LyondellBasell (LYB) Expands With New UK Distribution Hub

LyondellBasell Industries N.V. LYB has unveiled a new Polyolefins distribution hub in the United Kingdom. This move is part of the company's continued commitment to improving the customer experience by bringing inventory closer to its customers' locations. Order lead times will be reduced as a result of this move.

LyondellBasell's global footprint includes a distribution hub in the United Kingdom. This new hub, in addition to the company's existing distribution channels, represents a big step forward in providing clients with faster access to the company's products.

The establishment of this new hub in the United Kingdom is the result of a combined effort with logistics specialist Bertschi, which has a long history of competence in the industry. The hub will be strategically positioned in Middlesborough to ensure optimal distribution and timely delivery.

LyondellBasell's logistics expertise and commitment to customer-centric solutions are expected to contribute to the success of this distribution hub.

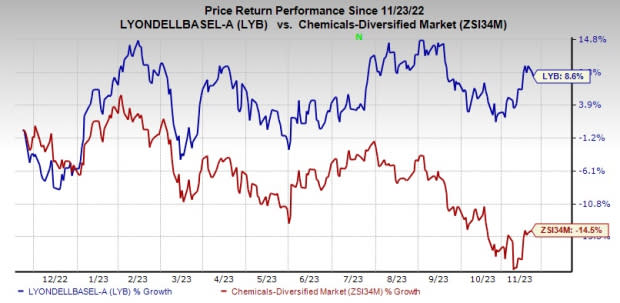

Shares of LyondellBasell have gained 8.6% over the past year against a 14.5% decline of its industry.

Image Source: Zacks Investment Research

The company, on its third-quarter call, said that it anticipates seasonally lower demand across most industries in the fourth quarter. Higher feedstock costs, new industry capacity and slowing Chinese demand growth continue to put pressure on global olefins and polyolefins margins. Following the end of the summer driving season, oxyfuels and refining margins are projected to fall.

Nonetheless, oxyfuel margins are expected to remain significantly higher than historical averages. LyondellBasell plans to operate its assets in line with market demand during the fourth quarter, with average operating rates of 85% for North American olefins and polyolefins (O&P) assets, 75% for European O&P assets and 70% for Intermediates & Derivatives assets.

LyondellBasell Industries N.V. Price and Consensus

LyondellBasell Industries N.V. price-consensus-chart | LyondellBasell Industries N.V. Quote

Zacks Rank & Key Picks

LyondellBasell currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks in the basic materials space include Denison Mines Corp. DNN, Axalta Coating Systems Ltd. AXTA and The Andersons Inc. ANDE.

Denison Mines has a projected earnings growth rate of 100% for the current year. It currently carries a Zacks Rank #1 (Strong Buy). DNN delivered a trailing four-quarter earnings surprise of roughly 225%, on average. The stock is up around 50.9% in a year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Axalta has a projected earnings growth rate of 5.4% for the current year. It currently carries a Zacks Rank #1. AXTA delivered a trailing four-quarter earnings surprise of roughly 6.7%, on average. The stock is up around 17.4% in a year.

Andersons currently carries a Zacks Rank #2. The stock has gained roughly 36.6% in the past year. ANDE beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 64.4%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Andersons, Inc. (ANDE) : Free Stock Analysis Report

LyondellBasell Industries N.V. (LYB) : Free Stock Analysis Report

Denison Mine Corp (DNN) : Free Stock Analysis Report

Axalta Coating Systems Ltd. (AXTA) : Free Stock Analysis Report