Lyft (LYFT) Plans to Rent Out Its Office Space in Four Cities

With majority of its employees opting for flexible working arrangements or continuing to work from home, Lyft Inc. LYFT is planning to rent out nearly half of its corporate office spaces in four cities, namely San Francisco, New York City, Nashville and Seattle. Per a recent report, the company plans to put 275,000 of 615,000 square feet on the sublease market.

Lyft is expected to commence its subleasing efforts this week, with plans to rent entire floors to others while maintaining separate entries for its own staff and operations.

Notably, in March, the company made an announcement related to shifting to a “fully flexible workplace” for its roughly 4,000 employees.

Rachel Goldstein, a Lyft vice president, stated, “While we continue to believe that in-person connections are important, many of our team members opted to work remotely after we shifted to a flexible workplace strategy.”

We believe the aforementioned move came up on the back of Lyft’s cost-cutting initiatives and reduced hiring. Last month, Lyft laid off about 60 employees and folded its car-rental business for riders.

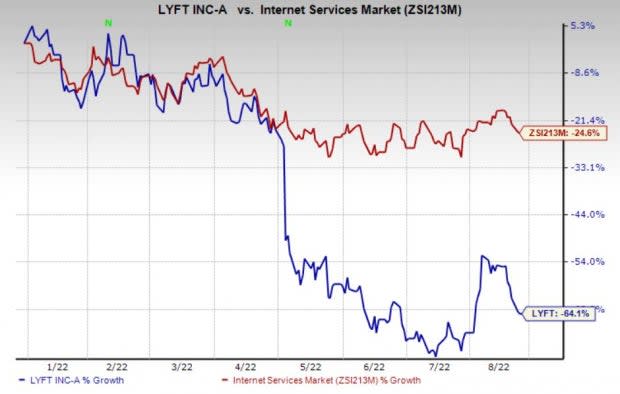

So far this year, shares of Lyft have declined 64.1% compared with the industry’s loss of 24.6%.

Image Source: Zacks Investment Research

Zacks Rank and Stocks to Consider

Currently, Lyft carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some better-ranked stocks in the broader Zacks Transportation sector that investors can consider are GATX Corporation GATX, Triton International Limited TRTN and Teekay Tankers Ltd. TNK, each carrying a Zacks Rank #2 (Buy).

GATX Corporation has an expected earnings growth rate of 17.8% for the current year. GATX delivered a trailing four-quarter earnings surprise of 28.9%, on average.

The Zacks Consensus Estimate for GATX’s current-year earnings has improved 2.1% over the past 90 days. Shares of GATX have gained 16% over the past year.

Triton has an expected earnings growth rate of 22.4% for the current year. TRTN delivered a trailing four-quarter earnings surprise of 7.5%, on average.

The Zacks Consensus Estimate for TRTN’s current-year earnings has improved 4.2% over the past 90 days. Shares of TRTN have gained 21.5% over the past year.

Teekay Tankers has an expected earnings growth rate of 140.1% for the current year. TNK delivered a trailing four-quarter earnings surprise of 46.1%, on average.

The Zacks Consensus Estimate for TNK’s current-year earnings has improved more than 100% over the past 90 days. Shares of TNK have gained 122.6% over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Teekay Tankers Ltd. (TNK) : Free Stock Analysis Report

GATX Corporation (GATX) : Free Stock Analysis Report

Triton International Limited (TRTN) : Free Stock Analysis Report

Lyft, Inc. (LYFT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research