Luxor Capital Group, LP Reduces Stake in Five Point Holdings LLC

On October 2, 2023, Luxor Capital Group, LP (Trades, Portfolio) executed a significant transaction involving Five Point Holdings LLC (NYSE:FPH), a prominent developer of mixed-use, master-planned communities in California. This article provides an in-depth analysis of the transaction, the profiles of both Luxor Capital Group, LP (Trades, Portfolio) and Five Point Holdings LLC, and the potential implications of the transaction on the stock market.

Details of the Transaction

Luxor Capital Group, LP (Trades, Portfolio) reduced its stake in Five Point Holdings LLC by 45,500 shares, resulting in a total holding of 12,425,036 shares. The transaction, which occurred at a trade price of $2.93 per share, had a negligible impact on the firm's portfolio. However, it did result in Luxor Capital Group, LP (Trades, Portfolio) holding a significant 17.95% of Five Point Holdings LLC's traded stock.

Profile of Luxor Capital Group, LP (Trades, Portfolio)

Luxor Capital Group, LP (Trades, Portfolio), based at 1114 Avenue of the Americas, New York, NY, is a firm with a diverse portfolio of 42 stocks. The firm's top holdings include Liberty Global PLC(NASDAQ:LBTYA), Liberty Global PLC(NASDAQ:LBTYK), Pegasystems Inc(NASDAQ:PEGA), Triumph Financial Inc(NASDAQ:TFIN), and Ally Financial Inc(NYSE:ALLY). With an equity of $5.01 billion, the firm's top sectors are Communication Services and Financial Services.

Overview of Five Point Holdings LLC

Five Point Holdings LLC, a US-based company, specializes in the development of new communities that include commercial, retail, educational, and recreational elements. The company's four reportable segments are Valencia, San Francisco, Great Park, and Commercial. With a market capitalization of $188.288 million, the company's stock is currently priced at $2.72. However, according to GuruFocus's GF Valuation, the stock is significantly overvalued with a GF Value of $2.07.

Performance of Five Point Holdings LLC's Stock

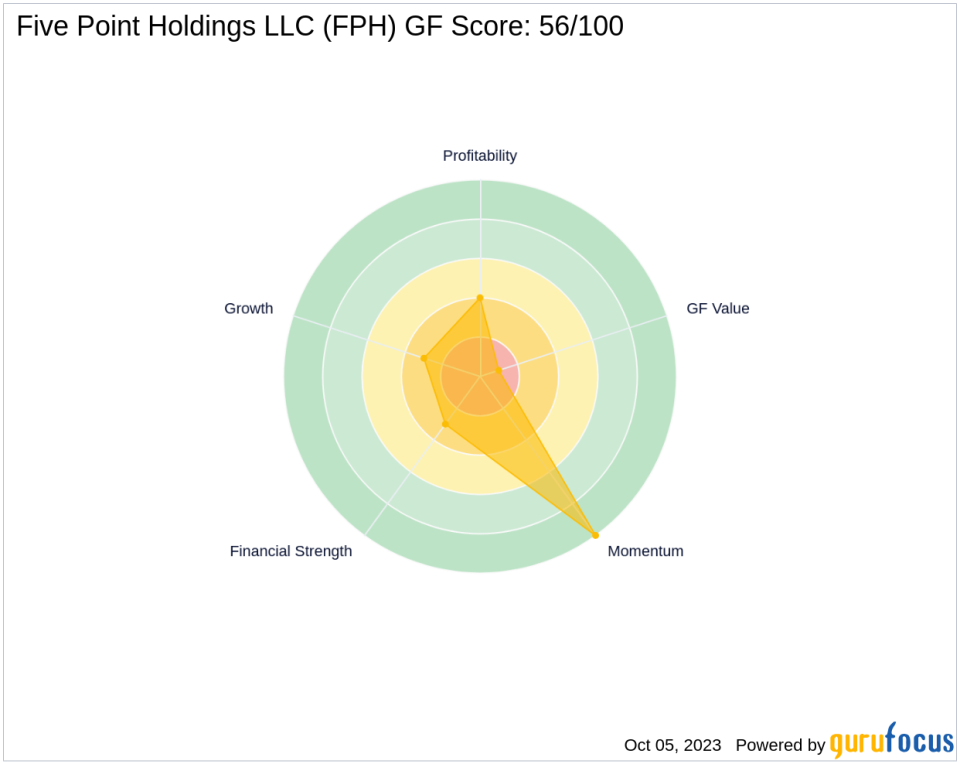

Since its Initial Public Offering (IPO) on May 10, 2017, Five Point Holdings LLC's stock has experienced a significant decrease of 82.11%. However, the stock has gained 18.26% year-to-date (YTD). The stock's GF Score is 56/100, indicating poor future performance potential. The company's Financial Strength is ranked 3/10, its Profitability Rank is 4/10, and its Growth Rank is 3/10.

Financial Health of Five Point Holdings LLC

Five Point Holdings LLC's financial health is characterized by a cash to debt ratio of 0.31, a Return on Equity (ROE) of 4.19, and a Return on Assets (ROA) of 0.90. The company's gross margin growth is 4.80, while its operating margin growth and three-year revenue growth are both at 0.00. The company's Piotroski F-Score is 4, and its Altman Z score is 1.12.

Momentum of Five Point Holdings LLC's Stock

The stock's Relative Strength Index (RSI) for 5 days, 9 days, and 14 days are 30.14, 34.54, and 38.28 respectively. The stock's momentum index for 6 - 1 month and 12 - 1 month are 27.43 and 15.27 respectively.

Largest Guru Holder of Five Point Holdings LLC's Stock

The largest guru holder of Five Point Holdings LLC's stock is Third Avenue Management (Trades, Portfolio). However, the exact share percentage held by Third Avenue Management (Trades, Portfolio) is currently not available.

In conclusion, Luxor Capital Group, LP (Trades, Portfolio)'s recent transaction involving Five Point Holdings LLC's stock is a significant event that could potentially influence the stock's performance and the firm's portfolio. As of October 5, 2023, all data and rankings are accurate and are based on the provided relative data.

This article first appeared on GuruFocus.