Luxor Capital Group, LP Adjusts Stake in Five Point Holdings LLC

Overview of Luxor Capital's Recent Trade

On November 14, 2023, Luxor Capital Group, LP (Trades, Portfolio) made a notable adjustment to its investment in Five Point Holdings LLC (NYSE:FPH), a company specializing in the development of mixed-use, master-planned communities. The firm reduced its position by 14,500 shares, resulting in a share change of -0.12%. This transaction occurred at a trade price of $2.59, leaving Luxor Capital Group, LP (Trades, Portfolio) with a total of 12,405,536 shares in the company. Despite this reduction, Five Point Holdings LLC still represents 0.64% of Luxor Capital's portfolio, with the firm holding a significant 17.92% of the traded company's stock.

Insight into Luxor Capital Group, LP (Trades, Portfolio)

Luxor Capital Group, LP (Trades, Portfolio), based in New York, is a firm recognized for its expertise in the market. With an investment philosophy that emphasizes value, the firm manages a diverse portfolio comprising 42 stocks. Its top holdings include Liberty Global PLC(NASDAQ:LBTYA), Pegasystems Inc(NASDAQ:PEGA), and Ally Financial Inc(NYSE:ALLY), with a strong focus on the Communication Services and Financial Services sectors. Luxor Capital Group, LP (Trades, Portfolio) oversees an equity portfolio valued at approximately $5.01 billion.

Five Point Holdings LLC at a Glance

Five Point Holdings LLC, trading under the symbol FPH in the USA, went public on May 10, 2017. The company's business model revolves around the ownership and development of large-scale, mixed-use communities that integrate residential, commercial, and recreational spaces. Its primary revenue is generated from the Great Park segment, which is centered around the development of the Orange County Great Park in California.

Financial and Market Position of Five Point Holdings LLC

With a market capitalization of $176.652 million and a current stock price of $2.5519, Five Point Holdings LLC is considered modestly undervalued according to GF Valuation, with a GF Value of $3.13. The stock's price to GF Value ratio stands at 0.82, and it has a PE percentage of 5.00. However, the stock has experienced a decline of 1.47% since the transaction date and a significant drop of 83.21% since its IPO. Year-to-date, the stock has seen an increase of 10.95%.

Impact of Luxor Capital's Holdings in Five Point Holdings LLC

After the recent transaction, Luxor Capital Group, LP (Trades, Portfolio)'s holding in Five Point Holdings LLC remains substantial, with over 12 million shares. This stake constitutes a significant portion of both the firm's portfolio and the company's available stock, indicating Luxor Capital's continued confidence in the long-term value of Five Point Holdings LLC.

Performance Indicators for Five Point Holdings LLC

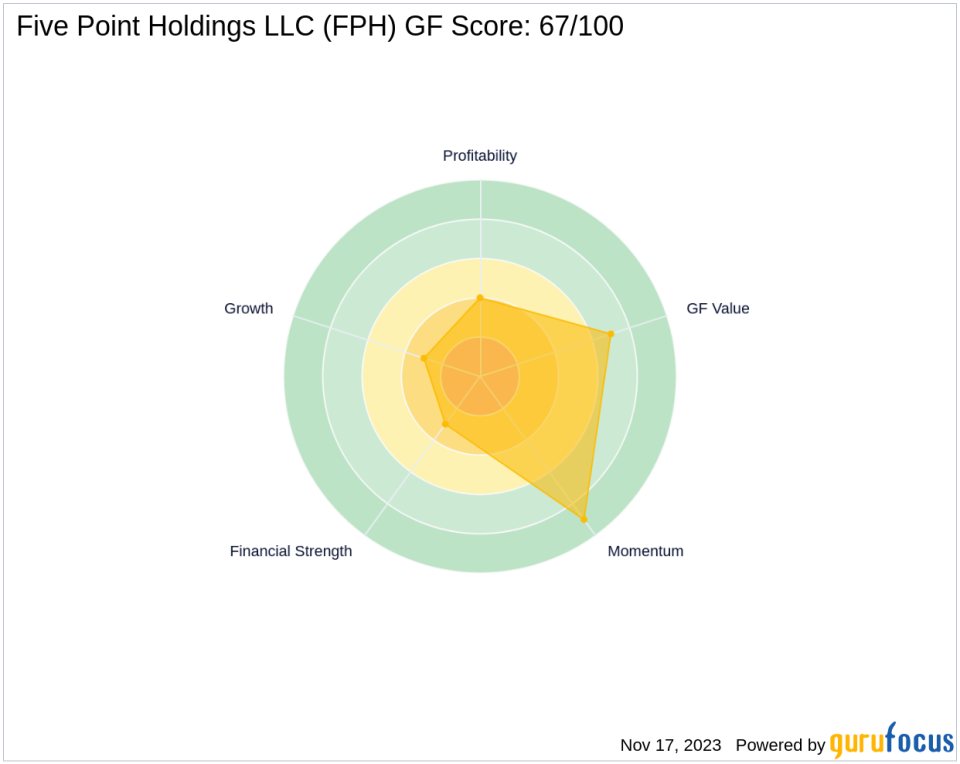

Five Point Holdings LLC has a GF Score of 67/100, suggesting a potential for poor future performance. The company's Financial Strength is rated at 3/10, with a Profitability Rank of 4/10 and a Growth Rank of 3/10. The GF Value Rank stands at 7/10, while the Momentum Rank is high at 9/10, indicating recent positive price movements.

Comparing Luxor Capital with the Largest Guru Shareholder

The largest guru shareholder in Five Point Holdings LLC is Third Avenue Management (Trades, Portfolio). However, the specific share percentage held by this firm is not provided. Luxor Capital Group, LP (Trades, Portfolio)'s position, while recently reduced, still represents a significant stake when compared to other investors in the company.

Market Reaction and Prospects for Five Point Holdings LLC

Since Luxor Capital Group, LP (Trades, Portfolio)'s transaction, the stock price of Five Point Holdings LLC has slightly decreased. The stock's momentum and the high Momentum Rank suggest that there may be potential for future price increases, although the overall performance indicators present a mixed outlook. Investors will be watching closely to see how Luxor Capital Group, LP (Trades, Portfolio)'s investment decisions influence the market and whether Five Point Holdings LLC can improve its financial and growth metrics moving forward.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.