LyondellBasell (LYB) Acquires PolyPacific Polymers in Malaysia

LyondellBasell Industries N.V. LYB recently announced 100% buyout of PolyPacific Polymers Sdn. Bhd. (“PPM”) in Port Klang, Malaysia. PPM is a 25kt facility manufacturing reinforced and modified polyolefin compounds.

After the completion of the buyout, the site will undergo a rebranding and name change. The employees will also become employees of LyondellBasell. PPM will continue to manufacture and supply the ongoing business products to its consumers.

LyondellBasell will exit the PolyPacific, a 50:50 joint venture, which will become wholly owned by Mirlex Pty Ltd.

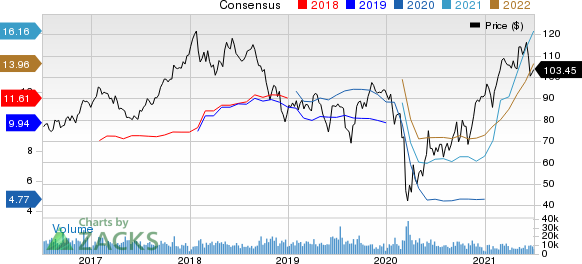

Shares of LyondellBasell have surged 54.5% in the past year compared with 47.5% rise of the industry.

Image Source: Zacks Investment Research

The company, in its last earnings call, noted that it anticipates operating at nearly full capacity globally to meet strong demand that is expected to persist owing to low inventories and maintenance downtime across industry. Strong North American integrated polyethylene margins are expected to continue as U.S. producers look to fulfil domestic order backlogs, rebuild inventories and serve export demand.

In the second half of 2021, it is expected that increased mobility will drive higher demand for gasoline and jet fuel, improving margins for its Refining and Oxyfuels & Related Products businesses. Moderating feedstock costs are also expected to increase second-quarter margins in the Advanced Polymer Solutions segment. The company looks forward to further reduce debt in the near future.

LyondellBasell Industries N.V. Price and Consensus

LyondellBasell Industries N.V. price-consensus-chart | LyondellBasell Industries N.V. Quote

Zacks Rank & Key Picks

LyondellBasell currently sports a Zacks Rank #1 (Strong Buy).

Some other top-ranked stocks in the basic materials space are Nucor Corporation NUE, Olin Corporation OLN and Cabot Corporation CBT.

Nucor has a projected earnings growth rate of around 344.9% for the current year. The company’s shares have surged 133.4% in a year. It currently flaunts a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Olin has an expected earnings growth rate of around 506.7% for the current year. The company’s shares have skyrocketed 311.5% in the past year. It currently sports a Zacks Rank #1.

Cabot has an expected earnings growth rate of around 137.5% for the current fiscal. The company’s shares have surged 57.6% in the past year. It currently flaunts a Zacks Rank #1.

Zacks' Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create "the world's first trillionaires." Zacks' urgent special report reveals 3 AI picks investors need to know about today.

See 3 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nucor Corporation (NUE) : Free Stock Analysis Report

Cabot Corporation (CBT) : Free Stock Analysis Report

LyondellBasell Industries N.V. (LYB) : Free Stock Analysis Report

Olin Corporation (OLN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research