Lululemon (NASDAQ:LULU) Reports Q4 In Line With Expectations But Stock Drops

Athletic apparel and accessories retailer Lululemon (NASDAQ:LULU) reported results in line with analysts' expectations in Q4 CY2023, with revenue up 15.6% year on year to $3.21 billion. On the other hand, next quarter's revenue guidance of $2.19 billion was less impressive, coming in 3.2% below analysts' estimates. It made a GAAP profit of $5.29 per share, improving from its profit of $0.94 per share in the same quarter last year.

Is now the time to buy Lululemon? Find out by accessing our full research report, it's free.

Lululemon (LULU) Q4 CY2023 Highlights:

Revenue: $3.21 billion vs analyst estimates of $3.20 billion (small beat)

EPS: $5.29 vs analyst estimates of $5.03 (5.1% beat)

Revenue Guidance for Q1 CY2024 is $2.19 billion at the midpoint, below analyst estimates of $2.26 billion

Management's revenue guidance for the upcoming financial year 2024 is $10.75 billion at the midpoint, missing analyst estimates by 1.7% and implying 11.8% growth (vs 19.1% in FY2023)

Gross Margin (GAAP): 59.4%, up from 55.1% in the same quarter last year

Same-Store Sales were up 12% year on year

Market Capitalization: $59.19 billion

Calvin McDonald, Chief Executive Officer, stated: "We are pleased with the strong finish to our 2023 fiscal year and continue to be ahead of our Power of Three ×2 strategy. During the fourth quarter, we saw continued momentum across our channels, geographies, and merchandise categories, driven by our teams around the world. As we step into 2024, we are focused on the significant opportunities ahead for lululemon as we navigate the dynamic retail environment and deliver for guests through innovative new products and brand activations. "

With roots in yoga and hockey, Lululemon (NASDAQ:LULU) is a designer, distributor, and retailer of athletic apparel and accessories for men and women.

Apparel, Accessories and Luxury Goods

Within apparel and accessories, not only do styles change more frequently today than decades past as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel, accessories, and luxury goods companies have made concerted efforts to adapt while those who are slower to move may fall behind.

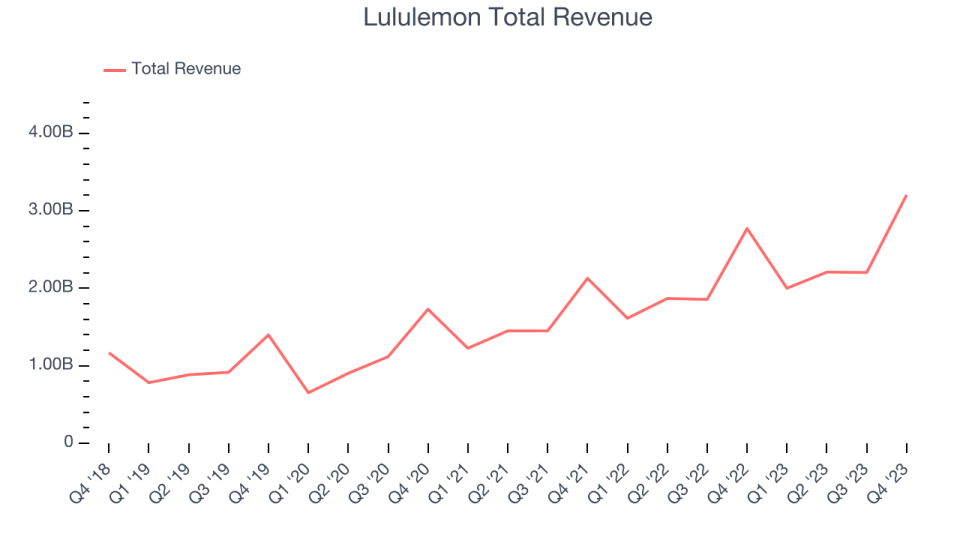

Sales Growth

Examining a company's long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Lululemon's annualized revenue growth rate of 23.9% over the last five years was exceptional for a consumer discretionary business.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Lululemon's annualized revenue growth of 24% over the last two years aligns with its five-year revenue growth, suggesting the company's demand has been stable.

