LyondellBasell Industries NV Reports Resilient 2023 Earnings Amid Market Challenges

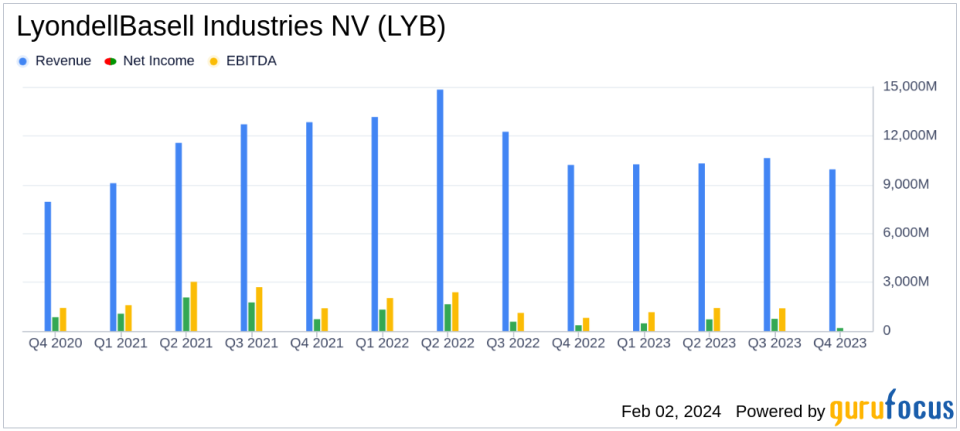

Net Income: $2.1 billion for the full year, $185 million for Q4.

Diluted Earnings Per Share (EPS): $6.46 for the full year, $0.56 for Q4.

EBITDA: $4.5 billion for the full year, $639 million for Q4.

Cash from Operating Activities: $4.9 billion for the full year, showcasing a 98% cash conversion rate.

Dividends and Share Repurchases: Returned $1.8 billion to shareholders.

Strategic Moves: Divestiture of Ethylene Oxide and Derivatives business and investment in Saudi Arabian joint venture.

Capital Investments: $1.5 billion reinvested in the business.

On February 2, 2024, LyondellBasell Industries NV (NYSE:LYB) released its 8-K filing, detailing the company's financial performance for the fourth quarter and full year of 2023. LyondellBasell, a global leader in the petrochemical industry, reported net income of $185 million for the fourth quarter and $2.1 billion for the full year. The company's diluted earnings per share stood at $0.56 for the quarter and $6.46 for the year, with EBITDA reaching $639 million and $4.5 billion, respectively.

LyondellBasell's operations span across the United States, Europe, and Asia, with a significant portion of its production coming from North America. As the world's largest producer of polypropylene and a major producer of polyethylene and propylene oxide, its chemicals are integral to a variety of consumer and industrial products.

The company's performance in 2023 was marked by resilience in the face of bottoming markets. Despite challenges such as soft global demand, capacity additions, and economic uncertainty, LyondellBasell generated $4.9 billion in cash from operating activities, achieving a 98% cash conversion rate. This robust cash flow underlines the company's operational efficiency and its ability to generate liquidity from its earnings.

LyondellBasell's financial achievements in 2023 are significant for the chemicals industry, which is characterized by cyclical demand and sensitivity to raw material costs. The company's ability to maintain profitability and strong cash flows amidst market headwinds is a testament to its strategic management and operational excellence.

Key financial metrics from the company's income statement, balance sheet, and cash flow statement highlight the disciplined approach to capital allocation. LyondellBasell reinvested approximately $1.5 billion in the business through capital expenditures while returning $1.8 billion to shareholders in dividends and share repurchases. The company also maintains a robust investment-grade balance sheet, with $7.6 billion of available liquidity at year-end.

CEO Peter Vanacker commented on the company's strategic progress, stating:

"During the fourth quarter, LyondellBasell's businesses delivered exceptional cash conversion amid challenging market conditions while we rapidly moved forward with our strategy. We have a clear and focused roadmap to deliver a more profitable and sustainable growth engine for LYB."

LyondellBasell's strategic decisions, including the divestiture of its Ethylene Oxide and Derivatives business for $700 million and the investment in a Saudi Arabian joint venture, reflect its commitment to optimizing its portfolio and investing in growth areas.

Looking ahead, the company anticipates continued headwinds in the first quarter of 2024 due to slow demand and economic uncertainty. However, LyondellBasell is aligning its operating rates with global demand and expects to operate its Americas assets at approximately 80%, and both its European and Asian assets and Intermediates & Derivatives assets at approximately 75%.

For a more detailed analysis of LyondellBasell's financial performance and strategic outlook, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from LyondellBasell Industries NV for further details.

This article first appeared on GuruFocus.