Luxor Capital Group, LP Reduces Stake in Five Point Holdings LLC

On September 22, 2023, Luxor Capital Group, LP (Trades, Portfolio) executed a significant transaction involving Five Point Holdings LLC (NYSE:FPH). The firm reduced its stake in the company, selling off 37,456 shares at a trading price of $2.92 per share. This article provides an in-depth analysis of the transaction, the profiles of both Luxor Capital Group, LP (Trades, Portfolio) and Five Point Holdings LLC, and the potential implications of this move on the market.

Details of the Transaction

The transaction saw Luxor Capital Group, LP (Trades, Portfolio) reduce its holdings in Five Point Holdings LLC by 0.30%, leaving the firm with a total of 12,470,536 shares in the company. This move had no significant impact on the firm's portfolio, with the position in Five Point Holdings LLC now accounting for 0.73% of its total holdings. Despite the reduction, Luxor Capital Group, LP (Trades, Portfolio) still holds a significant 18.02% stake in Five Point Holdings LLC.

Profile of Luxor Capital Group, LP (Trades, Portfolio)

Luxor Capital Group, LP (Trades, Portfolio), based at 1114 Avenue of the Americas, New York, NY, is a firm with a diverse investment portfolio. As of the date of the transaction, the firm held stocks in 42 different companies, with a total equity of $5.01 billion. Its top holdings include Liberty Global PLC (NASDAQ:LBTYA), Liberty Global PLC (NASDAQ:LBTYK), Pegasystems Inc (NASDAQ:PEGA), Triumph Financial Inc (NASDAQ:TFIN), and Ally Financial Inc (NYSE:ALLY). The firm's investments are primarily concentrated in the Communication Services and Financial Services sectors.

Overview of Five Point Holdings LLC

Five Point Holdings LLC, a US-based company, is a leading developer of mixed-use, master-planned communities in California. The company's business segments include Valencia, San Francisco, Great Park, and Commercial. The Great Park segment, which is centered around the development of the Orange County Great Park, contributes the most to the company's revenue. As of the transaction date, the company had a market capitalization of $205.594 million and a stock price of $2.97. The company's PE percentage stood at 8.25, indicating its profitability.

Analysis of Five Point Holdings LLC's Stock

According to GuruFocus, Five Point Holdings LLC's stock is significantly overvalued, with a GF Value of 2.08 and a Price to GF Value ratio of 1.43. Since the transaction, the stock has gained 1.71%, but it has lost 80.46% of its value since its IPO in 2017. However, the stock has seen a year-to-date gain of 29.13%.

Evaluation of Five Point Holdings LLC's Performance

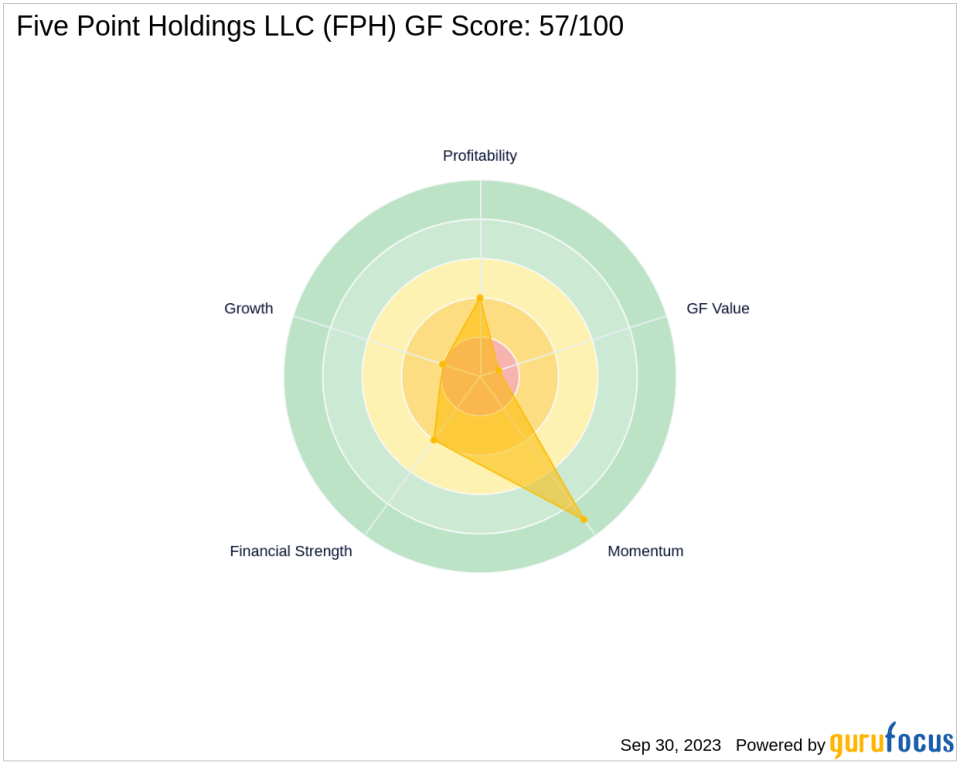

Five Point Holdings LLC has a GF Score of 57/100, indicating poor future performance potential. The company's Balance Sheet Rank is 4/10, its Profitability Rank is 4/10, and its Growth Rank is 2/10. The company's Piotroski F-Score is 4, and its Altman Z score is 1.13, indicating potential financial distress. The company's Cash to Debt ratio is 0.31, ranking it 811th in the industry.

Industry Context and Comparison

In the Real Estate industry, Five Point Holdings LLC has a Return on Equity (ROE) of 4.19 and a Return on Assets (ROA) of 0.90, ranking it 766th and 959th respectively. The company's Gross Margin Growth is 4.80, but its Operating Margin Growth is 0.00. Over the past three years, the company's revenue has declined by 21.00%, and its EBITDA has declined by 17.20%.

Conclusion

In conclusion, Luxor Capital Group, LP (Trades, Portfolio)'s decision to reduce its stake in Five Point Holdings LLC is a significant move that could have implications for both the firm and the traded company. Despite the reduction, Luxor Capital Group, LP (Trades, Portfolio) still holds a substantial stake in Five Point Holdings LLC. The transaction, coupled with Five Point Holdings LLC's performance and industry context, provides valuable insights for investors and market watchers alike.

This article first appeared on GuruFocus.