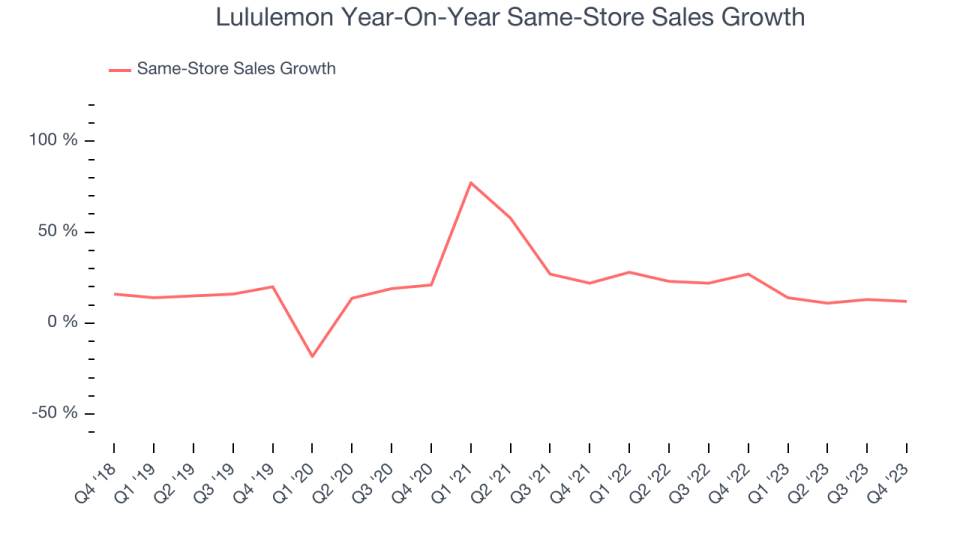

We can dig even further into the company's revenue dynamics by analyzing its same-store sales, which show how much revenue its established locations generate. Over the last two years, Lululemon's same-store sales averaged 18.8% year-on-year growth. Because this number is lower than its revenue growth, we can see the opening of new locations is boosting the company's top-line performance.

This quarter, Lululemon's year-on-year revenue growth clocked in at 15.6%, and its $3.21 billion of revenue was line with Wall Street's estimates. The company is guiding for revenue to rise 9.3% year on year to $2.19 billion next quarter, slowing from the 24% year-on-year increase it recorded in the same quarter last year. Looking ahead, Wall Street expects sales to grow 13.5% over the next 12 months, a deceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

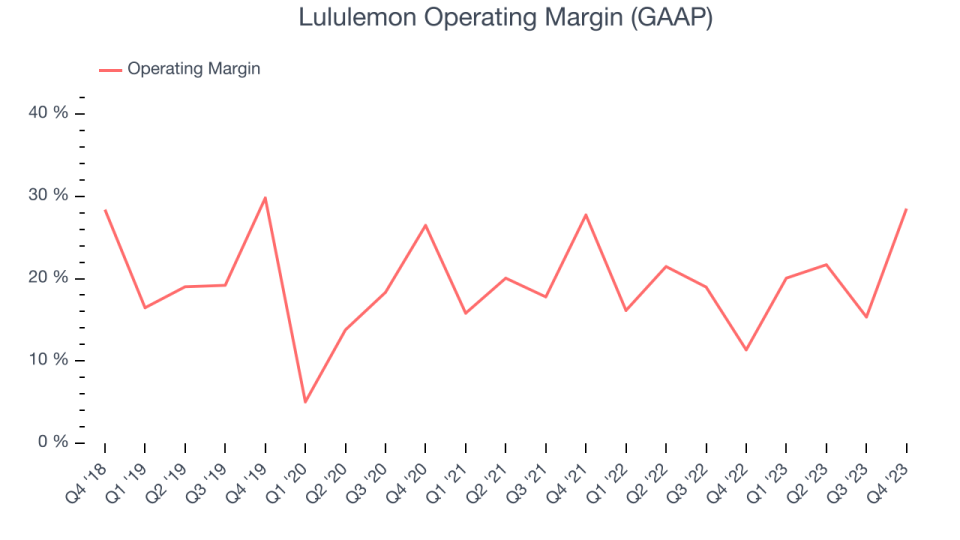

Operating Margin

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Lululemon has been a well-managed company over the last eight quarters. It's demonstrated it can be one of the more profitable businesses in the consumer discretionary sector, boasting an average operating margin of 19.5%.

In Q4, Lululemon generated an operating profit margin of 28.5%, up 17.2 percentage points year on year.

Over the next 12 months, Wall Street expects Lululemon to become more profitable. Analysts are expecting the company’s LTM operating margin of 22.2% to rise to 23.2%.

Key Takeaways from Lululemon's Q4 Results

It was encouraging to see Lululemon slightly top analysts' revenue and EPS expectations this quarter. The company's growth was driven by a 12% increase in its same-store sales, with American stores growing 7% and international stores growing 44% on a constant currency basis. Despite the beats, its full-year revenue and earnings guidance fell short of Wall Street's estimates, causing the stock to drop. The company is down 8.8% on the results and currently trades at $437 per share.

Lululemon may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.