Lumen (LUMN) Sells Some CDN Service Contracts to Akamai

Lumen Technologies LUMN has sold a few of its content delivery network (CDN) service contracts to Akamai Technologies. Both the companies will operate under a transition services agreement for 90 days. Post that period, Lumen plans to discontinue its CDN services. Customers will be able to work with Akamai for all their CDN requirements.

Akamai is a leading provider of CDN services as its platform handles approximately 2 trillion web interactions on a daily basis. Its solutions help customers to address the challenges of bandwidth constraints and Internet traffic along with reducing the need for additional hardware to manage traffic loads.

LUMN continues to simplify its business operations and the sale of CDN contacts is part of that process. The company remains focused on its Quantum Fiber business as well as “cloudifying” network.

Lumen had 877,000 Quantum Fiber subscribers at the end of the second quarter while Quantum Fiber penetration was 26%. Management anticipates adding subscribers at a faster rate in the second half of 2023 driven by increasing investments in quantum marketing. The company also noted that it was well-poised to nearly double its current Quantum Fiber footprint to more than 7 million locations in the next four years.

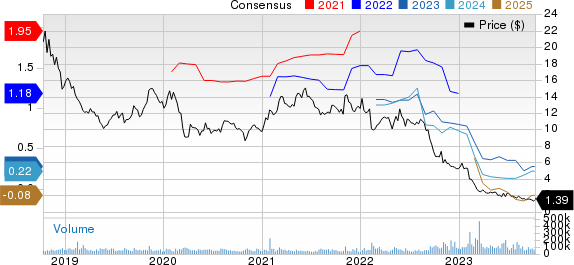

Lumen Technologies, Inc. Price and Consensus

Lumen Technologies, Inc. price-consensus-chart | Lumen Technologies, Inc. Quote

It offers a wide array of integrated services like wholesale network access, high-speed Internet access, managed hosting and colocation services etc. to its business and residential customers.

LUMN has undertaken a business transformation initiative whereby it has shed many non-core businesses to focus only on its robust growth opportunities. In August 2022, it sold its Latin American business to Stonepeak for $2.7 billion. It also completed the $7.5 billion divestiture of its 20-state ILEC business in October 2022. The company offloaded its EMEA business to Colt Technology Services for $1.8 billion in November 2022.

Lumen is working on creating a digital enterprise and adding innovative newer functionalities to the network infrastructure to drive more value for its clientele. As part of this strategy, in June 2023, it collaborated with Google and Microsoft to introduce a network interconnection ecosystem – ExaSwitch. This platform enables organizations with high bandwidth requirements to efficiently route their traffic between networks without the need for third-party intervention.

The ExaSwitch project was initiated by several key participants to facilitate traffic routing between major Internet and cloud networks. The initial adopters include Lumen, Google Cloud, Microsoft Azure and another major cloud provider. This ecosystem will expand as more members join, which makes it easier to automate, boost and effectively manage network capacity between its members.

LUMN currently carries a Zacks Rank #2 (Buy). Shares of the company have lost 79% against the sub-industry’s growth of 28.1% in the past year.

Image Source: Zacks Investment Research

Other Stocks to Consider

Some other top-ranked stocks in the broader technology space are Asure Software ASUR, Synopsys SNPS and VMware VMW. Each stock is sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Asure Software’s 2023 EPS has increased 5.9% in the past 60 days to 54 cents.

Asure Software’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average surprise being 676.4%. Shares of ASUR have surged 78.9% in the past year.

The Zacks Consensus Estimate for Synopsys’ fiscal 2023 EPS has gained 2.5% in the past 60 days to $11.09. SNPS’ long-term earnings growth rate is 16.4%. Shares of SNPS have climbed 77.5% in the past year.

The Zacks Consensus Estimate for VMware’s fiscal 2024 EPS has improved 5.9% in the past 60 days to $7.23.

VMware’s earnings outpaced the Zacks Consensus Estimate in two of the last four quarters, while missing it in the remaining quarters. The average earnings surprise is 1.2%. Shares of VMW have jumped 60.3% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

VMware, Inc. (VMW) : Free Stock Analysis Report

Synopsys, Inc. (SNPS) : Free Stock Analysis Report

Asure Software Inc (ASUR) : Free Stock Analysis Report

Lumen Technologies, Inc. (LUMN) : Free Stock Analysis Report