Lumen Technologies Inc (LUMN) Reports Mixed Financial Results Amid Strategic Shifts

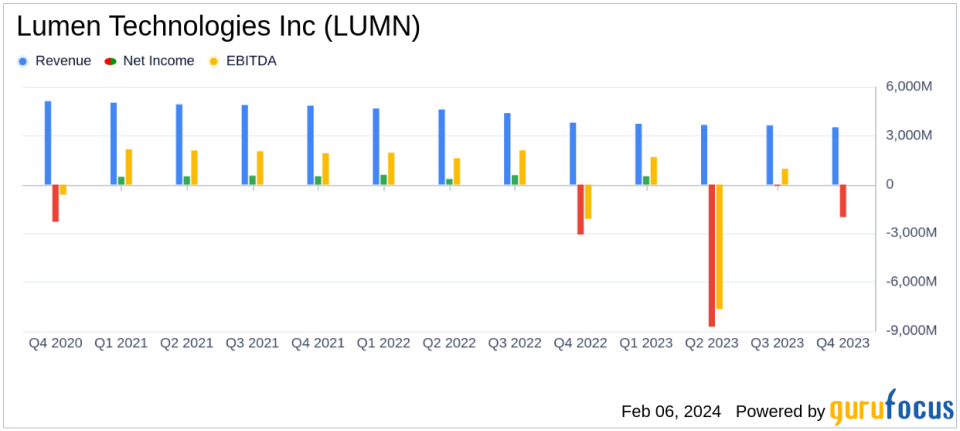

Net Loss: LUMN reported a net loss of $(1.995) billion in Q4 2023, improving from a net loss of $(3.069) billion in Q4 2022.

Revenue: Total revenue declined 7% year-over-year to $3.517 billion in Q4 2023.

Adjusted EBITDA: Adjusted EBITDA, excluding special items, decreased to $1.099 billion in Q4 2023 from $1.393 billion in Q4 2022.

Free Cash Flow: Free cash flow, excluding special items, was $50 million in Q4 2023, down from $126 million in the same period last year.

Debt Reduction: Net debt was reduced by $1.6 billion over the full year 2023.

Diluted EPS: Excluding special items, diluted earnings per share was $0.08 for Q4 2023, compared to $0.43 for Q4 2022.

Divestitures: The company completed the $1.8 billion divestiture of its EMEA business and the sale of select CDN contracts.

Lumen Technologies Inc (NYSE:LUMN) released its 8-K filing on February 6, 2024, disclosing its financial results for the fourth quarter and full year of 2023. The company, a major telecommunications carrier with a vast fiber network, is undergoing a strategic shift towards enterprise services, which now constitute nearly 80% of its revenue. Despite a challenging year, LUMN has made strides in reducing its net debt and divesting non-core businesses.

Financial Performance and Challenges

LUMN faced a net loss of $(1.995) billion in the fourth quarter of 2023, which included a substantial non-cash goodwill impairment charge of $1.9 billion. This impairment reflects the difference between the company's market capitalization and the carrying value of certain reporting units. Despite this, the net loss improved compared to the $(3.069) billion loss in the same quarter of the previous year, which included a higher goodwill impairment charge of $3.271 billion.

The company's revenue declined by 7% year-over-year to $3.517 billion in the fourth quarter, and by 17% to $14.557 billion for the full year. Adjusted EBITDA, excluding special items, also saw a decrease to $1.099 billion in Q4 2023 from $1.393 billion in Q4 2022. This decline in revenue and EBITDA is significant as it indicates the challenges LUMN faces in a competitive and rapidly evolving telecommunications industry.

Financial Achievements and Industry Impact

Despite the reported net loss, LUMN achieved a reduction in net debt by $1.6 billion over the full year, which is a critical step towards improving the company's balance sheet. This debt reduction is particularly important for telecommunications companies, which typically carry high levels of debt due to the capital-intensive nature of the industry.

Additionally, the company's divestiture of its EMEA business for $1.8 billion and the sale of select CDN contracts are part of its strategy to streamline operations and focus on core areas of growth. These divestitures allow LUMN to concentrate resources on its enterprise services, which are more aligned with the company's strategic direction.

Key Financial Metrics and Commentary

President and CEO Kate Johnson commented on the company's strategic priorities and financial guidance, stating,

In 2023, we outlined big, multi-year, strategic priorities including strengthening our balance sheet, executing on key programs to turn the core business around by 2025, and igniting new growth by delivering disruptive innovations that help our customers solve their next-gen networking needs. I am pleased to report that we delivered our 2023 EBITDA and free cash flow guidance, and we made material progress on our strategic priorities."

Free cash flow, excluding special items, was $50 million in the fourth quarter, a decrease from $126 million in the same period last year. This metric is crucial as it reflects the company's ability to generate cash to service debt and fund operations.

2024 Financial Outlook

LUMN provided its financial outlook for 2024, projecting Adjusted EBITDA to be between $4.1 to $4.3 billion and free cash flow to range from $100 to $300 million. These projections are essential for investors as they set expectations for the company's performance in the coming year.

In conclusion, LUMN's latest earnings report reflects a company in transition, facing significant challenges but also making strategic moves to position itself for future growth. The reduction in net debt and the focus on enterprise services are positive steps, but the decline in revenue and EBITDA highlights the competitive pressures in the telecommunications sector. Investors and potential GuruFocus.com members should monitor LUMN's progress on its strategic initiatives and its ability to adapt to industry changes.

Explore the complete 8-K earnings release (here) from Lumen Technologies Inc for further details.

This article first appeared on GuruFocus.