LXP Industrial Trust Reports Growth in Industrial Same-Store NOI and Robust Leasing Activity

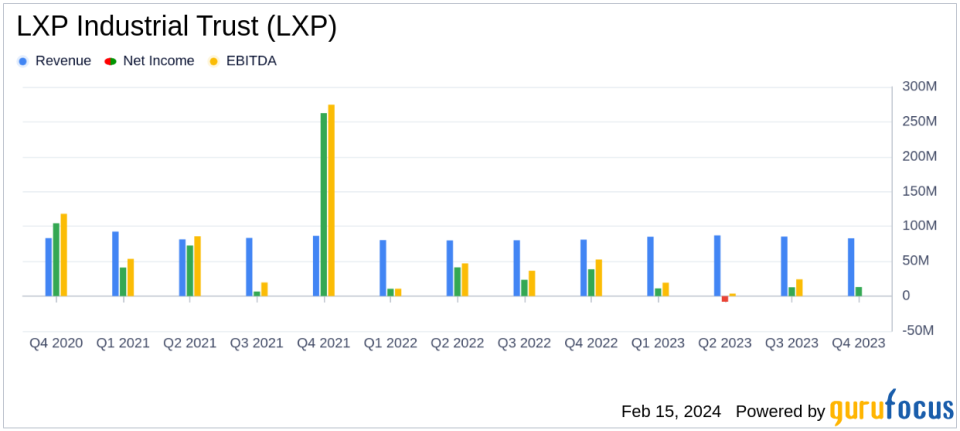

Net Income: $13.0 million for Q4 and $23.9 million for the full year 2023.

Adjusted Company FFO: $51.4 million for Q4, maintaining $0.17 per diluted share as in Q4 2022.

Industrial Same-Store NOI: Increased by 4.1% in 2023 compared to 2022.

Leasing Activity: Completed 6.8 million square feet of new leases and lease extensions in 2023.

Rental Increases: Base and Cash Base Rents increased by 40.1% and 27.0%, respectively, in 2023.

Balance Sheet Strengthening: Extended $300.0 million term loan to January 31, 2027, and issued $300.0 million of 6.75% Senior Notes due 2028.

Development Investments: Invested $122.1 million in development activities, with several projects completed or underway.

LXP Industrial Trust (NYSE:LXP), a leading real estate investment trust specializing in single-tenant industrial properties, announced its fourth quarter and full-year 2023 results on February 15, 2024. The company released its earnings through an 8-K filing, detailing a period of significant growth and operational success.

Company Overview

LXP Industrial Trust is a real estate investment trust that focuses on the ownership of equity and debt investments in single-tenant properties and land across the United States. The company primarily generates revenue through rental income, leveraging a portfolio that includes warehouse and distribution facilities in key markets.

Performance Highlights and Challenges

The fourth quarter saw LXP record a net income of $13.0 million, or $0.04 per diluted common share, a decrease from the $36.9 million, or $0.13 per diluted share, reported in the same quarter of the previous year. Despite this decline in net income, the company's Adjusted Company FFO remained stable at $51.4 million, or $0.17 per diluted share. The consistent FFO performance is crucial for investors, as it reflects the company's ongoing ability to generate cash flow from its operations.

One of the key achievements for LXP was the increase in Industrial Same-Store NOI by 4.1% in 2023 compared to 2022. This growth is significant as it indicates the company's success in enhancing the profitability of its existing property portfolio. Additionally, LXP completed 6.8 million square feet of new leases and lease extensions throughout the year, with Base and Cash Base Rents increasing by 40.1% and 27.0%, respectively. These rental increases are important as they demonstrate LXP's ability to capitalize on market conditions to improve its revenue streams.

However, the company also faced challenges, including a competitive market for industrial properties and the ongoing need to invest in development to sustain growth. These challenges could impact LXP's future performance if not managed effectively.

Financial Achievements and Industry Significance

LXP's financial achievements, such as the extension of its $300.0 million term loan and the issuance of $300.0 million in senior notes, are important as they improve the company's debt maturity profile and enhance financial flexibility. For a REIT like LXP, maintaining a strong balance sheet is critical for supporting continued investment in property acquisitions and development projects.

The company's investment of $122.1 million in development activities, including the completion of several warehouse/distribution facilities, positions LXP for future growth. These investments are vital in the REIT industry, where the ability to offer modern and strategically located industrial facilities can attract high-quality tenants and secure long-term leases.

Financial Tables and Analysis

For the full year 2023, LXP reported total gross revenues of $83.0 million for the fourth quarter, up from $81.1 million in the prior year's quarter. The increase was primarily due to revenue from acquisitions, market rent increases, and stabilized development projects, partially offset by sales.

The balance sheet reflects a solid financial position, with total consolidated debt of $1.8 billion at the end of the quarter, 92.8% of which was at fixed rates. The weighted-average term to maturity was 5.8 years, with a weighted-average interest rate of 3.9%. These figures underscore LXP's strategic approach to managing its debt obligations and interest rate exposure.

Looking ahead, LXP estimates net income attributable to common shareholders for the year ending December 31, 2024, to be in the range of $(0.02) to $0.02 per diluted common share, with Adjusted Company FFO expected to be between $0.61 to $0.65 per diluted common share.

In summary, LXP Industrial Trust's fourth quarter and full-year 2023 results demonstrate a company that is effectively managing its portfolio and finances to capitalize on the strong demand for industrial properties. The company's strategic investments and robust leasing activity bode well for its future performance, making it a potentially attractive option for value investors.

Explore the complete 8-K earnings release (here) from LXP Industrial Trust for further details.

This article first appeared on GuruFocus.