Lycopodium (ASX:LYL) Has Announced That It Will Be Increasing Its Dividend To A$0.45

Lycopodium Limited (ASX:LYL) has announced that it will be increasing its dividend from last year's comparable payment on the 6th of October to A$0.45. This makes the dividend yield 8.9%, which is above the industry average.

View our latest analysis for Lycopodium

Lycopodium's Dividend Is Well Covered By Earnings

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Based on the last dividend, Lycopodium is earning enough to cover the payment, but then it makes up 249% of cash flows. While the company may be more focused on returning cash to shareholders than growing the business at this time, we think that a cash payout ratio this high might expose the dividend to being cut if the business ran into some challenges.

If the trend of the last few years continues, EPS will grow by 20.4% over the next 12 months. Assuming the dividend continues along recent trends, we think the payout ratio could be 65% by next year, which is in a pretty sustainable range.

Dividend Volatility

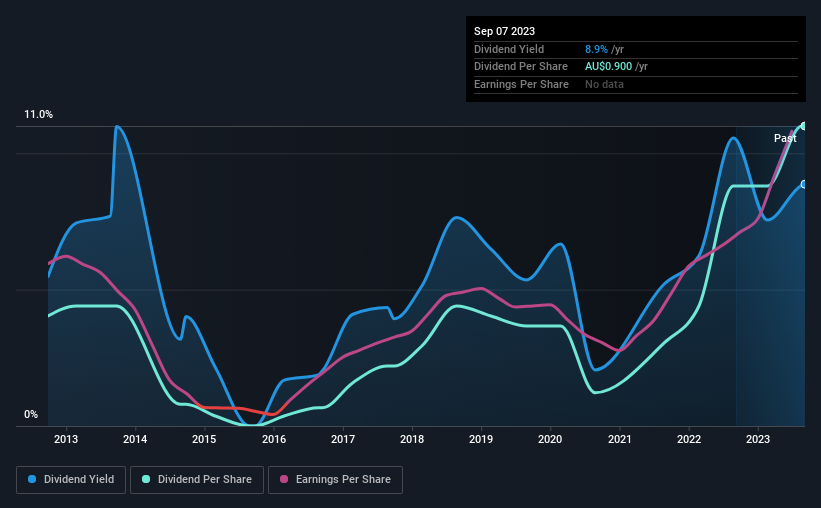

Although the company has a long dividend history, it has been cut at least once in the last 10 years. The dividend has gone from an annual total of A$0.33 in 2013 to the most recent total annual payment of A$0.90. This means that it has been growing its distributions at 11% per annum over that time. Dividends have grown rapidly over this time, but with cuts in the past we are not certain that this stock will be a reliable source of income in the future.

The Dividend Looks Likely To Grow

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. It's encouraging to see that Lycopodium has been growing its earnings per share at 20% a year over the past five years. Lycopodium is clearly able to grow rapidly while still returning cash to shareholders, positioning it to become a strong dividend payer in the future.

Our Thoughts On Lycopodium's Dividend

Overall, we always like to see the dividend being raised, but we don't think Lycopodium will make a great income stock. While Lycopodium is earning enough to cover the payments, the cash flows are lacking. This company is not in the top tier of income providing stocks.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. As an example, we've identified 1 warning sign for Lycopodium that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.