Lumen (LUMN) Q3 Earnings Miss Estimates, Revenues Down Y/Y

Lumen Technologies, Inc LUMN reported adjusted loss per share (excluding special items) of 9 cents for third-quarter 2023 compared with adjusted earnings per share (EPS) of 14 cents per share in the prior-year quarter. The bottom line missed the Zacks Consensus Estimate of 6 cents.

Quarterly total revenues were $3,641 million, down 17.1% year over year on a reported basis and declining 1% on a sequential basis. The Zacks Consensus Estimate is pegged at $3,590.1 million. Revenues in the second quarter were significantly impacted due to the completion of the sale of its Latin America business and its 20-state ILEC business to Apollo.

For the third quarter of 2023, the company's post-closing revenue impact from the actual amount received under the post-closing agreements with the buyers of the divested businesses was $23 million.

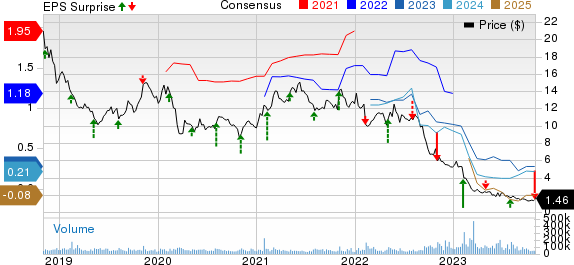

Lumen Technologies, Inc. Price, Consensus and EPS Surprise

Lumen Technologies, Inc. price-consensus-eps-surprise-chart | Lumen Technologies, Inc. Quote

Segment Performance

Lumen has adopted a new reporting structure that has collapsed International and Global Accounts or IGAM and large enterprises into the large enterprise channel. The company has moved the public sector to its separate channel.

By segment, Business revenues fell 10.1% to $2,894 million, affected by the sale of the correctional facilities business. Revenues from Large Enterprise fell 8% to $1,182 million.

Mid-Market Enterprise revenues fell 10% to $498 million. Public Sector revenues were down 3% to $444 million. Total Enterprise Channels’ revenues were down 8% to $2,124 million.

Revenues in Wholesale fell 16% to $770 million. Revenues from Mass Markets declined 36% year over year to $747 million.

Lumen anticipates witnessing healthy momentum in the Quantum business in the upcoming quarters. The company added 19,000 Quantum fiber subscribers, taking the count to 896,000 in the reported quarter.

In the third quarter, total enablements were approximately 141,000. As of Sep 30, 2023, the total enabled locations in the retained states stood at 3.5 million. The company is targeting to exceed 500,000 enabled locations in 2023.

Other Quarterly Details

Total operating expenses increased 14% year over year to $3,418 million.

Operating income was $223 million compared with $1,384 million reported in the year-ago quarter. Adjusted EBITDA (excluding special items) slipped to $1.049 billion from $1.688 billion for respective margins of 28.8% and 38.5%, owing to the negative impact of divestiture-related commercial agreements.

Cash Flow & Liquidity

In the third quarter, Lumen generated $881 million of net cash from operations compared with $1,123 million a year ago.

Free cash flow (excluding cash special items) for the year was $43 million compared with $620 million in the year-ago quarter.

As of Sep 30, 2023, the company had $311 million in cash and cash equivalents with $19,740 million of long-term debt compared with the respective figures of $411 million and $19,899 million as of Jun 30, 2023.

2023 View

For 2023, Lumen expects adjusted EBITDA in the range of $4.6-$4.8 billion. Free cash flow is projected to be between breakeven and $200 million.

Capital expenditures are estimated to be between $2.9 billion and $3.1 billion. The effective income tax rate for the full year is estimated to be nearly 26%.

Zacks Rank & Stocks to Consider

Lumen currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology space are Asure Software ASUR, Synopsys SNPS and Wix.com WIX. Each stock presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Asure Software’s 2023 EPS has increased 5.9% in the past 60 days to 54 cents.

Asure Software’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average being 676.4%. Shares of ASUR have surged 57% in the past year.

The Zacks Consensus Estimate for Synopsys’ 2023 EPS has gained 2.5% in the past 60 days to $11.09. SNPS’ long-term earnings growth rate is 16.4%. Shares of SNPS have surged 62.1% in the past year.

The Zacks Consensus Estimate for Wix’s 2023 EPS has remained unchanged in the past 60 days to $3.35.

Wix’s earnings beat estimates in all the trailing four quarters, delivering an average surprise of 319.3%. Shares of WIX have rallied 4.5% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Synopsys, Inc. (SNPS) : Free Stock Analysis Report

Asure Software Inc (ASUR) : Free Stock Analysis Report

Wix.com Ltd. (WIX) : Free Stock Analysis Report

Lumen Technologies, Inc. (LUMN) : Free Stock Analysis Report