17% (up 16% on constant-dollar basis). Direct to consumer net revenues accounted for 49% of the company’s total net revenues compared with 52% in the fourth quarter of fiscal 2020.

In the company’s store channel, sales increased 47% year over year and 3% on a two-year CAGR basis. Management highlighted that productivity was slightly lower when compared with 2019 levels due to impacts from the Omicron variant that led to greater capacity constraints, restricted staff availability and fewer operating hours across some locations

The company’s e-commerce business delivered an impressive performance, with comps rising 16% year over year. On a two-year CAGR basis, the e-commerce business grew 50%.

Margins

Gross profit improved 22% year over year to $1,236.2 million. However, gross margin contracted 50 basis points (bps) to 58.1%, thanks to escalated air freight expenses. Gross margin expanded 10 bps from the fourth quarter of fiscal 2019. The expansion was a result of leverage on occupancy, product team, depreciation and DC costs. Also, favorable impacts from foreign currency translation were an upside.

Adjusted income from operations jumped 27% year over year to $592.0 million. Adjusted operating margin expanded 90 bps to 27.8%. The metric contracted 200 bps from the fourth quarter of fiscal 2019.

SG&A expenses of nearly $642 million increased from $544.8 million reported in the year-ago quarter. SG&A expenses, as a percentage of net revenues, came in at 30.2%, down from 31.5% reported in the prior-year quarter, owing to leverage in store channel. This was somewhat offset by higher investments in corporate SG&A.

Store Updates

In the fiscal fourth quarter, the company opened 22 stores. As of Jan 30, 2022, it operated 574 stores. Management expects to open five to 10 net new company-operated stores in the first quarter of fiscal 2022. It anticipates opening approximately 70 net new company-operated stores in 2022.

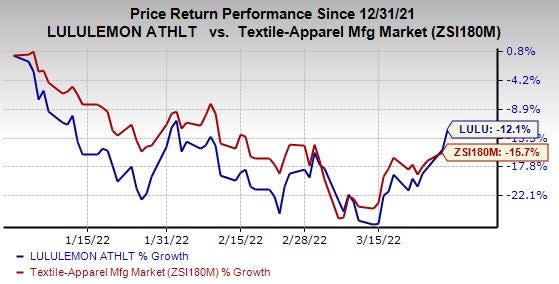

Image Source: Zacks Investment Research

Financials

lululemon exited the quarter with cash and cash equivalents of $1,259.9 million and stockholders’ equity of $2,740 million. At the end of 2021, the company had $397.0 million remaining under its committed revolving credit facility.

At the end of the year, the company’s inventories grew 49% to $966.5 million. On a number of units basis, inventory was up 33%.

In 2021, management repurchased 2.2 million shares for $812.6 million. As of Jan 30, 2022, the company had $187.5 million worth of stocks remaining under its share repurchase program. Management completed the remaining stock repurchases under the program in first-quarter fiscal 2022. On Mar 23, 2022, the company approved a new share buyback plan for up to $1 billion.

Outlook

For the first quarter of fiscal 2022, management anticipates net revenues in the range of $1.525 billion to $1.550 billion, indicating growth of 24-26%. The company expects quarterly gross margin to be down 200-250 bps year over year. Earnings per share (EPS) are projected to be $1.38-$1.43 during the quarter. Management highlighted that its quarterly guidance takes into account adverse impact of almost 300 bps from air freight costs stemming from port congestion and capacity constraints.

For fiscal 2022, net revenues are expected between $7.490 and $7.615 billion, suggesting growth of 20-22%. It anticipates gross margin to contract between 50 bps to 100 bps during fiscal 2022. For the year, EPS is envisioned in the range of $9.15 to $9.35.

The company’s shares have fallen 12.1% in the past three months compared with the industry’s decline of 15.7%.

Eye These Solid Picks

Some better-ranked stocks are Delta Apparel DLA, Gildan Activewear GIL and Columbia Sportswear COLM.

Delta Apparel currently sports a Zacks Rank of 1 (Strong Buy). DLA has a trailing four-quarter earnings surprise of 21.3%, on average. Shares of DLA have increased 0.4% in the past three months. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Delta Apparel's current financial year’s sales and EPS suggests growth of 12.3% and 19.1%, respectively, from the corresponding year-ago period's reported numbers.

Gildan Activewear, presently carries a Zacks Rank #2 (Buy) at present. Shares of Gildan Activewear have decreased 5.9% in the past three months.

The Zacks Consensus Estimate for Gildan Activewear’s 2022 sales and EPS suggests growth of 8.9% and 3.3%, respectively, from the corresponding year-ago reported figures. GIL has a trailing four-quarter earnings surprise of 66.6%, on average.

Columbia Sportswear currently has a Zacks Rank #2. COLM has a trailing four-quarter earnings surprise of 203.3%, on average. Shares of COLM have declined 2.9% in the past three months.

The Zacks Consensus Estimate for Columbia Sportswear's current financial-year sales suggests growth of 17.7% and the same for EPS indicates growth of 8.1% from the respective year-ago period's reported figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Columbia Sportswear Company (COLM) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

Gildan Activewear, Inc. (GIL) : Free Stock Analysis Report

Delta Apparel, Inc. (DLA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research